It’s doubly bad news for corporate defaults.

U.S. companies are failing to make debt payments at twice the pace they were a year ago. What’s worse, nearly eight months into 2016, there are already more defaults this year then there were in all of 2015. The data comes from a new report from Standard & Poors.

In the past week, the number of U.S. companies that have failed to make debt payments rose by 4 to 71, according to S&P. That’s more than double the 34 U.S. companies that had defaulted at this time in 2015.

None of the new defaults were big companies. The four new defaults last week included Cleveland auto parts distributor Transtar Holdings, and two oil and gas companies, Atlas Resource Partners (ARP) and Forbes Energy Services (FES). S&P said the fourth default was confidential, and didn’t name the company.

Around the world, the number of corporate defaults reached 104 in 2016. That’s the fastest pace of defaults since the financial crisis.

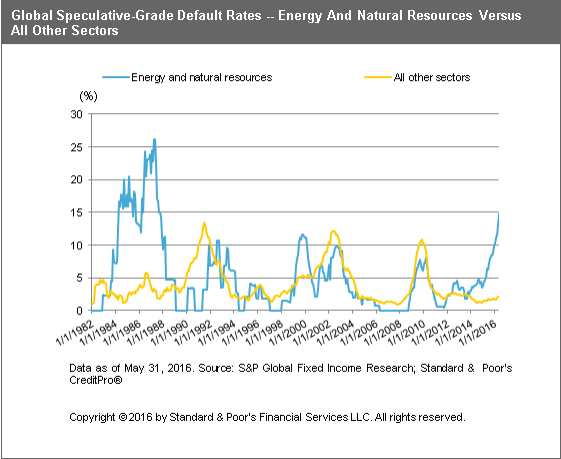

At least for now, the good news is that, in the immortal words of Ben Bernanke, the default crisis appears to be contained. As you can see from the above chart, the defaults in the oil and gas sector (the blue line) is spiking.

But the number of defaults for all other sectors (the yellow line) is up slightly, but mostly flat. In its report, S&P said the bond rating firm has seen a big jump in oil and gas defaults, but that so far that hasn’t spread to the rest of the economy.

Nonetheless, there have been some notable defaults this year outside of energy, among them New York supermarket chain Fairway (FWM), which filed for bankruptcy, and mall staple Claire’s Stores, which restructured its debt.

“So far, there has been little spillover effect into other sectors, but we are not ruling this out in the coming quarters,” said S&P in the report.