How institutional investors are driving a new gold rush

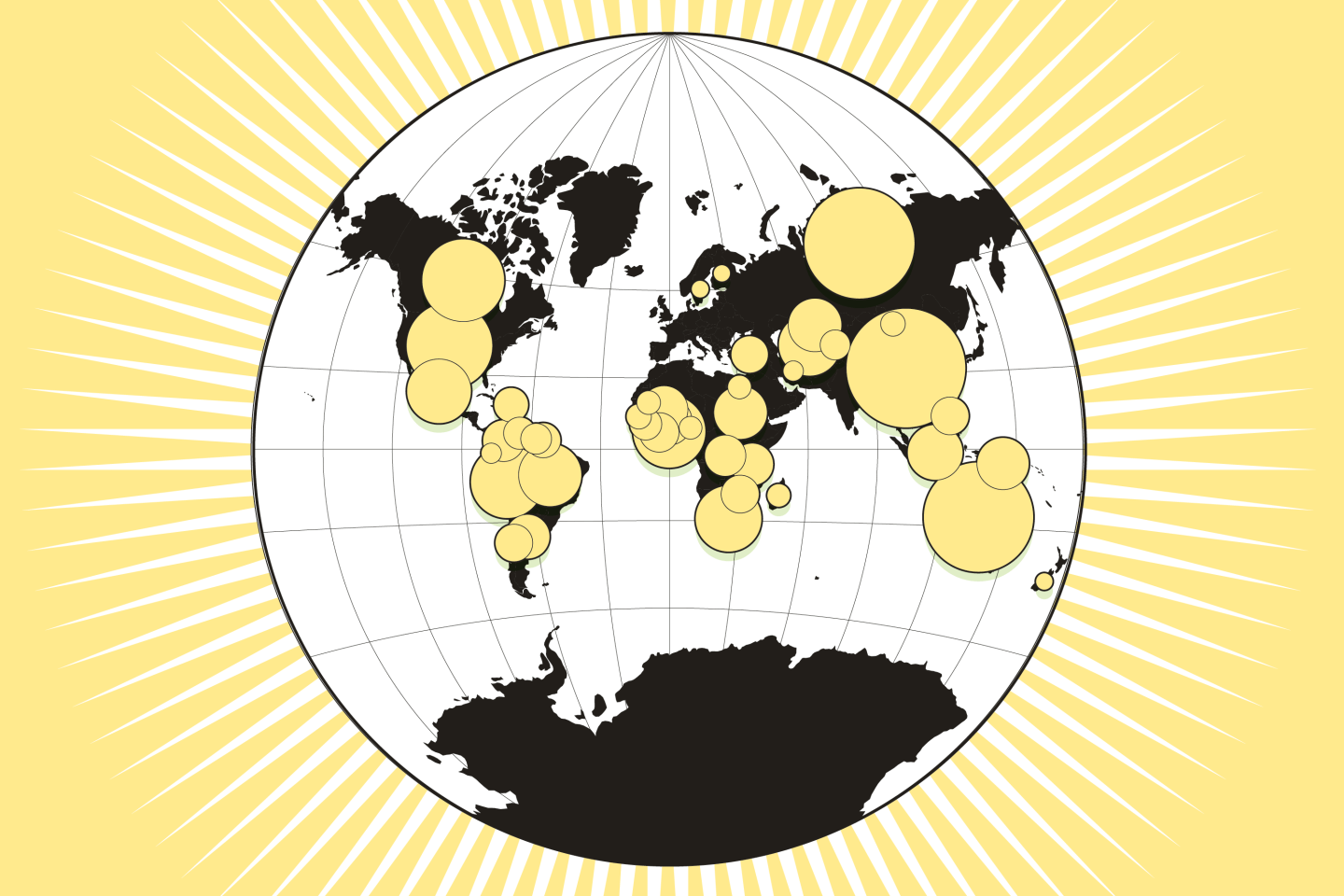

On Aug. 6 the price of gold hit a new record high of $2,067 per ounce. Even after sliding back under $2,000, gold was still up 28% as of early September. And over the past five years, the price of the precious metal has soared 75%. The recent surge has been driven by investors seeking a safe haven amid the economic chaos of the pandemic. While cash-strapped consumers have purchased less gold jewelry in 2020, the shortfall has been offset by institutional demand. Through August, the holdings of gold-backed exchange-traded funds grew by 938 metric tons, or some $51 billion, according to the World Gold Council. Meanwhile, global mining production—slowed by COVID-19 lockdowns—fell by 5% in the first half of 2020 versus 2019. Here’s a graphic breakdown of where gold is mined around the world.

A version of this article appears in the October 2020 issue of Fortune with the headline “Investors spark a new gold rush.”