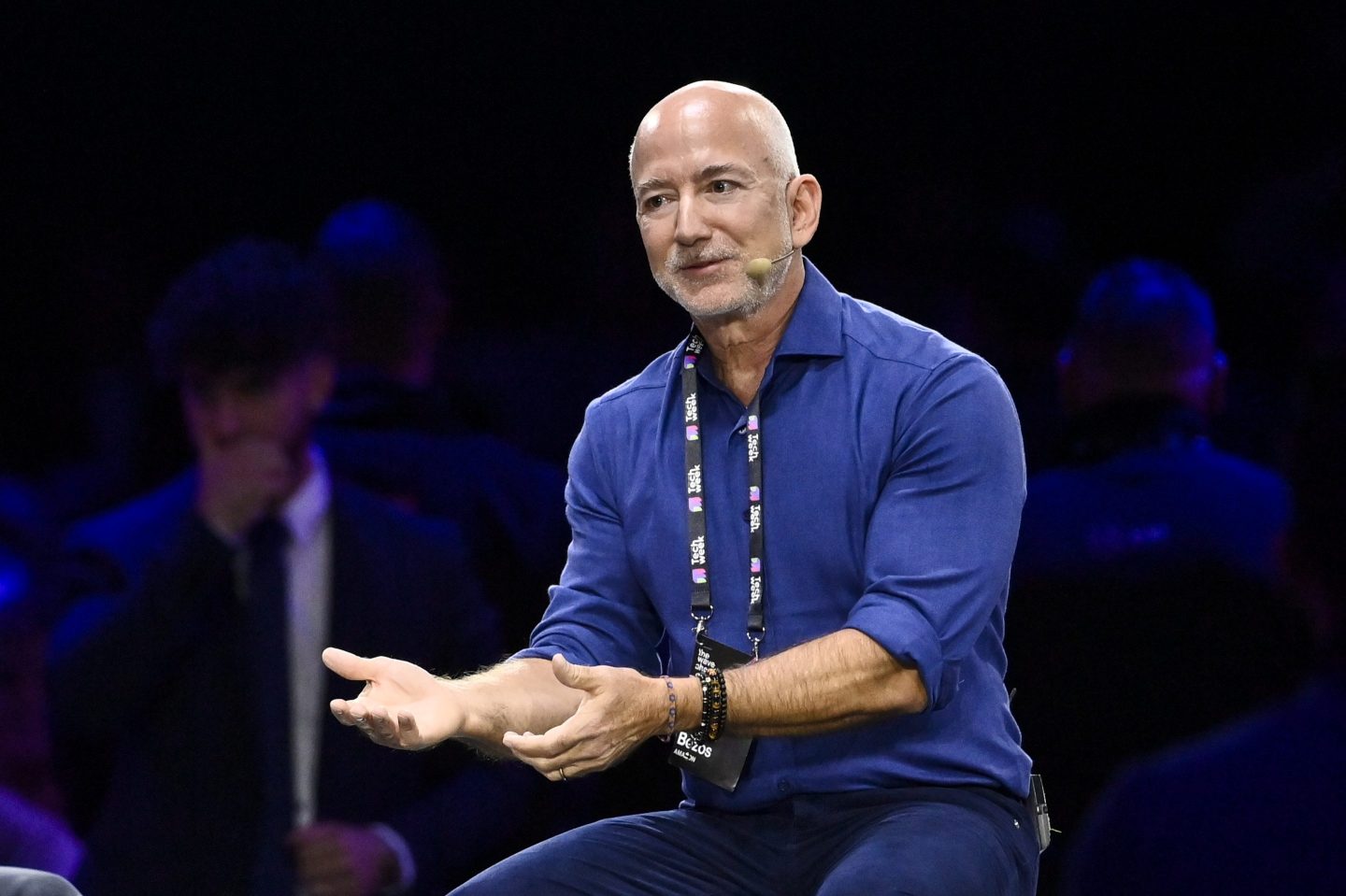

Former Microsoft (MSFT) Chief Executive Steve Ballmer could claim as much as $1 billion in tax benefits from his purchase of the Los Angeles Clippers, which is half of what he paid for the NBA franchise earlier this year.

An analysis of U.S. tax laws complied by The Financial Times found that Ballmer could claim about half of the purchase price in current terms over the next 15 years against his taxable income. Those credits could be claimed under an aspect of the tax code covering so-called active owners of sports franchises, the Financial Times said.

