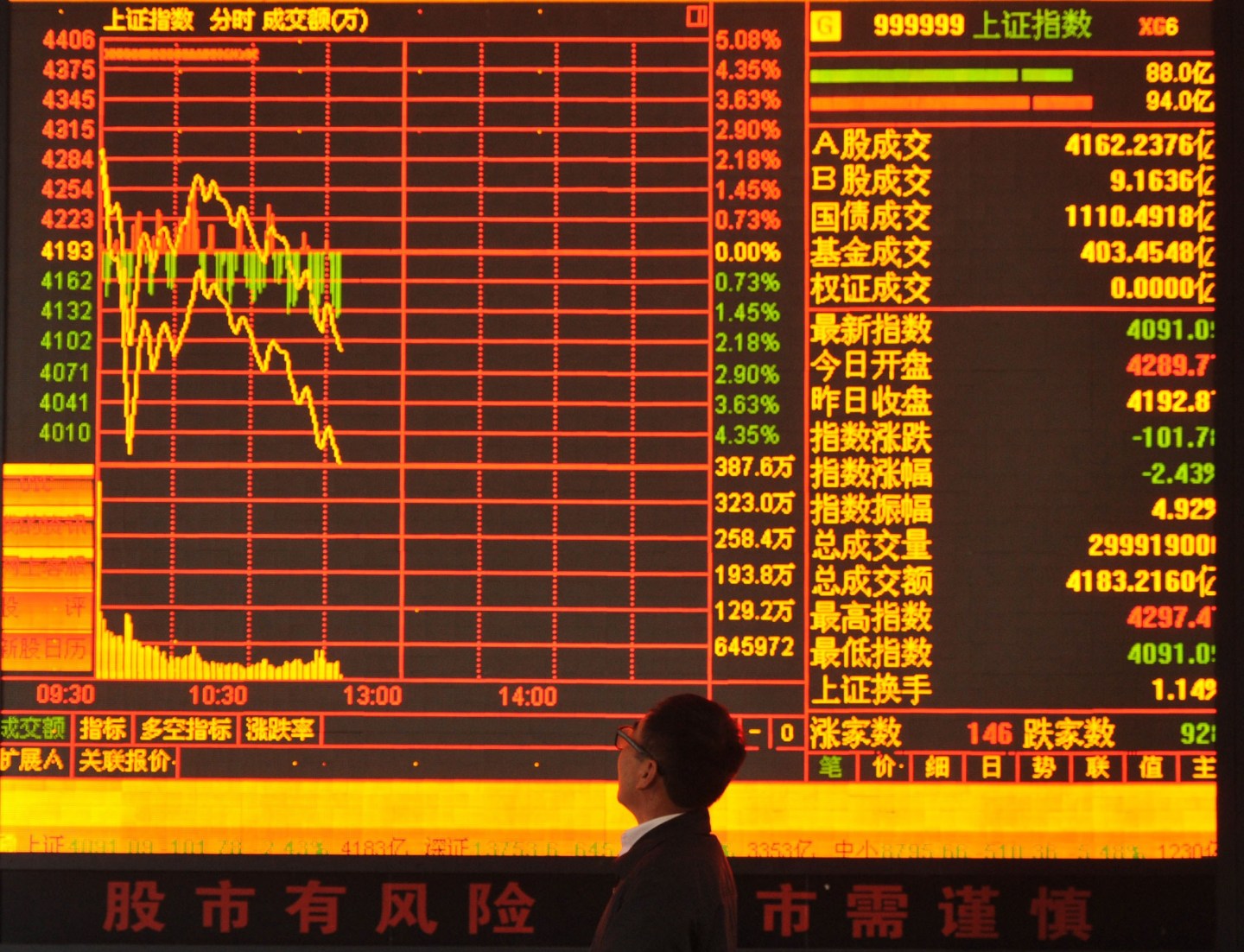

On Friday, China’s stock market fell yet again, pushing it into bear market territory.

More than a few economists these days are starting to say there are deep problems in China’s economy, but back in 2010, China was the darling of the economic left.

Both China and the U.S. had embarked on stimulus efforts in late 2008 and 2009. A year later, though, China’s economy seemed to be back on track, while the U.S. was still stuck. Left leaning economists, like Paul Krugman, said the reason was size. The U.S.’s stimulus effort had been too small. As Krugman wrote back in 2010, “Korea and China both engaged in much more aggressive stimulus than any Western nation—and it has worked out well.”

As recently as last year, the Federal Reserve Bank of St. Louis published a research paper that contemplated the divergent performances of the Chinese economy with those in the developed west. The economists Yi Wen and Jing Wu argued that that China performed so much better because:

China implemented bold, decisive fiscal stimulus programs that no other major nations dared to adopt. In particular, the Chinese government cleverly used its state-owned enterprises (SOEs) as a fiscal instrument to implement its aggressive stimulus programs in 2009, consistent with the very Keynesian notion of aggregate demand management through increased government spending

In the light of recent events, however, it might be time to rethink this analysis. The Shanghai stock market is down roughly 20% since December, and much more since its peak last June, while analysts and the Chinese government have been sharply revising their estimates for economic growth.

This dynamic puts into sharp relief the flaw of China’s outstanding economic performance over the past decade: It’s been been based on an unsustainable build up of capital and growth in exports. We’ve seen this story before, be it the Soviet Union in the 1950s, Brazil in the 1970s, or Japan in the 1980s. In each of these cases the governments pursued policies that encouraged investment—like capping interest rates so that businesses could take advantage of cheap loans, and artificially cheapening the currency to promote exports. Such policies make it profitable for businesses to invest, even when these investments don’t make economic sense.

And in each of these cases, the long economic boom was followed by a painful bust. Brazil was plagued for years by inflation, slow growth, and political instability following the collapse of their economy in the early 1980s. The Japanese suffered from a financial crisis in the early 1990s from which they’ve never really recovered. And China may be at the beginning of their own lost decade (or two) today.

The economists who praised China’s stimulus package for its relative size in 2009 were likely not considering that it doubled down on this flawed growth model, encouraging more investment by state-owned enterprises. After China’s stimulus package, the share of GDP that came from investment, much of it spurred by the government, soared to above 50%—an unheard of level in recent economic history.

Taken in this light, China’s stimulus was less about making up for the lack of demand in the economy, and more about encouraging businesses to create supply regardless of whether there was demand for the end product. We’re seeing the effects of this approach today, with collapsing commodity prices and a global downturn in the manufacturing industry, as the world produces far too much than is needed to meet global demand.

The United States likely could have used a longer and more sustained stimulus effort from the federal government, taking into account how large the recession ended up being. But that doesn’t mean that China’s stimulus was wise. Given the imbalances in the Chinese system, a large stimulus without a commitment to reforms to reverse those imbalances amounted to just kicking the can down the road. Now China, and the world, is dealing with the consequences.