Salesforce just became the fastest business software company to reach $5 billion in annual revenue. Now, it’s shooting for $10 billion.

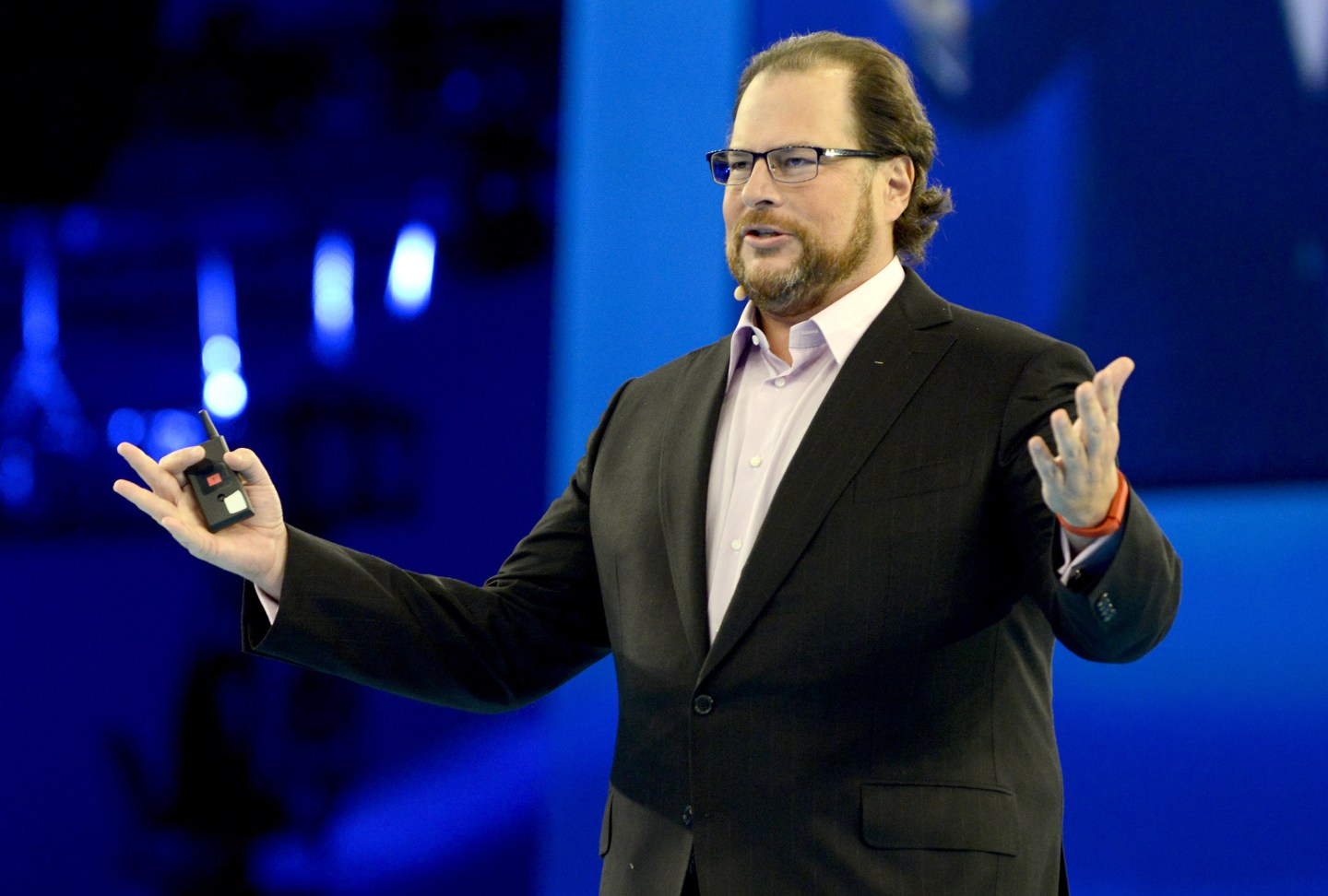

One reason chairman and CEO Marc Benioff is so confident: tremendous insight into future sales. “Salesforce delivered yet another year of exceptional growth, with revenue, deferred revenue and operating cash flow all growing more than 30%, while exceeding our expectations in non-GAAP operating margin improvement.”

As of Jan. 31, the software giant counted $5.7 billion in unbilled deferred revenue—sales that are contracted, but not yet reflected on the balance sheet.

For perspective, that’s more than the total annual sales reported by Salesforce in 2014, which neared $5.4 billion. Its guidance for the year ahead: $6.5 billion to $6.52 billion. Its loss for the year, $262.2 million. No matter, the outlook inspired Salesforce’s shares to jump 10% in after-hours trading.

Salesforce is not alone in talking up deferred revenue as a measure of its future success. Hortonworks is using a similar tactic by talking up billings.

Technically speaking, the company underdelivered this week for its first quarter as a public company. That is, if you pay attention to traditional measures, such GAAP revenue or net income (loss). Not if you look at Hortonworks’ billings, though.

“I think the top line is that we have momentum in terms of billings growth, that is the right way to look at and measure our progress,” CEO Rob Bearden, told me Wednesday during a conversation about his company’s results.

More on his spin in a moment, here are the relevant numbers: Total GAAP revenue for fiscal year 2014 grew 91% to $46 million. (It was $52.1 million before the impact of warrants exercised by AT&T and Yahoo). Hortonworks’ GAAP net loss widened to $177.4 million, compared with $63.1 million the previous year.

Bearden would rather have you consider the billings number for the year: $87.1 million: $87.1 million (a 134% increase that makes it look much closer in size to its big rival Cloudera). That number includes non-GAAP revenue, plus “the sequential quarterly change in deferred revenue.”

Fundamentally, this is because Hortonworks offers subscriptions for its software plus many “premeditated services” to get its software up and running for customers. During the fourth quarter, for example, Hortonworks added 99 “support subscription” customers, bringing its total to 332. (Reference accounts listed on its website include eBay, Priceline.com, and Spotify.)

Right now, Bearden estimates that an average of 30% of quarterly revenue is attributable to implementation and training services, with the rest from software subscriptions. Over the next six to eight quarters, this will shift to a 20% to 80% mix (services to software), he said.

“We could be double the size if we really built our services business and staffed for full delivery,” Bearden said. “What we believe is more important and appropriate is that we leverage the [Hadoop] ecosystem and certify industry-leading systems integrators on our technology.”

Incidentally, Hortonworks’ guidance calls for fiscal year 2015 billings of $150 million to $156 million. It is expecting annual revenue of $83.5 million to $86.5 million.

This item first appeared in the Feb. 26 edition of Data Sheet, Fortune’s daily newsletter on the business of technology. Sign up here.