Global stock markets have been rattled over the surprise slide in the value of the renminbi, which has fallen more than 3% against the dollar over the past three days.

The Chinese yuan began its decline on Monday, after the People’s Bank of China (PBOC) devalued its currency by about 2%. It continued on Tuesday after the market took advantage of new freedoms given to it by the PBOC to drive the currency roughly 1,500 basis points lower. Then the central bank stepped in to stem the weakening by “[instructing] state-owned Chinese banks to sell dollars on its behalf in the last 15 minutes of Wednesday’s trading,” according to a report in The Wall Street Journal.

American politicians are claiming that the PBOC’s recent decisions were driven by an effort to give an unfair advantage to Chinese exporters, but that’s not likely. As High Frequency Economics’ Carl Weinberg pointed out on Wednesday in note to clients, a 3% decline in the yuan is a fairly steep drop for such a short period of time. But it’s not a big enough move to affect global export markets in a meaningful way.

Indeed, the PBOC’s recent decisions could be good news for Western economies, as it indicates that China is willing to let the market have a greater say in the value of its currency.

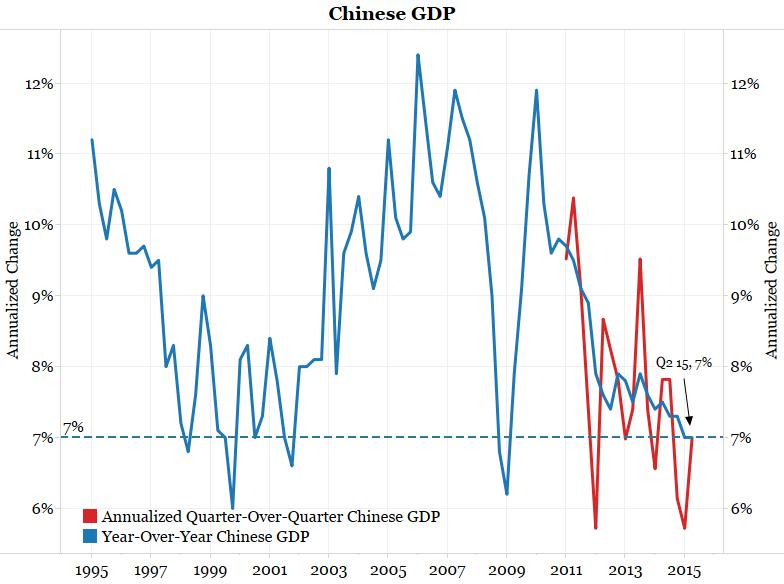

At the same time, the market is clearly saying that the value of the yuan should be going down and not up. And the market is forcing the yuan lower in part because growth prospects in the world’s second largest economy have slowed significantly. This chart, from David Bianco, shows how China’s official GDP growth statistics “are closing in on a 20-year low.”

Meanwhile, many independent analysts aren’t convinced that China is growing this quickly. A recent survey of analysts by The Wall Street Journal found that China’s real growth rate is between 3.8% and 6% on an annualized basis—far below the government estimate of 7%.

This growth slowdown, including recent data that shows a sharp reduction in export growth, has increasingly led China watchers to worry that the Chinese government doesn’t have the tools or the will to prevent the country from entering into a significant slowdown. Following the 30% crash in the Shanghai Composite Index last month, billionaire hedge fund manager Ray Dalio changed positions on China, writing that the event “has created a significant new challenge for policy makers.”

The bursting of the stock-market bubble, coming at the same time that economic growth is slowing and debt levels in many parts of China’s economy have grown extreme, has sapped the optimism of Western observers, like Dalio, who were previously impressed by the Chinese Communist Party’s handling of the nation’s economic rise.

In a press conference on Thursday, the PBOC tried to calm investors, saying that the fall in the Chinese yuan was simply a reaction to the strengthening dollar. However, the PBOC’s advertising of its market-based reforms belie the magnitude of the government’s moves to suppress volatility in the economy. As veteran China analyst Michael Pettis has written, free markets are all about volatility:

It’s not just that markets are about volatility. It is that volatility can never be eliminated. Volatility in one variable can be suppressed, but only by increasing volatility in another variable or by suppressing it temporarily in exchange for a more disruptive adjustment at some point in the future. When it comes to monetary volatility, for example, whether it is exchange rate volatility or interest rate and money supply volatility, central banks can famously choose to control the former in exchange for greater volatility in the latter, or to control the latter in exchange for greater volatility in the former.

Regulators can never choose how much volatility they will permit, in other words. At best, they might choose the form of volatility they least prefer, and try to control it, but this is almost always a political choice and not an economic one. It is about deciding which economic group will bear the cost of volatility.

Overcoming the recent turmoil in the Chinese economy will only be accomplished through politics. The transition from an export-led economy to one based on consumption is all about the transfer of economic power from capital to labor. Optimists argue that this transition can be smoothed by the large supply of rural Chinese that have yet to participate in the process of urbanization. As these workers move to the city, their increased productivity will boost economic growth and tamp down the rise in costs that threatens the great Chinese export machine.

But the question no one can answer is whether this process can continue without a major financial crisis, recession, or widespread labor unrest. History tells us that such events are inevitable during economic transitions of the kind that China is undergoing. But the actions of the Chinese Communist Party and the PBOC in recent weeks suggest that China’s leaders are determined to not to let any of these things happen. If they are successful, it will be an unrivaled historical achievement. If they aren’t, perhaps we’re in for the sort of hard landing that China bears have been warning about for years.