Each year I compile a list of predictions from a venture capitalist perspective—with the goal of providing a practical look into what to expect in the year ahead. With a lot of talk around a bubble and with companies in all sectors continuing rapid-scale and innovation, below are five mega-trends I anticipate will make a big impact in 2015.

1. The Internet-of-Things will be less about the things: In 2015, it will be about the software, not the hardware. Last year we saw feverish M&A activity in hardware but, next year, I expect to see the IoT battleground shift to software. I also predict that hardware IoT will prove out to become much more of a commodity. We already are seeing some of this played out in the smartwatch world with Apple (AAPL), FitBit and others focused on matching features and commoditized offerings. In 2015, I expect IoT software and services to take center stage.

2. Online education will graduate to higher valuations: Online is at a true inflection point and will accelerate. Just this month, Stanford’s Graduate School of Business took its investment in online education to a whole new level by announcing that a new program for company executives will be delivered entirely by way of the Internet. According to Global Industry Analyst, online education in 2015 will reach $107 billion, which will represent a doubling in just three years. There are many incumbent institutions now offering online curriculum, and several newer companies with innovative models making incredible progress like Udemy*, Coursera, Lynda and PluralSight. I wouldn’t be surprised if these garnered “unicorn” valuations and grew even faster.

3. New generation of marketplaces will surpass value of Apple: “Marketplaces 2.0” is a theme that will thrive as a mega-venture category. We witnessed major financing including sky-high valuations from LendingClub* ($3.6 billion), Airbnb ($10 billion in April) and Grubhub ($1.9 billion in April). Emerging marketplaces like Minted and Udemy are now real contenders capable of challenging the last generation of marketplaces like Craigslist and eBay. I believe that within just five years, the public valuations of all major online marketplaces like Etsy, LendingClub, Udemy, Minted*, Grubhub, Zillow (Z), and Airbnb will together approach and perhaps surpass Apple’s valuation today, and that is not even counting Alibaba (BABA). This dynamic will give way to the birth of the “Marketplaces 2.0” era, which could drive venture returns and improve employment markets.

4. The NASDAQ will flatline… and that’s okay: In 2014 the NASDAQ index created a massive amount of chatter in the investor blogosphere around talks of a “Bubble.” For 2015, I actually expect the NASDAQ to be relatively flat and may even be slightly lower. However, the real issue we will face in 2015 is volatility. This lackluster performance in 2015 will not affect early-stage venture as much, but it may put a more moderate tone to potential IPO’s. Having said that, great companies will continue to IPO in 2015 but the bar will be high. I see this as a very nice and gentle way to let “air out” of a perceived asset bubble, and much better than having a complete burst. While this may be viewed as negative, I view this as a positive in 2015 and perhaps necessary to keep a healthy and robust market of high-quality IPO’s going.

5. Bollywood is back; Brazil misses the goal: For international and emerging market ventures, 2015 will be the year of India. Brazil, Russia, India, and China all had been developing and maturing very impressive Internet properties in the last few years, and we saw some of those hit the IPO market in 2014. Alibaba certainly proved that for China. India had a very positive election, which should bolster confidence and allow the country to thrive in 2015. There are many great technology companies there that will take advantage of this positive landscape. Companies like Flipkart, Snapeal, Quikr* and Yatra* are companies to watch. On the other hand, Brazil was not as lucky as India in terms of its Presidential election and political landscape. I predict that Brazil will struggle in the coming year. Meanwhile, we could potentially see some major India IPO’s in the coming years. As a result, there will be some increased and renewed attention on India from the global venture community.

Overall, 2015 will be an important year for progress in key geographies and sectors. However, volatility and talk of bubbles will make this a potentially difficult year for those who may not have the stomach for fluctuations.

