The 10 U.S. spot Bitcoin exchange-traded funds continue to unravel. On Wednesday, outflows were recorded from every ETF for the first time, amassing the greatest losses since trading began in January, with $563.7 million exiting the funds, according to CoinGlass data. The latest figures continue an almost two-month decline. In the past four weeks, the funds have seen around $6 billion in losses, a drop in assets under management of around 20%.

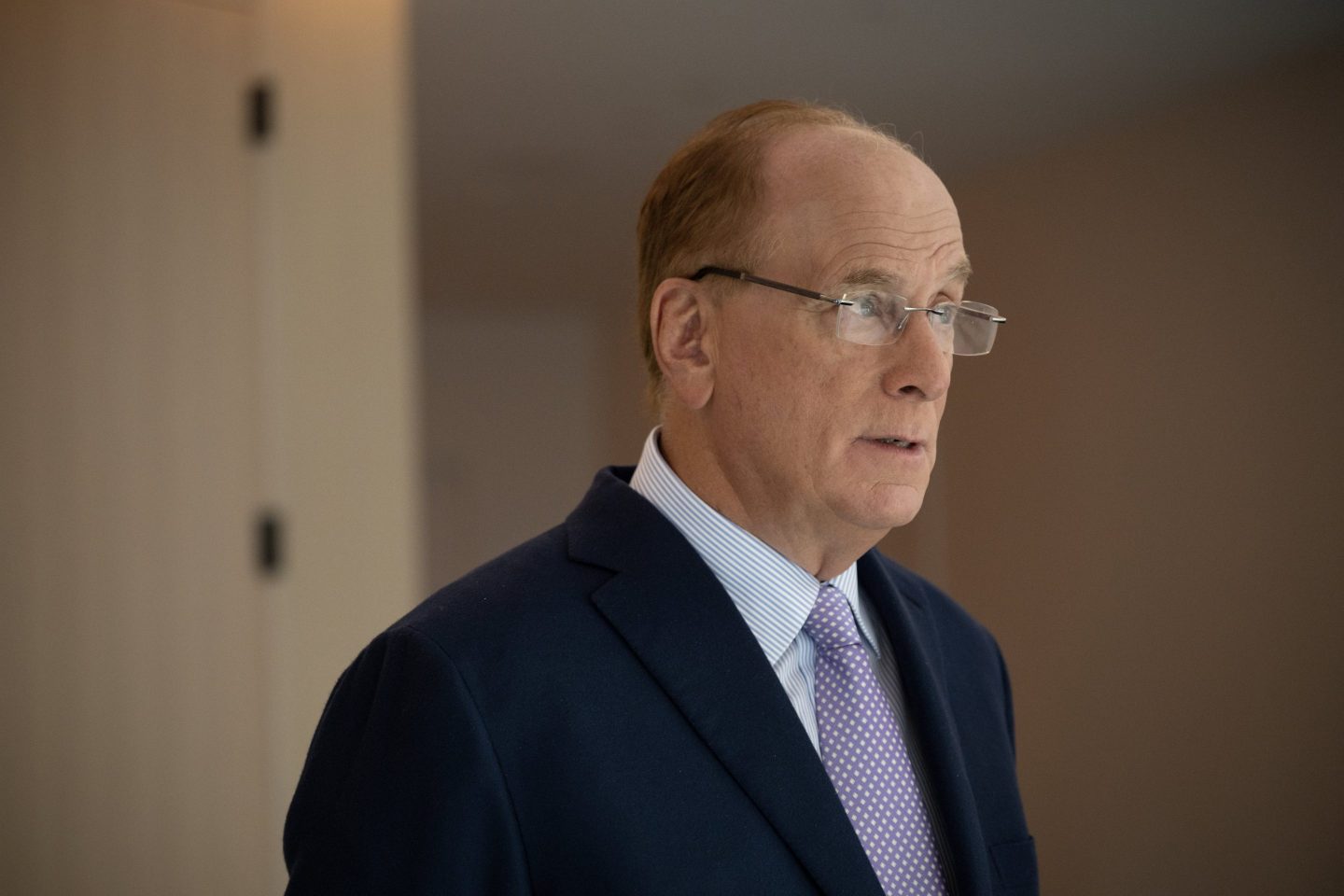

BlackRock’s IBIT—the most successful fund, with $17.24 billion in assets under management—recorded outflows for the first time, seeing $36.9 million worth of shares liquidated. The fund’s inflows have dried up since April 24. Meanwhile, the other two largest funds, Fidelity’s FBTC and Grayscale’s GBTC, saw $191.1 million and $167.4 million in losses, respectively.

The simple explanation for why funds have been retracting is the declining value of the underlying asset. Bitcoin climbed 65% from the year’s start to its all-time high of $73,000 in March, according to CoinGecko data. It has fallen almost 20% since, now trading near $59,000. This timeline aligns with when the outflows began.

Bitcoin’s price correction has been caused by myriad factors. Following the April 19 halving, “buy the rumor, sell the news” investors have shorted Bitcoin, and miners have sold surplus reserves to counteract rising production costs. In addition, the Federal Reserve’s dovish fiscal policy has created further downward pressure, keeping interest rates at a 23-year high after two months of disappointing inflation data. As of March 31, inflation was at 3.48%, according to the consumer price index, up from 3.2% in February.

In addition to the somewhat challenging market conditions for risk assets like Bitcoin, Eric Balchunas, Bloomberg’s senior ETF analyst, told Fortune that the recent outflows are also fairly typical in the early stages of an ETF.

“I wouldn’t call this a bloodbath of outflows by any stretch. This is a pretty tough correction, no doubt, but the assets and the flows are going to zigzag their way up over the course of the year,” he said. Instead, he emphasized that while skittish investors and tactical traders are quick to sell when the asset is falling, the bulk of investors, in his view, appear to be holding on long term.

Balchunas also noted that the recent drop in Bitcoin will serve as a reminder to ETF investors that the underlying asset is volatile and not an equivalent value store like gold, which he suspects some wholesalers of the issuers may be selling to clients. “Once you go up as high as they did, that comedown feels like crap,” he added.

While a fizzle in the initial ETF frenzy may be inevitable, the first prolonged stalling in the funds raises more existential questions about how the funds will continue to grow. For instance, the issuers currently don’t have access to the clients of major registered investment advisors and broker-dealer platforms like Morgan Stanley, JPMorgan, or Wells Fargo. Moreover, while the Nasdaq, Cboe, and NYSE Arca all filed 19b-4s to the Securities and Exchange Commission in January, to allow for the trading of related ETF options, there has been no progress.

In Balchunas’s view, just because the ETFs provide easy access to Bitcoin, that can’t be the full narrative: Many mainstream investors still need another reason to buy the token.

“It’s almost like you put your band’s music on Spotify. Instead of like selling vinyl records, you clearly are gonna have more possible audience,” he said. “But the music has to be the main thing you’re selling.”