When a country’s currency is crashing, it usually means the market has concluded that the place is not being very well run. In response, rulers can take certain steps to try and restore people’s confidence in their government and economy. This might include some mix of budget trimming, policy changes, and accountability measures. Or they can try something desperate—like finding a scapegoat and taking them hostage.

Unfortunately for the people of Nigeria, their leaders went with Plan B. This came after the country’s government responded to a free fall of the naira by blaming cryptocurrency exchanges, including Binance, for the crash. To sort out the mess, the company dispatched two executives who the Wall Street Journal has identified as Binance’s regional manager for Africa, Nadeem Anjarwalla, and Tigran Gambaryan, a former special agent with the IRS who leads financial crime compliance. When they arrived, Nigerian authorities seized the men’s phones and passports, and detained them in a guarded house.

So why would they do that? The Financial Times has the explanation: An advisor to Nigeria’s president says the Binance execs are “providing a ‘lot of information’ and suggested that Nigeria may seek to impose a $10bn fine as ‘retribution’ because they ‘really messed up’ our economy. Sources say this is not a final fee and should be seen as the starting point in a negotiation.”

In other words, they took hostages to give them leverage in a corporate shakedown. This is a playbook that’s becoming depressingly familiar in world affairs lately and puts Nigeria’s rulers in the same company as Hamas or Vladimir Putin’s mafia regime in Russia, which has detained innocent reporter Evan Gershkovich for nearly a year with no justification.

As for Binance, look, they’re nobody’s idea of a model corporate citizen. Under the regime of new CEO Richard Teng, however, the company has shown every indication it’s trying to take compliance seriously and said in a blog post it has met repeatedly with Nigerian officials. As for the detained executives, I can’t speak for Anjarwalla but can attest that Gambaryan is highly regarded in law enforcement and cybersecurity circles, and has helped with numerous criminal and terrorism investigations. Both men have young children asking their mothers every night when dad is coming home.

There’s also the claim by Nigerian leaders that Binance, and crypto in general, is hijacking the role of the central bank in determining the naira’s value. It is true that many Nigerians are turning to crypto, and that the growth of stablecoins has begun to challenge regional currencies in a number of places. But such activity is a symptom, not a cause—and is no different than what takes place in the alleys of Buenos Aries where Argentines have for decades bought black-market U.S. dollars. In all of these situations, the local population has lost faith in the government’s ability to protect the value of the national currency.

The final irony in all this is that even if this stunt works and Nigeria’s rulers shake down Binance for billions of dollars, it won’t do a thing to help the country’s currency woes. If Nigeria’s leaders want to get to the root of the problem, they should stop blaming crypto and look instead at Nigeria’s reputation as a hotbed of scams and kleptocracy, which is why the country ranks 145th on Transparency International’s global corruption index. Taking hostages is only going to make things worse.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

CipherTrace, the crypto forensics startup acquired by Mastercard in 2021, is telling customers it is shutting down key services. (Fortune)

A federal judge refused a request by Gemini and bankrupt Genesis to throw out an SEC lawsuit over Earn, concluding that the crypto rewards program amounted to the sale of unlicensed securities. (Bloomberg)

Ethereum's new Dencun update, which lowers gas fees through the creation of a new form of storage space on the blockchain for L2s, is now live. (Fortune)

Microstrategy says it will sell $500 million of convertible notes to purchase more Bitcoin, a move that comes weeks after the cybersecurity-turned-crypto firm did the same to buy $821 million worth of the currency. (Bloomberg)

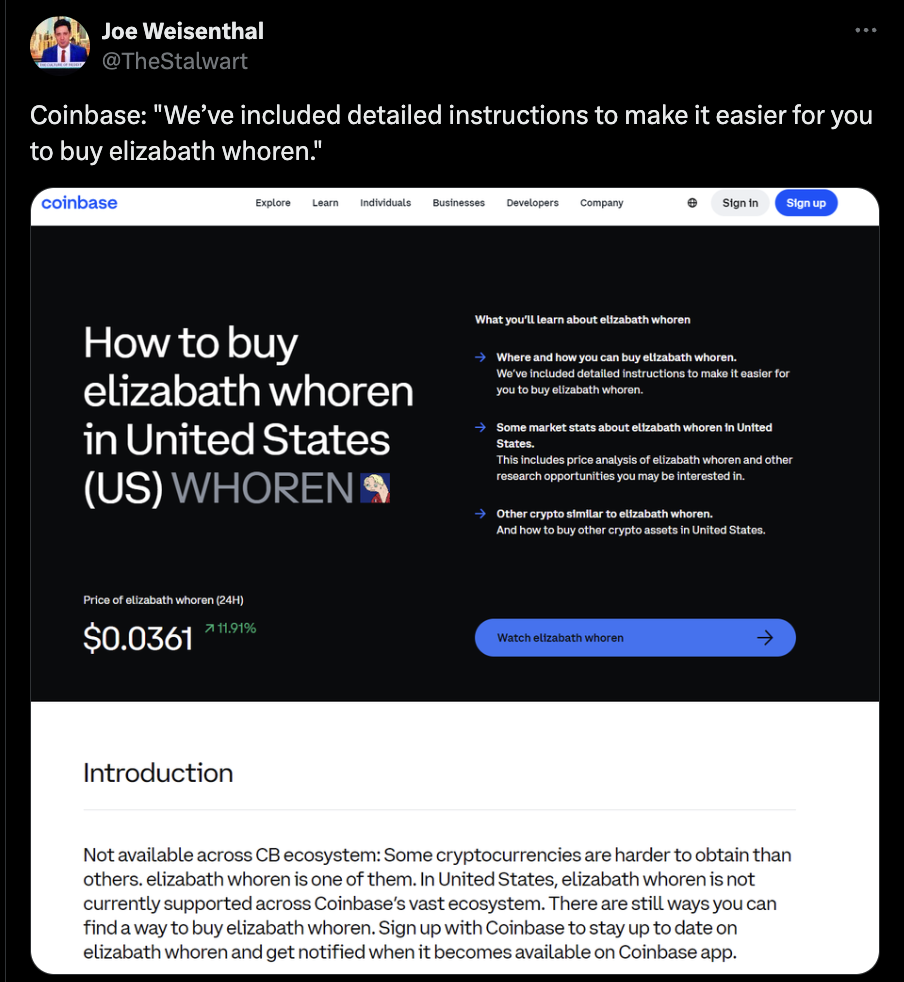

Coinbase took down an auto-generated page that provided instructions on how to buy a new memecoin named for a misogynist slur of Sen. Elizabeth Warren (D-Mass.). (Coindesk)

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.