Lululemon Athletica has had a stellar run on the stock market in 2016. But the yoga and running gear maker couldn’t extend the gains on Thursday, after outlook targets that were a bit softer than Wall Street expected.

For much of this year, Lululemon (LULU) had been a star performer within the athletic gear space, a subcategory of apparel that has benefited from the “athleisure” trend that Lululemon helped popularize.

Through Thursday’s closing price, the stock had soared 46% year-to-date—easily besting the 6% drop for Nike (NKE) and 51% slump for Under Armour (UA) over the same period. Lululemon’s shares benefited from a detailed five-year sales target of $4 billion announced earlier this year, as well as hopes of a healthier brand due to a leaner inventory, fewer markdowns, and better consumer response to new apparel.

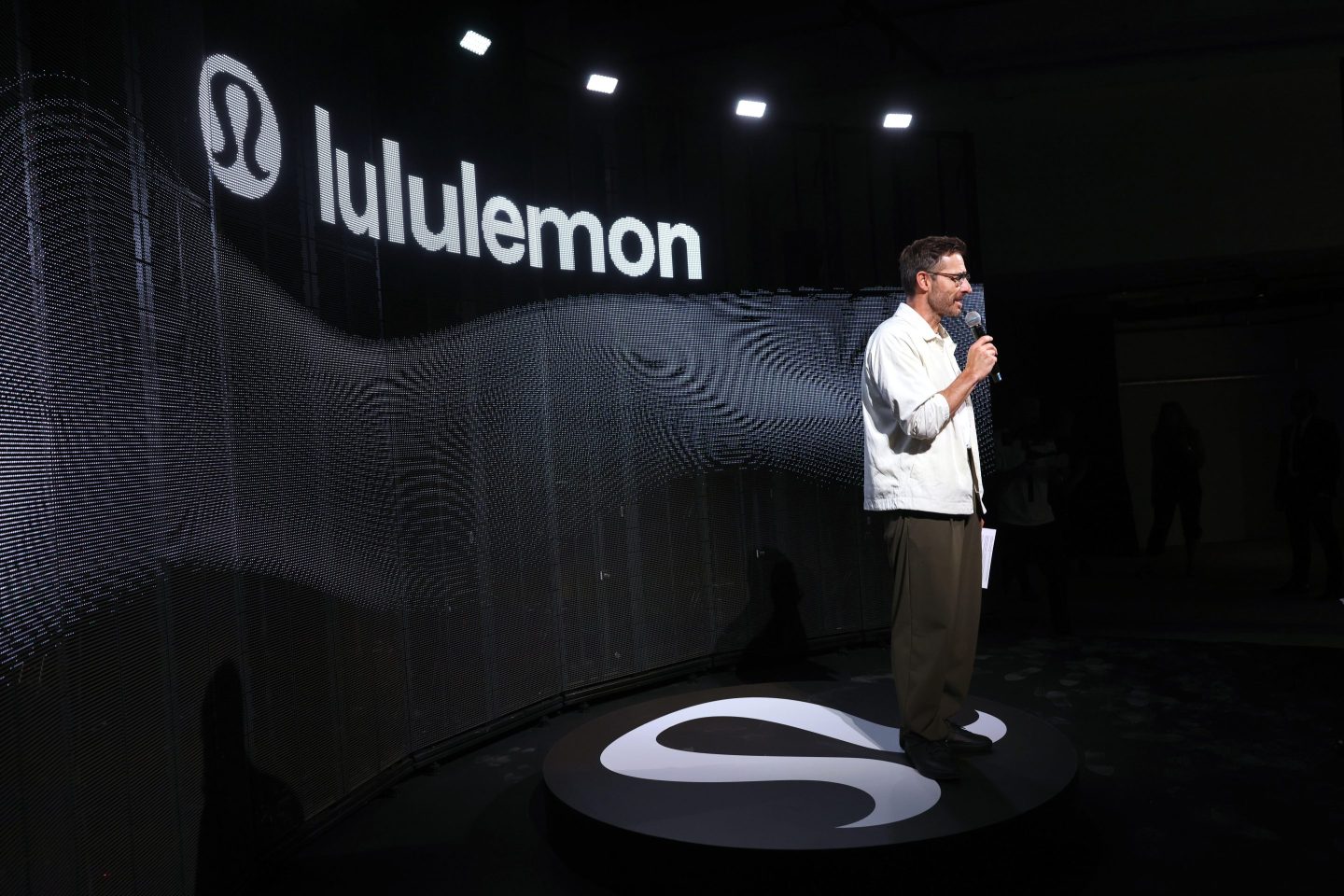

But the Canadian company’s stock slipped about 7% in after-hours trading on Thursday, despite a 14% increase in fiscal second-quarter sales to $514.5 million and total comparable store sales rising 5% on a constant dollar basis. Sales were helped by a strong performance for the men’s business, which continues to grow faster than the overall business. Chief Executive Laurent Potdevin also called out improving sales for women’s tanks and bras, driven by a colorful assortment that’s selling well.

Investors were more keenly focused on Lululemon’s outlook targets. Lululemon projected fiscal third-quarter of $535 million to $545 million on earnings of 42 cents to 44 cents per share. The average of those targets fell below Wall Street’s estimates of $542 million and 44 cents, respectively.

Wall Street ignored the important improvement Lululemon made on gross margins, which had been an issue in recent quarters due to some elevated markdowns. Gross margins improved to 49.4% in the latest quarter from 46.8% a year ago. That’s significant because Lululemon had reported eight straight quarters of declines for that key metric. Executives told investors that further improvement is projected for the current quarter.

Potdevin‘s prepared statements interestingly addressed a broader philosophical conundrum retail brands are facing today as it relates to demand for apparel and other discretionary goods. As Fortunereported earlier on Thursday, consumers are more interested in “experiences” over buying more goods. That has pressured department stores, luxury retailers, and mass-market apparel brands, among many others.

“Retail is evolving at an increasingly rapid pace,” Potdevin said. “We are starting to see a shift in how consumers engage with brands and how they value purpose-driven brands.” Experiences are given a premium over transactions, he said.

Of course, Potdevin believes Lululemon—which is at its core an apparel maker—is a brand that can play into the interest in “experiences.” He argues the company can be relevant due to those physical stores and the “deep understanding of the communities we’re active in.” Part of that can be reflected in Lululemon’s plans to open smaller format stores as a way to become more influential in more communities.

Calling Lululemon an “experience” seems to be a bit of a stretch. But Potdevin likes to think big picture. Lululemon—which started as a yoga brand—is much more than that today. It will be up to Potdevin to transform the brand further as it aims to nearly double its business over the next five years.