It’s not quite panic, but it still ain’t pretty.

U.S. stocks are bracing for a bad start to the week after Greece’s debt crisis spiraled out of control at the weekend.

In pre-market trading, futures on the S&P500, the Nasdaq and the Russel 2000 are all down by 1% or more, following the lead of European markets which have taken a much harder beating as the risk of a Eurozone breakup looms afresh.

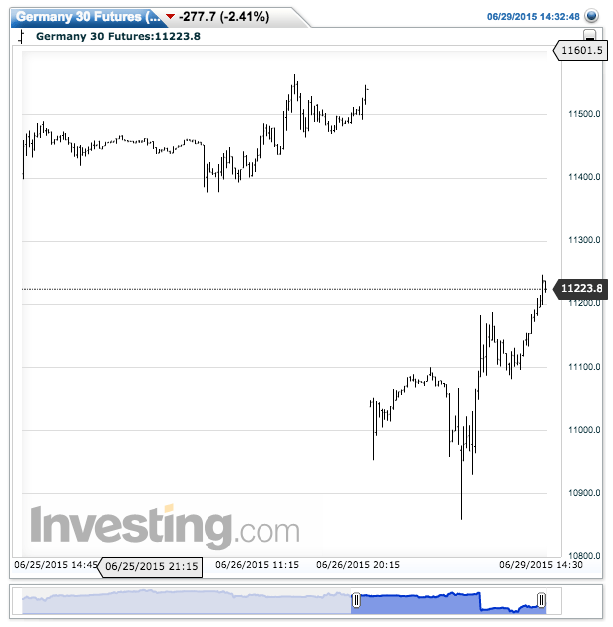

The main stock indexes in Europe fell by up to 4% across the board on opening Monday, and are down by between 2.3% and 3.9% by lunchtime (Athens’ stock market, like its banks, is shut).

On any normal day, that would be called a bloodbath in Europe, but memories of 2010 and 2012, when the Eurozone crisis peaked, are still fresh, and there seems to be a palpable sense of “well, that could have been worse.” Most markets hit their intra-day lows immediately, the main difference being the degree to which they have recovered since (Germany faring better than Italy and Spain).

True, the yields on government bonds in some of the Eurozone’s weaker countries have spiked on ‘contagion’ fears, as markets price in the risk that a Greek exit from the Eurozone would lead to a broader breakup: Italy’s 10-year yield has risen 21 basis points to 2.37%, Spain’s is up 20 basis points at 2.32%, and Portugal’s is up 31 basis points at 3.03% (a basis point is a hundredth of a percentage point).

Those are big changes, but the absolute levels are still a long way from 2012, when markets seemed on the verge of forcing all of those countries out of the Eurozone until ECB President Mario Draghi promised to do “whatever it takes” to preserve the Eurozone. Spain’s yields peaked at over 7.75%, Italy’s at over 7.5%.

“This story won’t get too out of hand unless we start to see any evidence that the Greeks are likely to vote No (at their referendum) on Sunday,” said Deutsche Bank strategist Jim Reid. “At this point the sell-off could get messy. If this doesn’t happen, the negativity may well be contained even if the story will be far from over.”

This market reaction won’t be to the liking of the Greeks, who’ll have been hoping for something stronger to underline the risks of a breakup,” said Christian Odendahl, chief economist at the Center for European Reform in London. “But it won’t be much comfort to the Europeans either, because it shows the markets are worried about what ‘Grexit’ would mean for the future of the Eurozone.”

Away from Europe, there is more nasty mood music coming from China, where the Shanghai market continued to unravel despite a cut in interest rates and reserve requirements from the central bank at the weekend. The Shanghai Composite closed down 3.3% after a 7.4% shellacking on Friday, amid reports that the army of retail punters who had driven the market up 150% since July are struggling to meet ‘margin’ calls on leveraged accounts.

Amid the carnage, investors looked for the safe haven of the dollar, as usual, but its rally early Monday has also now largely unwound. The euro is trading at $1.1118, down less than a cent from its close on Friday. Meanwhile, in the commodities markets, crude oil futures hit their lowest in three weeks on fears that financial market volatility could again hit global growth and, consequently, energy demand. By 0900 ET, they were at $58.61 a barrel, down around a dollar from late Friday.