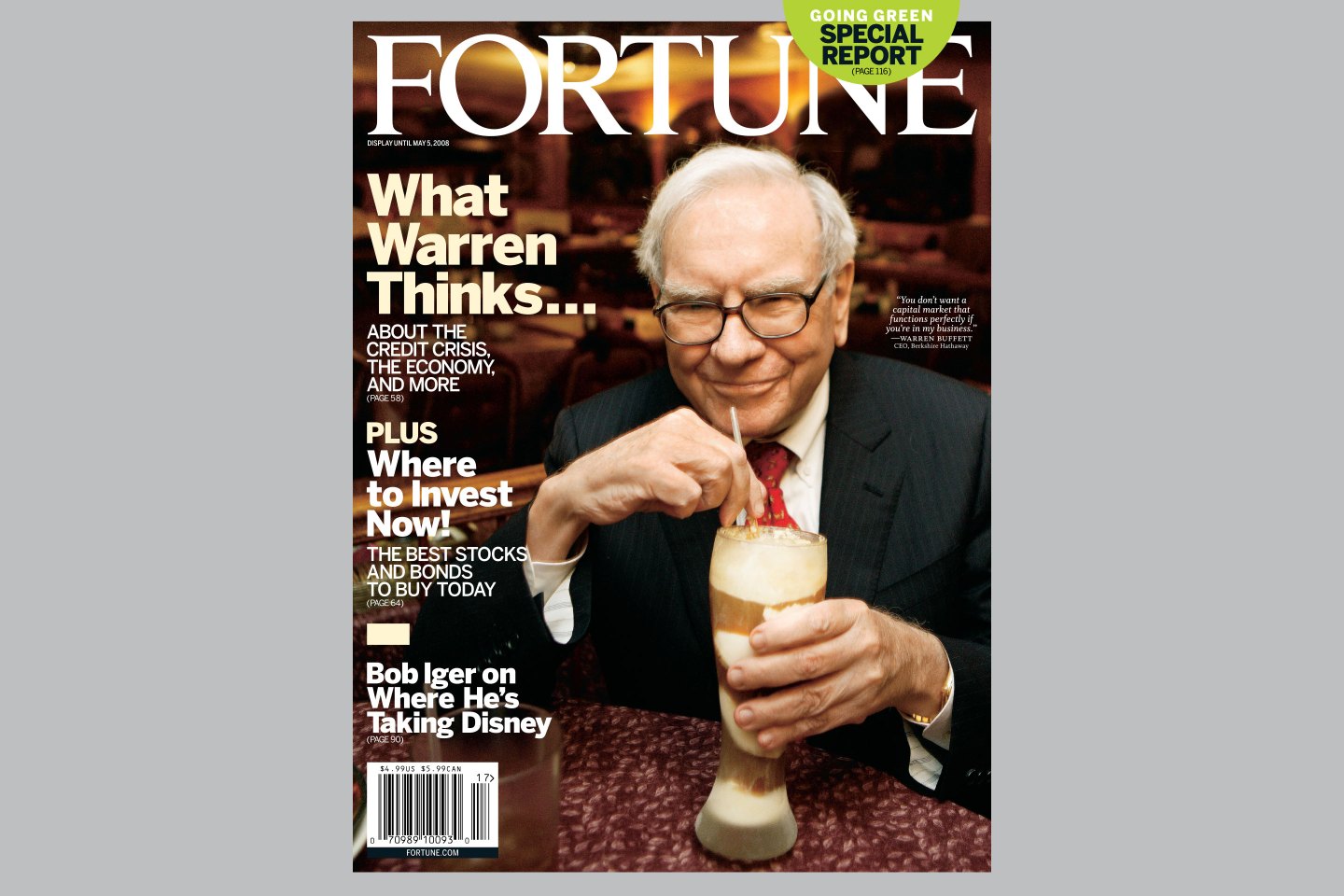

Yesterday, I had the rare opportunity to quiz four of the smartest economists who have ever served in government – Ben Bernanke, Michael Boskin, Joseph Stiglitz and Maurice Obstfeld – on the five things that puzzle me about today’s economy. The panel was put together by David Wessel of the Hutchins Center at Brookings as part of a celebration of the 70th anniversary of the President’s Council of Economic Advisers.

My five mysteries, and some takeaways:

The productivity mystery: If we are in a new industrial revolution, why isn’t productivity growing?

Lively disagreement on this, but the answer seems to be a combination of bad statistics, long lags in achieving productivity gains from technology, and a recognition that the “internet of things” may not be as big as electricity. Some talk about Robert Gordon’s new book The Rise and Fall of American Growth, which I haven’t read. Who has time for 784 pages?