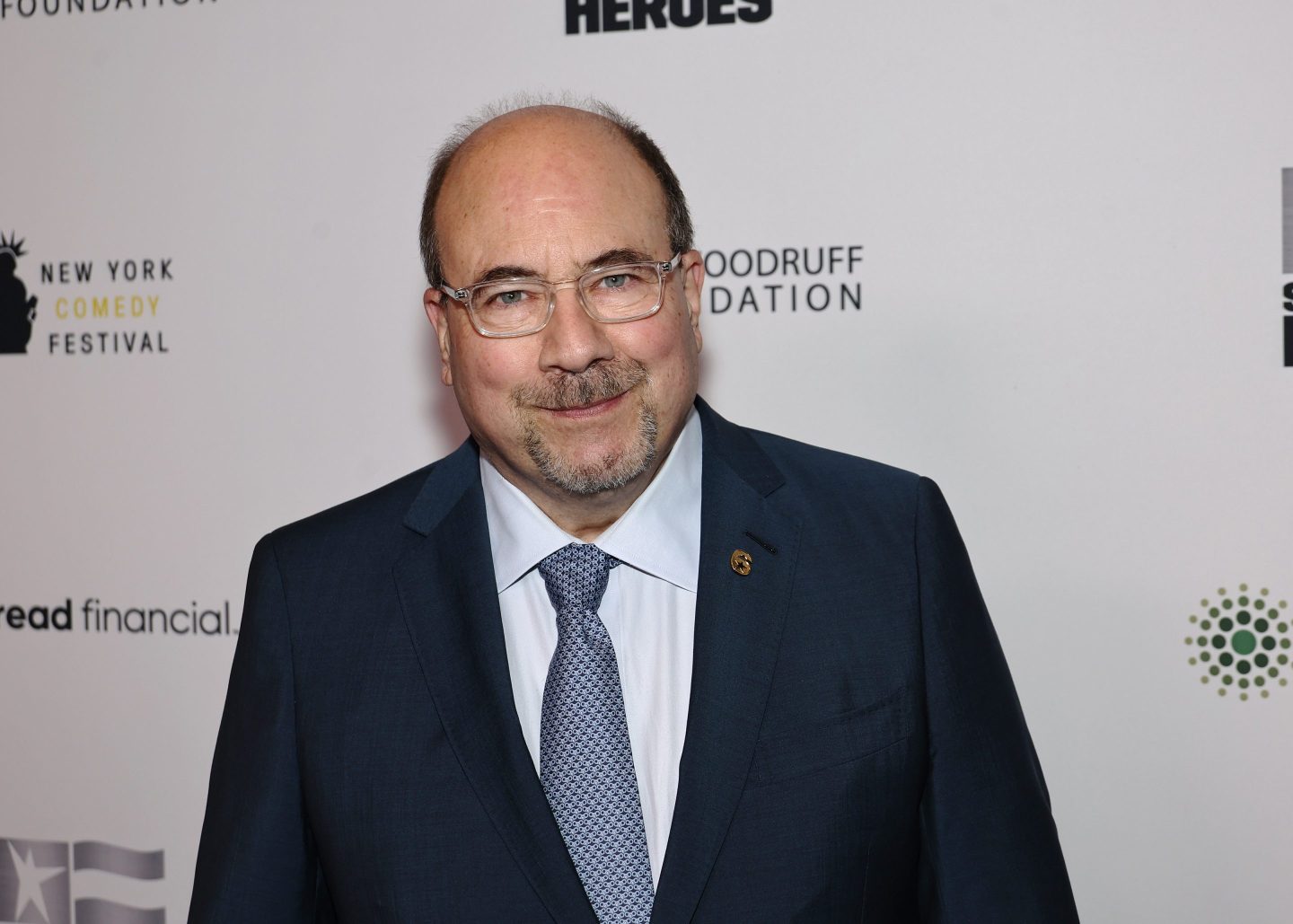

Sergio Monsalve (@vcserge) is a partner with Norwest Venture Partners, where he focuses on early-stage and growth investments in e-commerce, consumerized SaaS, consumer finance and educational technologies. Companies marked with * in this post are NVP portfolio companies.