Good morning from France, where I’m attending Paris Blockchain Week, the largest crypto conference in Europe, which is either the budding world leader in digital asset regulation or a Byzantine mess of clashing jurisdictions, depending on who’s talking.

Yesterday, I had the opportunity to kick off the event by moderating a fireside chat with Richard Teng, who took over as CEO of Binance following the landmark enforcement action and $4.3 billion settlement led by the U.S. Justice Department. With his predecessor, the once ubiquitous Changpeng Zhao, set to be sentenced and likely imprisoned later this month, Teng occupies a knotty position.

After a turbulent transition last November that saw nearly $1 billion in outflows, it seemed that Teng had maintained Binance’s Teflon status, aided by the recent rally in crypto prices. As he told me, the platform has managed to attract nearly 20 million new users since November and saw $9 billion flow into the exchange last month. According to data from The Block, Binance still had close to 50% of total spot exchange volume in March.

Despite the rosy figures, Teng’s brief tenure has still been pockmarked by the typical scandals that have plagued the firm since its launch in 2017. First and foremost is the detention of its head of financial compliance, former IRS special agent Tigran Gambaryan, by Nigerian authorities. On Monday, Gambaryan pleaded not guilty to tax evasion charges and was remanded by a judge to a medium-security prison that was the site of an Islamist militant raid in 2022—what I had been told by people close to the case was the worst possible outcome.

Binance is obviously in a tricky position with Gambaryan, negotiating behind the scenes but being publicly cagey with information. When I asked Teng what Binance was doing to ensure Gambaryan’s release, he answered that it was a sensitive manner, but that Binance was “working very collaboratively with the Nigerian authorities.”

When I followed up about reports that Binance might be on the hook for a $10 billion fine by the Nigerian government, or whether Teng would travel to appear before the country’s House of Representatives, he said that he couldn’t comment on “rumors in the marketplace.” I asked one last time whether Binance was taking further steps to ensure the safety of employees around the world, given that Gambaryan and his colleague had been arrested during a seemingly routine visit with authorities. “We have discussed enough of this subject matter,” Teng said. “Let’s move on.”

Teng’s curt response is emblematic of his approach to the CEO position, a marked departure from CZ’s more charismatic but haphazard leadership. Teng comes from a regulatory background, having served at the Monetary Authority of Singapore for 14 years, as well as six years as CEO of Abu Dhabi Global Market. His presence is measured and conservative, which seems appropriate as the exchange tries to shed its reputation of lawlessness.

I asked Teng his favorite question—whether Binance would ever pick a site for its global headquarters, as he told Fortune’s Jeff John Roberts the company eventually would during an interview last November. Once again, Teng largely demurred, although he did offer a meager new detail that Binance had a “few jurisdictions” under consideration, enough of an update to be picked up by a raft of crypto publications.

Outside of Nigeria—as well as the Philippines, which recently enforced its ban of Binance, sending users scrambling to withdraw funds—the most consequential challenge facing the exchange will be the appointment of a monitor by the Justice Department and Treasury Department. The soft deadline of Feb. 20 came and went, though the law firm Sullivan & Cromwell is reported to be the top pick for the position.

While the presence of U.S. Feds in every aspect of Binance may seem like a turnoff for the exchange’s international user base, Teng stressed that he viewed the appointment as a competitive advantage. “This is also a demonstration of our willingness—a demonstration of our ability to comply with all the rules and regulations,” he told me. As the platform preserves its market dominance, the numbers seem to back up his bold proclamation—at least for now.

Leo Schwartz

leo.schwartz@fortune.com

@leomschwartz

DECENTRALIZED NEWS

The layer-1 blockchain firm Monad Labs raised $225 million backed by a slew of investors including Paradigm, Electric Capital, and prominent crypto influencers. (Fortune)

Hong Kong is reportedly poised to approve spot Bitcoin ETFs as soon as this month, with China Asset Management, Harvest Fund Management, and Bosera Asset Management among the applicants. (Reuters)

Deputy Treasury Secretary Wally Adeyemo testified before the Senate Banking Committee for a hearing on illicit finance, specifically naming Tether as an alternative payment tool used by Russia. (Wall Street Journal)

Sen. Elizabeth Warren (D-Mass.) sent a letter to House Financial Services Committee chair Patrick McHenry (R-N.C.) and ranking member Maxine Waters (D-Calif.), warning against a potential stablecoin bill. (Politico)

A federal prosecutor described Avi Eisenberg’s $110 million exploit of Mango Markets as stealing in the opening statement of the crypto trader’s criminal trial. (CoinDesk)

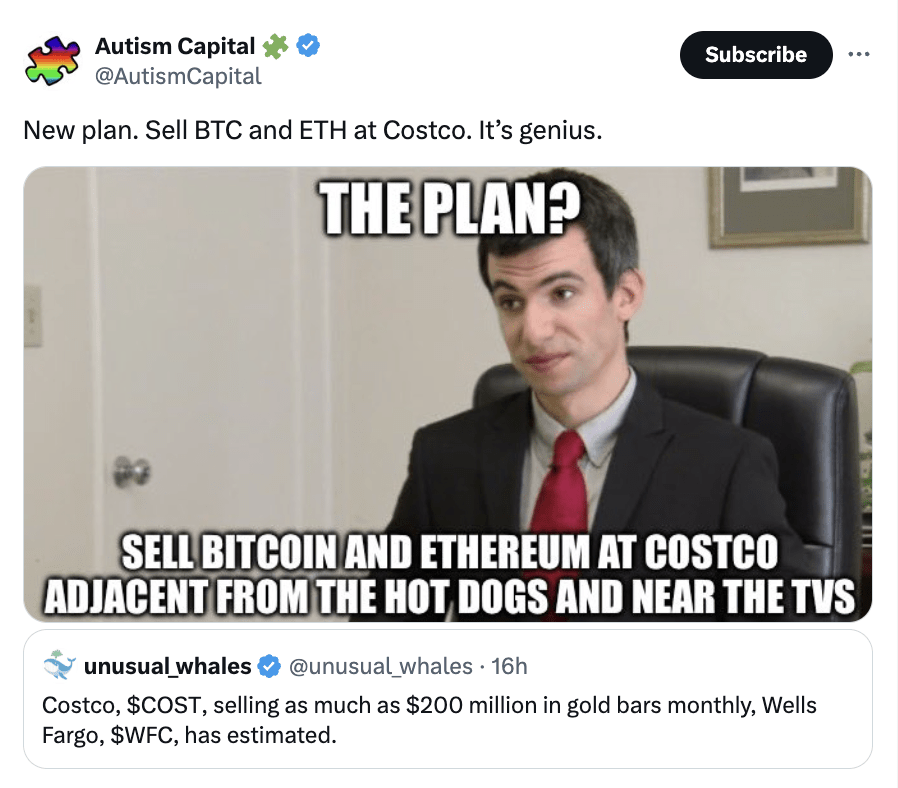

MEME O’ THE MOMENT

First gold bars, next … crypto?

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.