The inflation mystery: With unemployment below 5 percent, why isn’t there any? What happened to the “Philips Curve” relationship between unemployment and inflation?

Bernanke said the Philips Curve is probably still the best framework economists have to understand the macro economy. Obstfeld says that may be true in the U.S., but globally, the relationship has vanished.

The oil mystery: Why aren’t falling oil prices a good thing for the economy?

Stiglitz, who is fond of asymmetries, said big price movements have both good and bad economic effects, but the bad ones tend to win out in the short term.

The China mystery: Will its problems spill over into the rest of the global economy?

All agree China is a problem, but Bernanke played the optimist: “The good news is that the Chinese government has large resources and is willing to use them.” He also pointed out most Chinese debt is held inside the country, not overseas, limiting contagion.

The inequality mystery: Why is it getting worse?

Boskin and Stiglitz tussled over this one, as expected. Boskin’s argument: that global inequality has fallen; that inequality within developed countries is driven primarily by technology and globalization; and that it’s better to focus on lack of growth overall than on inequality. Stiglitz referred to Thomas Piketty’s book Capital in the Twenty-First Century which, at 696 pages, I also haven’t read.

More news below.

| Alan Murray | |

| @alansmurray | |

| alan.murray@fortune.com |

Top News

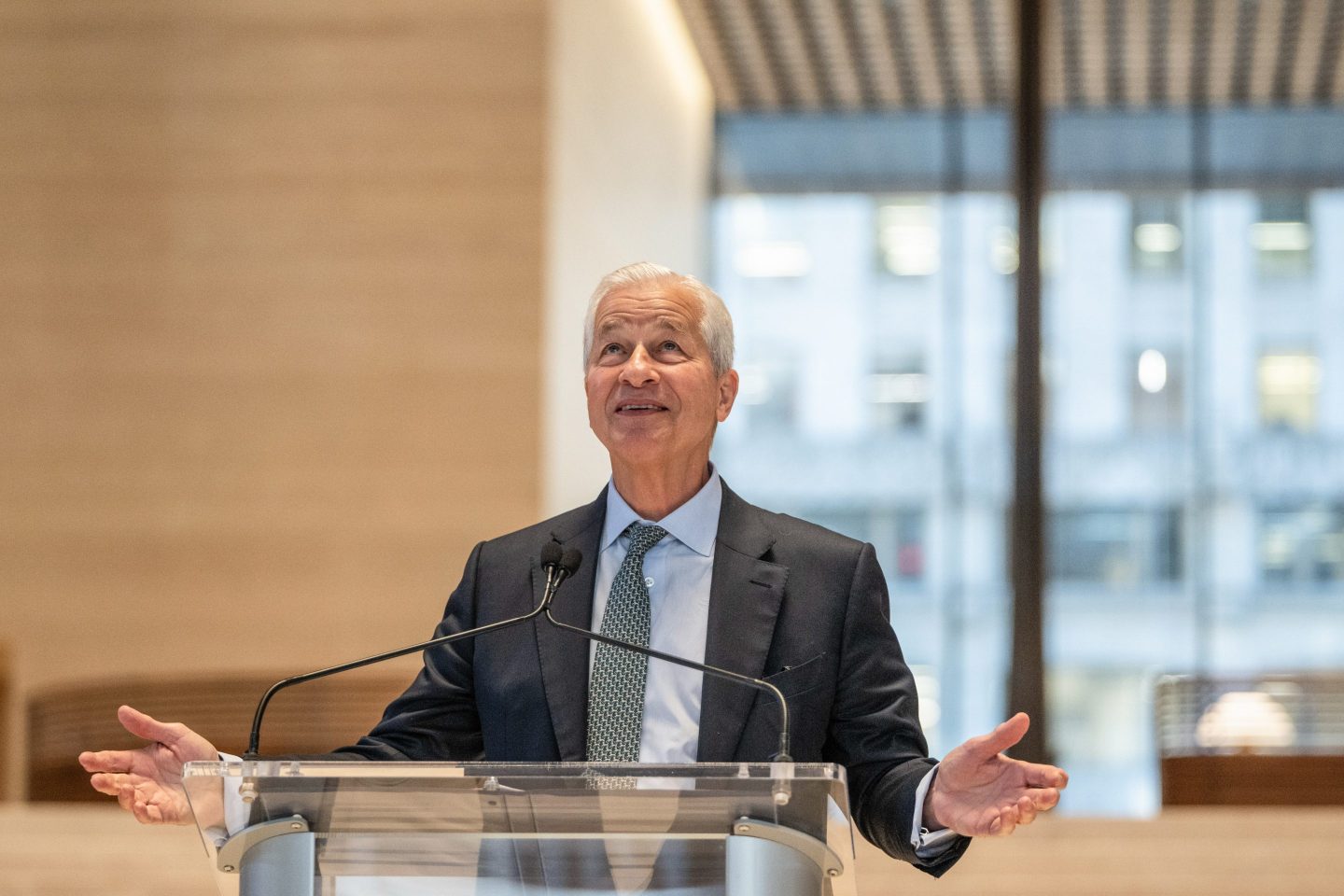

•Dimon buys J.P. Morgan stock

J.P. Morgan Chase & Co. CEO James Dimon bought $26 million in his bank's shares, a move designed to stem the tide of negative sentiment overwhelming bank stocks this year. The purchase comes after a 20% drop in J.P. Morgan's share price so far this year and a broader selloff that has stung big banks including Citigroup and Bank of America. “Jamie Dimon stepped up to the plate,” said Mike Mayo, an analyst with CLSA, who took the purchase as a positive sign for shares. Fortune

•Investors have lost $1.78 trillion in 2016

The S&P 500 Index has dropped 10.5% since the first trading day of this year, erasing $1.78 trillion in value for investors at a pace of $57 billion per trading day in 2016. That's roughly equal to the GDP of Canada in 2014, according to the World Bank. The gloom continued on Thursday as the S&P 500 extended its losses for the fifth consecutive day, falling 1.2% and hitting its lowest closing since April 2014. The biggest losses, in terms of value, have been for Amazon, Bank of America, and Alphabet. Fortune

•Crude oil falls to 12-year low

Oil tumbled to the lowest level in more than 12 years at just a tad over $26 per barrel, with some observers warning that oil in the teens could be a real prospect in the near future. One analyst warned that oil had become so disconnected to the cost of getting it from the ground that traders were pushing the commodity down to new round numbers. Oil is down 29% this year on speculation a global glut will persist as Iranian exports increase after the removal of sanctions and U.S. crude inventories remain swollen. Bloomberg

