British personal computer maker Raspberry Pi confirmed its plan for an initial public offering in London, marking a small step for the city that’s fallen behind a broader listings revival in Europe.

The offering will consist of new shares to raise $40 million and existing shares sold by stakeholders, the company said in a statement Wednesday. Raspberry Pi, which is controlled by a charitable foundation, expects to list on the main market of the London Stock Exchange in June, it said.

The flotation, albeit small, is a welcome boost to the ailing UK market, whose share has fallen to just about 2% of the $12.3 billion raised in IPOs in Europe this year, the lowest in decades, according to data compiled by Bloomberg. With UK stocks trading at a discount to many major foreign markets, the London IPO market is being hindered by the prospect of companies achieving higher valuations elsewhere.

Rasberry Pi was seeking a valuation of about £500 million ($637 million) via the listing, Bloomberg News reported earlier this month. The IPO would be the biggest in London since Kazakhstan’s Air Astana JSC listed its global depositary receipts there in February.

The investment arm of chipmaker Arm Holdings Plc has agreed to buy $35 million shares in the IPO, while Lansdowne Partners UK LLP will purchase up to $20 million as a part of cornerstone investment agreements. Both are existing shareholders in the company.

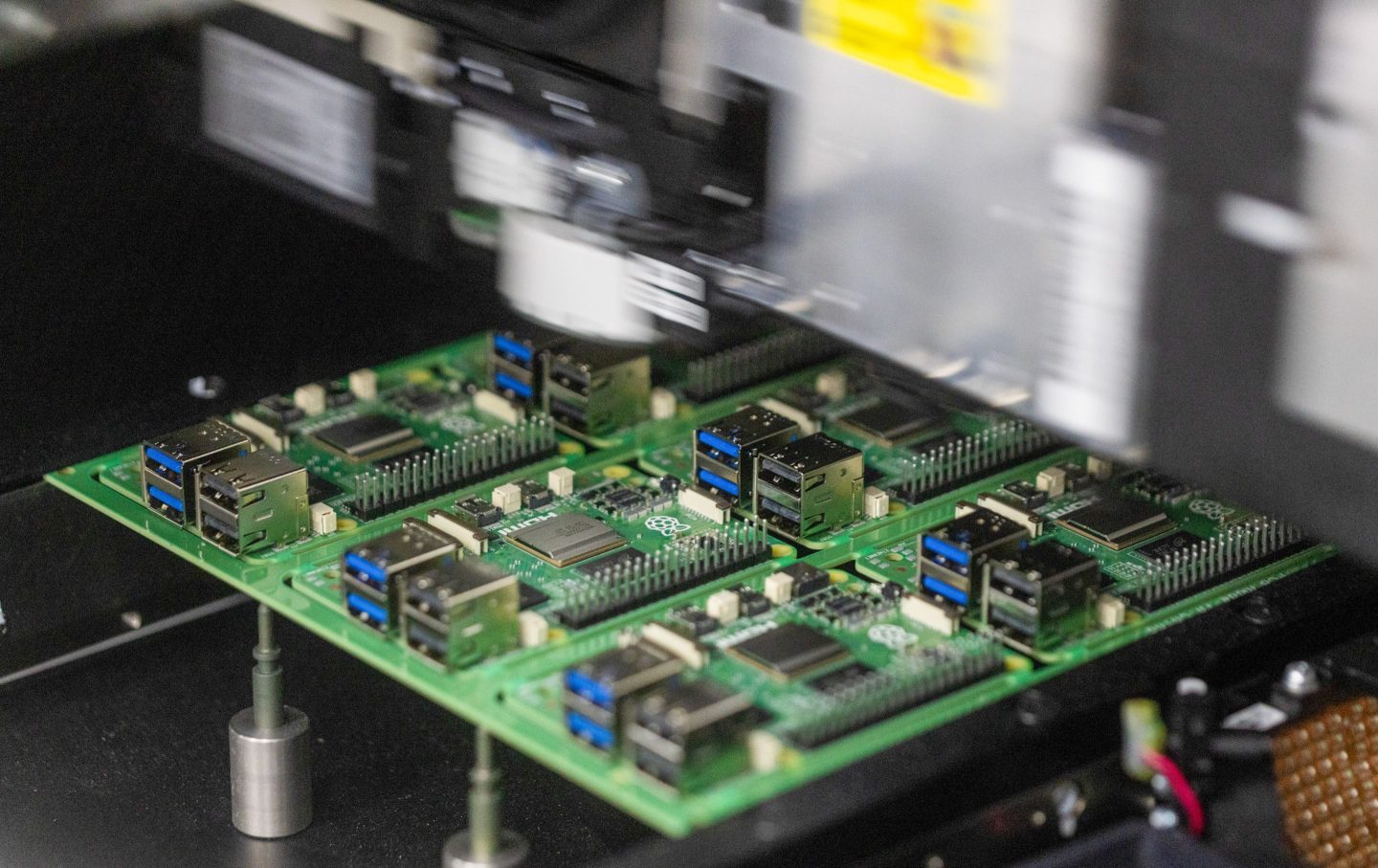

The company, which makes low-cost computers popular among hobbyists and educators, has in the past raised money from Arm and Sony Group Corp.’s semiconductor division. British chip designer Arm had itself chose to list in New York instead of London.

Raspberry Pi had revenue of $265.8 million last year and adjusted earnings before interest, taxes, depreciation, and amortization of $43.5 million. Jefferies International Limited and Peel Hunt LLP are joint global co-ordinators for the IPO.

The company plans to use the money from the sale of new shares for engineering capital expenditure, to enhance its supply chain resilience and for general purposes.