Let’s make this a flashback Friday and step back to the crypto world of 2013. It’s hard to believe just how different things were back then: There was no Ethereum, regulators didn’t know or care what crypto was, and Bitcoin went on its first big ride, from $13 all the way to $1,000 by the end of the year. Back then, the industry was defined by larger-than-life characters who believed in Bitcoin with a passion that made them seem crazy—understandably in some cases—to outsiders.

One of my favorite people from this era was Wences Casares, the founder of one of the first crypto custody firms, Xapo. A charismatic Argentine with movie star looks, Casares is rightfully regarded today as crypto royalty who ran with the original gang of Bitcoin OGs—he almost certainly knew Satoshi—who built the industry. But as a tech reporter, I thought the premise of his startup was daft: A firm that promised to store your Bitcoins in a bunker that was buried under a mountain in Switzerland.

This over-the-top security was partly a marketing stunt, but it also reflected the sense of paranoia among many early crypto founders who feared money-printing governments and feckless banks the way you and I might fear snakes or wildfires. In Casares’s case, his paranoia was understandable given the economic ruin bad rulers had inflicted on his native Argentina, which had experienced a series of full-blown currency collapses.

To make a long story short, Xapo’s crazy custody scheme worked, and the startup soon branched into other crypto services. In 2019, Casares sold the custody portion of Xapo’s business for $55 million to Coinbase (which does not use Swiss bunkers) and stepped back to take on the role of elder statesman of sorts, while letting others run Xapo as a crypto bank of sorts. That bank is still going today, with 25,000 Bitcoins (worth around $1.3 billion!) on its balance sheet—a reminder that many of those crypto founders in the early days got very, very rich.

Today’s version of Xapo is a very different sort of company, though Casares still sits as chairman. I spoke with its top lawyer, Joey Garcia, who explained its current business model: A bank that pays customers interest on both their cash and Bitcoin, but never lends out or touches the crypto. It entails a $150 annual service fee (Axios has a good rundown of how exactly it works) and has a network of overseas licenses. The company wouldn’t share any figures to indicate how many customers are using it or how much money it’s making, but it did say its biggest customer base is in Argentina and Latin America.

Xapo has also moved away from its founding policy of having customers oversee the custody process themselves, but its current emphasis on fully backed reserves stored in highly secure accounts does reflect Casares’s original ethos. For those of us in the U.S., much of this is academic since regulators are highly unlikely to bless its business model. But it’s still fun to reflect on Xapo and Casares, who is among a handful of founders from the early era—others include Kraken’s Jesse Powell, Coinbase’s Brian Armstrong, and DCG’s Barry Silbert—who built businesses that continue to thrive.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Kraken filed to dismiss a November lawsuit by the SEC, which accused it of failing to register and of comingling funds, claiming the suit was retaliation for lawful speech and brought by a "politically compromised agency." (Fortune)

DeFi platform Euler has bounced back from a $200 million hack last year with a 2.0 version of its lending platform that employs decentralized "vault" technology. (CoinDesk)

A bankruptcy judge approved plans for FTX to sell its 7% stake in hot AI startup Anthropic, which will likely fetch the firm around $1 billion. (The Block)

Andreessen Horowitz invested $100 million in startup Eigen Layer, which supports projects that engage in re-staking tokens on the Ethereum blockchain. (Bloomberg)

Ethereum founder Vitalik Buterin said he is excited about the potential of AI to audit for bugs that are the source of so many crypto hacks. (CoinDesk)

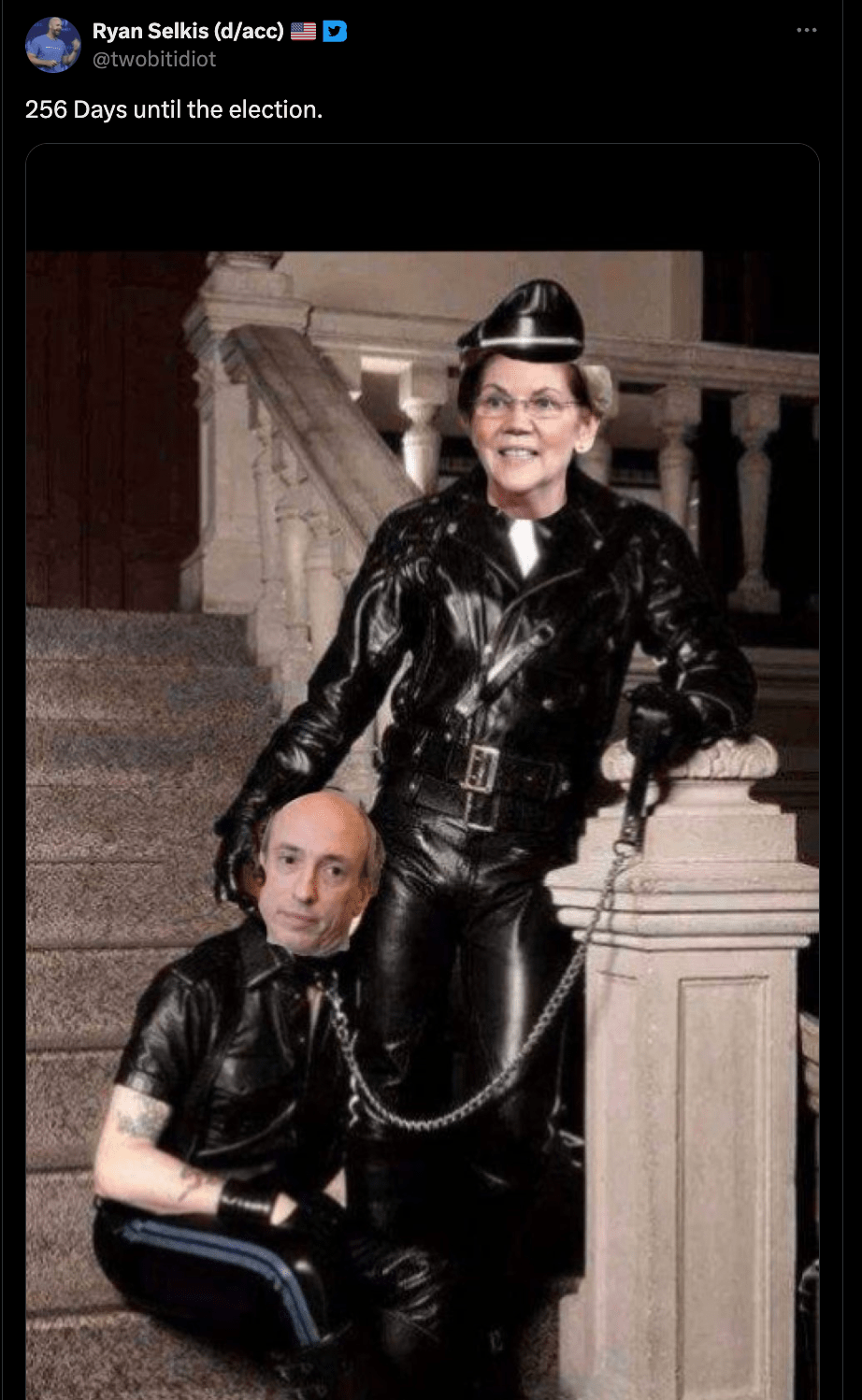

MEME O’ THE MOMENT

Let the campaign season begin:

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.