UniCredit SpA said it will assess the next steps in its pursuit of Banco BPM SpA, after an Italian court struck down some conditions imposed on a takeover by the government, while leaving others intact.

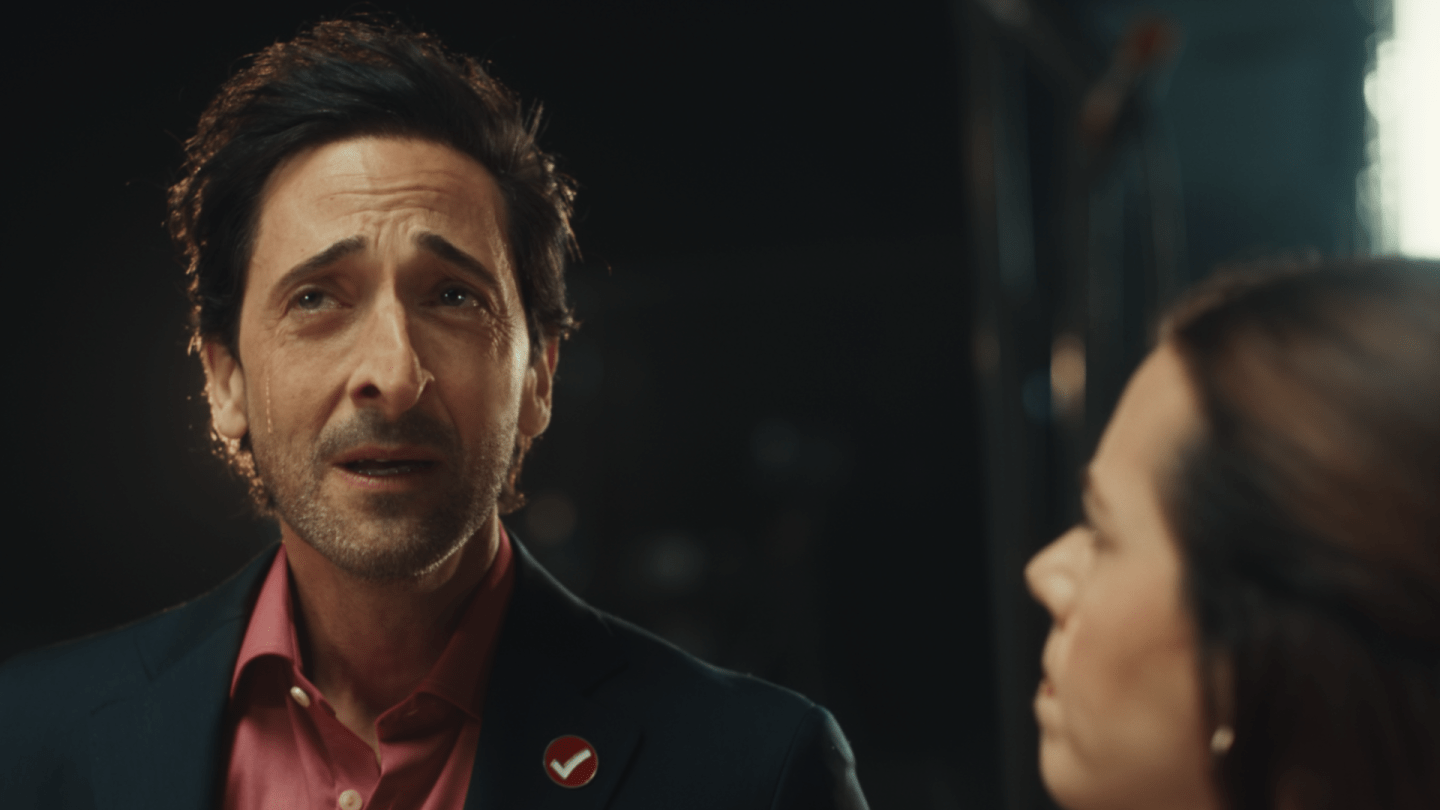

In a ruling published Saturday, the administrative court of Lazio annulled two demands by the government while confirming a requirement that UniCredit exits its Russian business and that keeps unchanged domestic investments at Banco BPM’s newly acquired asset manager Anima Holding SpA. Chief Executive Officer Andrea Orcel had previously said such demands could halt his takeover plan.

UniCredit welcomed the decision as “unequivocal proof that the way in which Golden Power was used was illegitimate,” referring to the process that allows authorities to block or impose conditions on transactions involving strategic assets. “UniCredit will now evaluate all relevant steps in a timely manner.”

Orcel is facing a tight timeline, with the expiry of the offer period set for July 23. The CEO is set to receive a backing from the European Union, which is expected to rebuke the government in Rome and question the way it intervened in the deal. But a plan by French rival Credit Agricole SA, announced shortly before court the ruling, to increase its stake in Banco BPM further complicates matters.

Shares of Banco BPM rose 2.4% at 9:55 a.m. in Milan on Monday, while UniCredit fell 0.5%.

UniCredit unveiled its unsolicited all-share offer for Banco BPM in November with the terms offering almost no premium on Banco BPM’s closing price before the bid. They currently imply a price for Banco BPM of about €14.6 billion ($17 billion), while the bank has a market capitalization of €15.2 billion, as of Friday. That suggests shareholders expect the larger lender to boost its bid of 0.166 newly issued shares for each one in the smaller rival.

The deal irked the government in Rome, and it prompted Credit Agricole — the largest shareholder in Banco BPM — to raise its stake to better defend its interests in Italy. The French lender has commercial agreements with both Italian lenders and is seeking to defend its interest in its largest market outside France.

Credit Agricole currently owns 19.8% of Banco BPM after increasing its stake earlier this year. It said late Friday that it requested authorization from the European Central Bank to raise its holding above 20%. It doesn’t intend “to acquire or exercise control.”

The court ruling was welcomed by all parties involved in the deal. Banco BPM said on Saturday that the court outcome confirms the legitimacy of the government conditions and urged UniCredit to clarify its intention on the ongoing offer. A government official said the decision largely confirms the legitimacy and structure of the prescriptions.

UniCredit said that, alongside the “illegitimate use” of the golden power, “often misleading” campaigns by Banco BPM to discredit it may have deprived BPM’s shareholders of the possibility of an improvement in its offer terms if the process had been orderly.

UniCredit’s pursuit of Banco BPM is just one of several overlapping deals currently going on among Italy’s banks. It made the offer when it became clear that the government in Rome was looking to build a large banking group around the formerly bailed-out Banca Monte dei Paschi di Siena SpA, with Banco BPM seen as a potential candidate for a merger.

After UniCredit’s move, the government is now instead backing a deal between Monte Paschi and Mediobanca SpA. The offer period for that takeover, valued at around €15 billion, is starting Monday. Mediobanca on Friday reiterated its opposition, saying the bid is too low and the deal is lacking rationale.