If you want to ignite a firestorm among modern information technology people, just ask which cloud provider is number one among large corporate customers. Amazon Web Services, born in 2006, is by almost any count, the dominant player in overall market share. But IBM, which is, oh, about 10 times as old as AWS, is bound and determined to be considered in the same upper strata—a claim that sends some cloud observers into a frenzy.

For example, last week, on its first quarter earnings call, IBM (IBM) claimed cloud revenue of $3.8 billion, up from $2.3 billion for the year-ago period. And, CFO Martin Schroeter pegged cloud revenue for the trailing 12 months at $7.7 billion. This is very impressive on its face, but no one is exactly sure what that number entails. Most likely it includes good chunk of related software and services and infrastructure hardware IBM uses to run cloud. That muddies the waters—not that IBM is alone in that practice—Microsoft (MSFT) and other IT incumbents all do similar mash-up numbers.

“I don’t know how IBM counts that [total] but the number very likely includes a lot of associated services as well as SoftLayer plus all the managed services which IBM broke out of its Global Services unit last year,” said Carl Brooks, research analyst for 451 Research. IBM bought SoftLayer, a respected cloud player, two years ago in a catch-up bid to AWS.

AWS numbers, which were broken out for the first time last week on parent company Amazon’s (AMZN) first quarter call , are viewed as more purely “cloud.” They represent the sales (or rental) of computing, storage, and network services to customers. They do not include a lot of software and services that have been around for decades but which can now be deployed with or attached to cloud infrastructure. For it’s first quarter, AWS logged a profit of $265 million on revenue of $1.57 billion compared to $245 million in profit on revenue of $1.05 billion for 2013.

For all of 2014, AWS claimed $4.64 billion in revenue, up from $3.11 billion for 2013.

Brooks said IBM does well among companies wanting hosted cloud services — that is they want to have cloud-like flexibility but they don’t want to run their jobs on shared infrastructure. Last week IBM touted some new 451 Research to show its strength there.

IBM’s issue, as has been pointed out ad nauseum, is that while it can claim big numbers in key growth area—cloud, analytics, et cetera—it also struggles under the load of no-longer key big businesses that are expensive to maintain and sell.

Brooks credits IBM CEO Ginni Rometty with doing heroic work re-aligning the company around new technologies and deployment choices, but said she remains saddled with those older businesses. “IBM can’t do these big two-year data center build outs anymore,” He said. “No one will wait for them.”

When even the biggest of the big —companies like General Electric— (GE) are talking up public cloud deployment it’s a problem for mainstream IT companies who are late to that particular party.

As AWS keeps adding services seemingly by the week, the old guard has to meet that new pace while supporting customers running an array of older technologies.

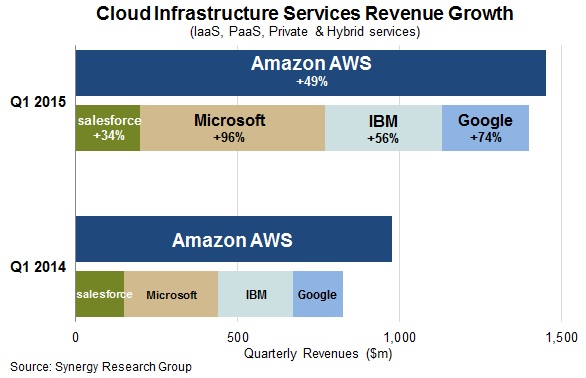

By all accounts IBM and Microsoft and Google (GOOG)—which is coming at cloud from its position as a search engine and Internet ad company—have made huge steps in their cloud efforts in the past two years. But AWS remains king of the castle.

New research from Synergy Research Corp. analyst John Dinsdale estimates that the Amazon’s cloud revenue all by itself eclipses that of Google, IBM, Microsoft and Salesforce.com cloud revenues combined. (Dinsdale combines infrastructure-as-a-service, platform-as-a-service revenue in a “cloud” bucket. It does not include software-as-a-service revenue.)

In any case, last week’s earnings calls presage an escalating battle for market share and mind share in cloud. Stay tuned.