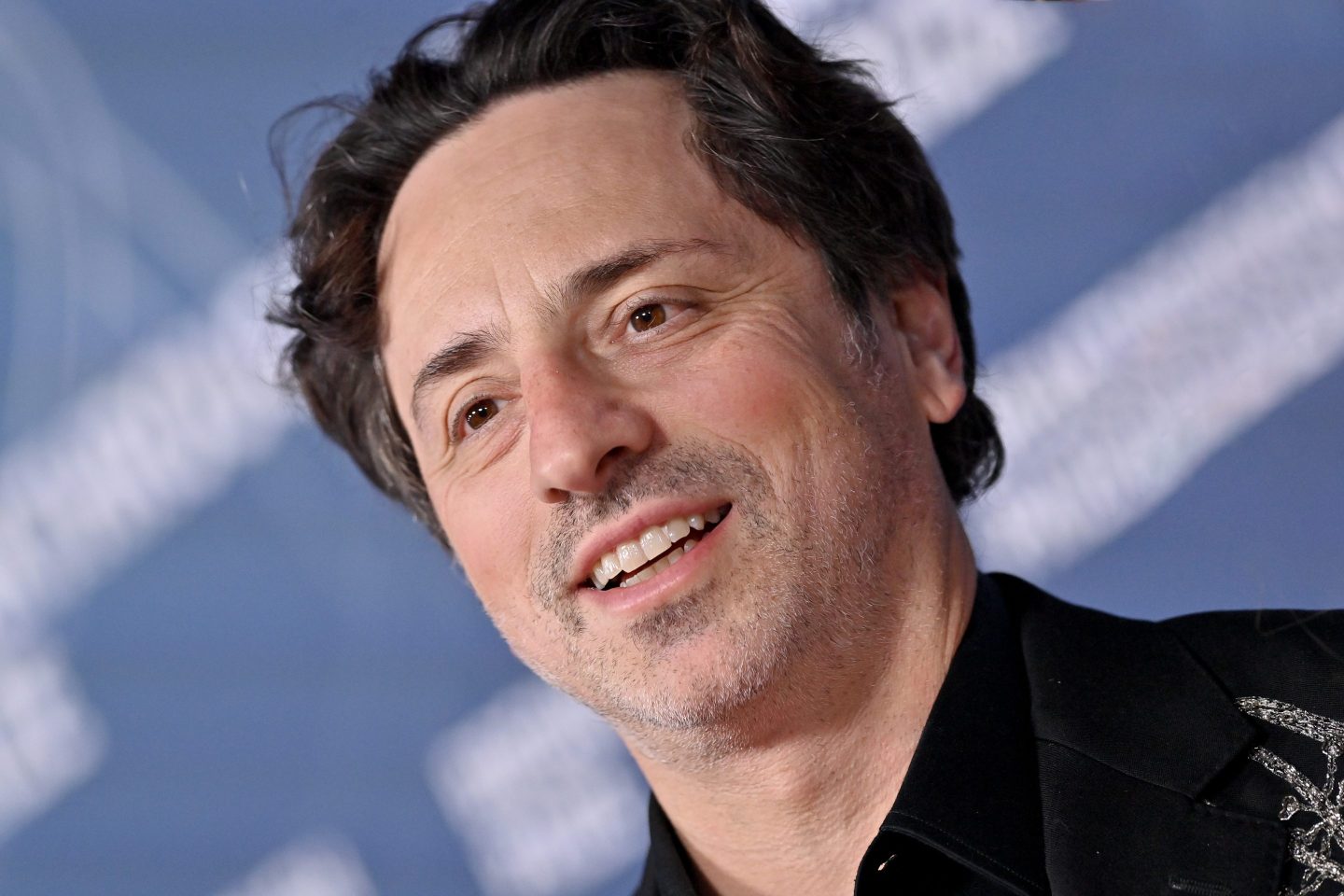

Ballmer, a basketball fan, bought the Clippers earlier this year in a bidding battle that included other big names in business, such as Oracle (ORCL) Chairman Larry Ellison. The final price Ballmer paid easily topped the previous record for an NBA team of $550 million.

Ballmer’s decision to own an NBA franchise comes at a lucrative time for the league. The NBA reportedly reached long-term media rights deals with two networks that would more than double the fees it received under the previous contracts. ESPN has touted a number of ratings records earlier this year around the timing of the NBA finals, and consumer demand for basketball footwear has been strong, another indication of the league’s popularity.