Click to enlarge.

FORTUNE — Since my Bullish Cross account expired [see note] I’ve missed my daily dose of technical Apple (AAPL) analysis. So the “Chart Talk” note issued Friday by Stephen Suttmeier, a top Merrill Lynch technical analyst, was like a visit from an old and somewhat obsessive friend.

Suttmeier was following up on a note he issued April 18, when Apple shares had broken through support at $420 on expanding volume and seemed to be headed straight toward the next support level at (gulp!) $325-$310.

Friday’s Chart Talk acknowledged that April’s breakdown proved short-lived and that Apple was showing some “signs of bottoming.”

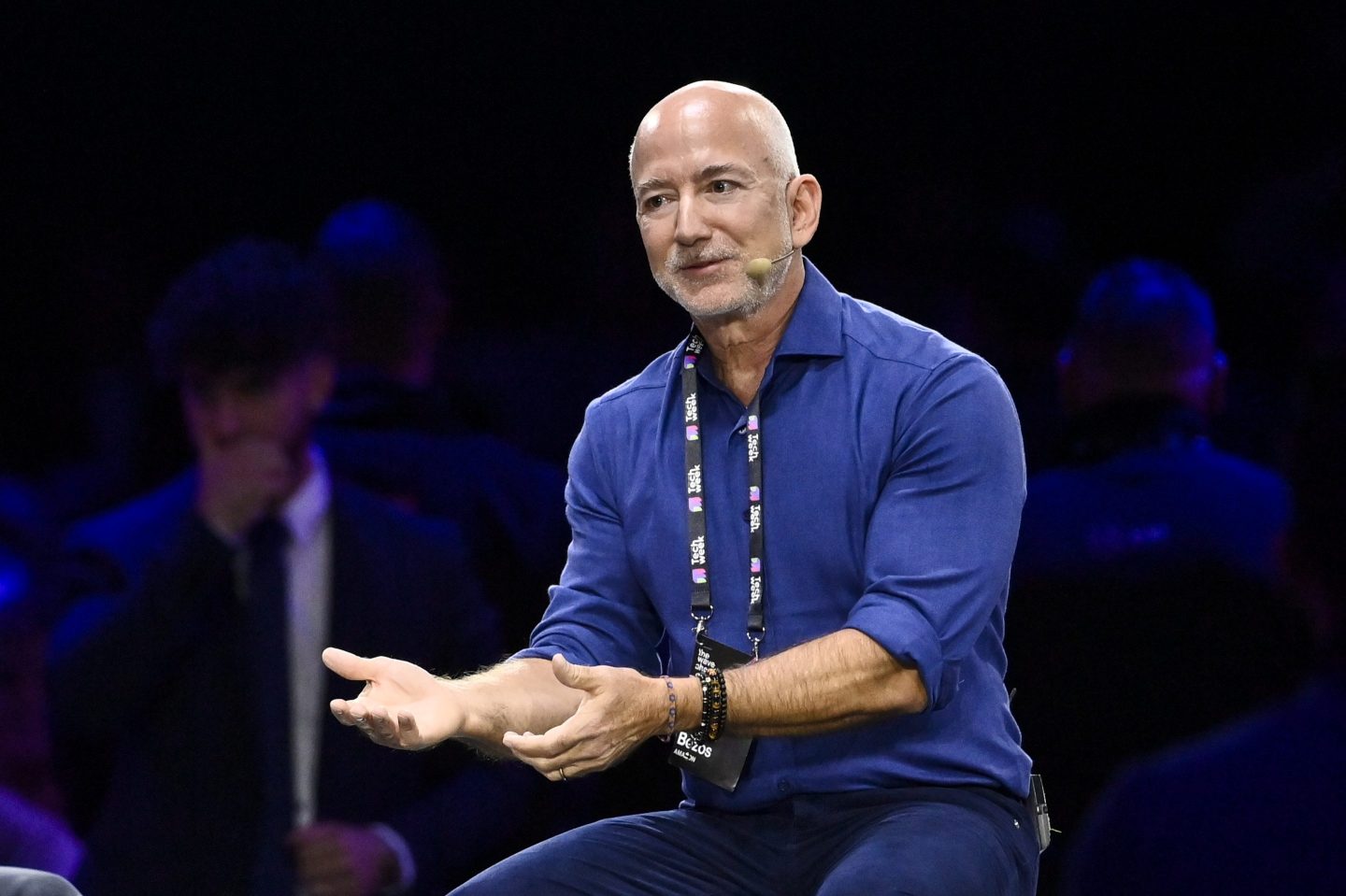

For evidence, he pointed to the chart (above) of Apple’s on-balance volume (OBV), a technical indicator that is supposed to show whether smart money is moving into or out of a stock.

“Volume tends to lead price,” says Suttmeier, “and OBV is a volume indicator that measures accumulation.”

In a section titled “Key Levels to Watch” he writes:

“Some backing-and-filling is possible, which in our view would be healthy and support a better base or bottom that would favor a stronger rally. The improvement in OBV is consistent with base-building and suggests limited downside. The key is holding support at $420. Below $420 would weaken the pattern and increase the risk for a drop back to the $382.6 low. Above $470-485 would break the last two lower tops and point to a bottom in AAPL. The January breakdown point near $500 and the falling 200-day moving average near $541 offer resistance. But if AAPL backs-and-fills and holds $420, a breakout above $470-485 would complete a stronger bottom pattern and project upside to $550-580.”

There. Don’t you feel better?

Note: An earlier version of this post suggested that my account had been cancelled. It has since been restored.