The rally that lifted crude oil prices by more than 25% from their January stalled as the International Energy Agency warned that there will be no return to the boom-time days for at least five years.

The watchdog, which monitors trends in the global energy market on behalf of consumer nations, said in a new report Tuesday that the market will exit its current glut “relatively swiftly” but warned that the rebalancing would be ” comparatively limited in scope.” As such, it said, prices will stabilize “substantially below the highs of the last three years.”

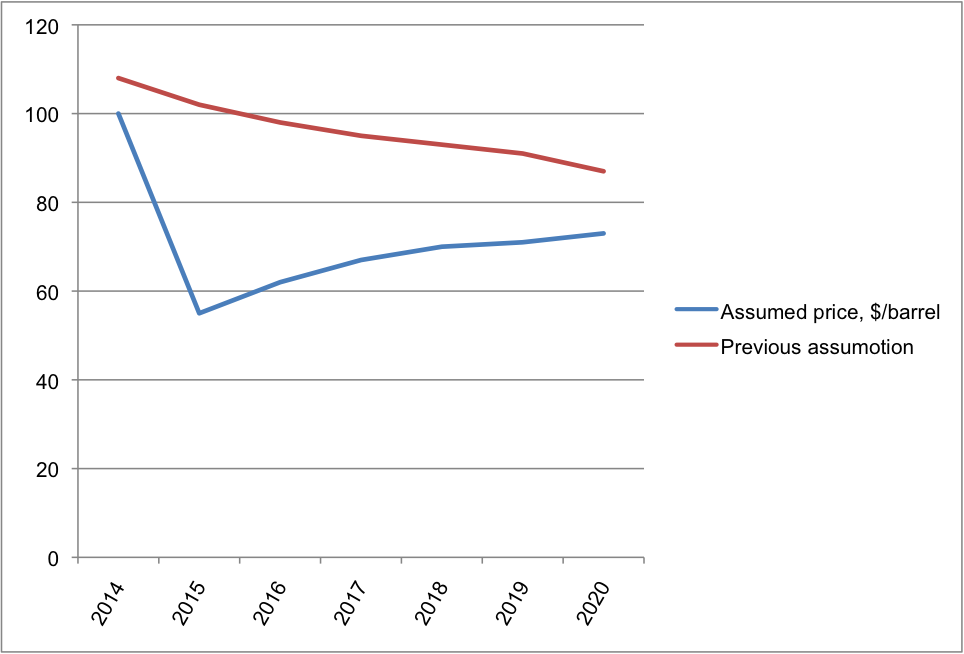

The central assumptions in the IEA’s new forecasts are for crude prices to average $55/bbl this year, rising to $62/bbl next year, but then only rising another $11/bbl to an average of in $73/bbl 2020.

Benchmark crude futures fell by over 1.5% in response to the report but later recovered some of their declines. By lunchtime in Europe Tuesday, they were down 66c at $52.21 a barrel.

The IEA’s new assumptions, if they pan out, will basically rip up the internal accounting of many of the world’s oil producers, and of the governments behind them that depend on their revenues. Many had assumed that the Organization of Petroleum Exporting Countries would always support prices at or around $100/bbl, until the cartel abruptly changed course in November, triggering a global price war in an effort to defend its market share.

Companies like BP Plc (BP) have tended to take their investment decisions on a basis of whether projects would make money at a price of $80/bbl. BP and many others have announced massive cuts in spending in recent weeks, cuts that analyst say will take a lot of the world’s more expensive oil off the market.

The IEA said two fundamental changes on both the supply and demand sides of the equation meant that “this time will be different.” On the supply side, it said it expects output from North American shale oil to continue growing, albeit at a slower rate than in recent years.

One positive side effect of the expanded role of shale oil is that the IEA expects the volatility of oil prices to subside in the coming years, because the shale industry is uniquely well placed to react quickly to price signals.

One the demand side, the IEA said, there has been a profound structural slowdown in growth due to a number of factors that add up to one big one: the world economy just doesn’t need as much oil to generate the same amount of growth as it used to.

The biggest single factor behind that is the rise of renewable sources of energy, especially in Emerging Markets, which has accounted for almost of the incremental rise in global demand over the last 25 years.

“Renewables and natural gas are increasingly price-competitive against oil and coal in emerging markets and will continue to encroach – whether directly or indirectly – on oil consumption,” the IEA said, pointing in particular to China’s pressing need to cut air pollution and its “de-emphasis” of fuel-intensive manufacturing to generate growth.

By 2020, the IEA estimates the world will be burning an average of 99.05 million barrels a day, up from 92.4 million b/d last year. It expects countries outside OPEC to satisfy nearly half of that, and within OPEC, it expects Iraq–whose output hit a 25-year high of 3.7 million barrels a day last year–to raise its production still further.

By contrast, the IEA expects output from Russia, to fall by over 5% between now and 2020 due the combined effect of lower prices and sanctions, which it said will limit investment in the country’s oil sector.

Watch more of the discussion about oil from Fortune’s video team: