For Britain, a Brexit could me a currency crisis for the pound, a massive increase in the country’s trade deficit, and big ballooning of the country’s debt, not to mention a likely recession.

Across, though, if Britain were to leave the EU, it is unlikely it would be Brexigeddon for U.S. economy. The U.K. is the third largest generator of revenue for the S&P 500 among our trading partners, according to data provider FactSet. But it’s still pretty small. U.K. sales make up just 2.9% of the overall revenue of the S&P 500. Still, some Fortune 500 companies may not feel so proper if Britain leaves the EU.

Here’s a list of the companies in the Fortune 500 companies that would be the most affected if Brexit passes (All data from FactSet).

BlackRock (BLK)

Fortune 500 rank: 250

Revenue from U.K.: 21.6%

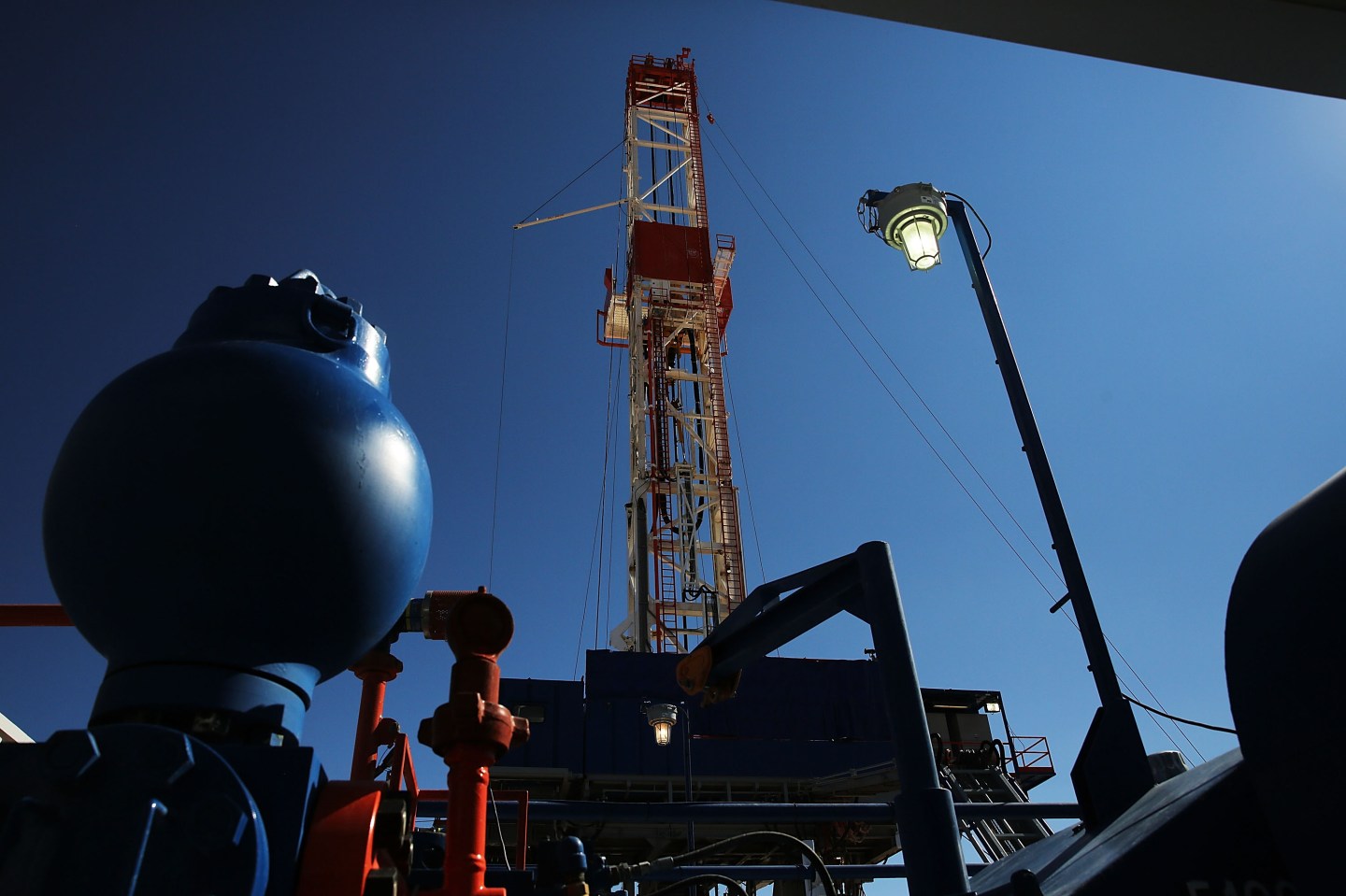

Apache (APA)

Fortune Rank: 388

Revenue from U.K.: 20.1%

News Corp. (NWSA)

Fortune 500 rank: 327

Revenue from U.K.: 18.5%

CBRE Group (CBG)

Fortune 500 rank: 259

Revenue from U.K.: 17.6%

Update: This story is based on data from FactSet. An earlier version of this story listed Newmont Mining as generating a large percentage of its revenue from the U.K. The company says it does not get any of its sales from the U.K.