•AIG settles with Carl Icahn

American International Group agreed to give two board seats to hedge fund managers Carl Icahn and John Paulson, both of whom had called for the giant insurer to be split up. Paulson is joining AIG's board along with Samuel Merksamer, who is a managing director of Icahn Capital. Icahn says he declined the board because he is too busy. AIG, meanwhile, said the appointments would bring "financial and business expertise to the Board." The victory is a minor one for the activists, as AIG is expanding its board, not replacing any directors. Fortune

Around the Water Cooler

•Who would want to buy Pandora?

Pandora Media is reportedly shopping itself around but the pitch isn't super compelling: it has annual revenue of about $1 billion and around 250 million registered users, but also loses about $10 million monthly. The company's market value has dropped drastically to only around $2 billion from $7.5 billion in 2014, but as Fortune reports, it is difficult to see the move to shop for a buyer as anything other than a virtual fire sale. Hopes for a turnaround appear to be increasingly remote. Fortune

•GM unveils electric car for Europe

General Motors Chief Executive Mary Barra has unveiled the company's new all-electric car for the European market, part of an effort by the company to ramp up production of electric vehicles and plug-in hybrids even though sales for those vehicles are consistently outpaced by gas-powered alternatives. Electric vehicles are necessary for the industry to meet increasingly strict emissions laws. GM also sees plug-in vehicles as ideal self-driving cars that can be used as an autonomous transportation-as-a-service. Fortune

•Zynga needs a reboot

Shares of Zynga are yet again tanking, falling around 15% on Thursday after the gaming company behind Farmville and Words With Friends adjusted its first-quarter financial outlook below what analysts had expected. “Zynga has been a ‘show me’ story for so long, many investors have stopped paying attention,” said one analyst that covers the company. Recapturing the attention of users and investors would require something big. And while Zynga has two key titles in the works, there have been delays that have prevented their release – pushing back any opportunity for Zynga to restore credibility with gamers. Fortune

•Rolls-Royce revs up turnaround

Rolls-Royce shares surged as much as 16%, the biggest intra-day gain since September 2002, as investors cheered cost cutting efforts that started last year and should provide consistency for the embattled engine maker. After five profit warnings in two years, Rolls-Royce importantly stuck to its November forecast for 2016 earnings even as sales are sluggish as tumbling oil price undermines sales of engines it makes for specialist offshore vessels just as demand for corporate and regional jets has also dropped. The investor optimism was also notable as Rolls-Royce also cut its dividend to preserve cash, the first time that action has occurred since 1992. Bloomberg