On Monday, Apple announced that its new savings account is open for business. The iPhone maker’s new banking product, which was announced last fall, is available to those with an Apple credit card and offers a tasty interest rate of 4.15%.

Apple’s savings account is notable both for the rate, which is one of the highest around, and as another signal of how far the company is leaning into the financial services world. To pull this off, it has extended a tie-up with Goldman Sachs, which is also behind Apple’s credit card, in an arrangement that lets Apple become a big player in the world of personal finance while dodging most of the responsibilities that go with that.

“I think Apple can eke out the economics of the bank without actually becoming a bank. They can leverage with Goldman to power all of these financial services and be the conduit to the consumer for a lot of these things, brand it as Apple, take that high-margin cut, and offload all of this sort of underlying responsibility to Goldman,” the CEO of payments company Paddle told the Financial Times.

Nice work if you can get it. Apple is getting all the upside of being a bank without all the regulatory misery. Meanwhile, the company has found a new way to strengthen the golden handcuffs that keep people tied to its iPhones even as they grow frustrated with its monopolistic behavior.

All of this is ironic because Apple does little in the way of innovation these days. Its Apple Pay service is a good product but nothing groundbreaking, and the company has had no part in major efforts to reinvent the underlying technology of payments. Needless to say, it is actively hostile to crypto.

This has got to irk Coinbase, which has been testing all sorts of interesting consumer finance products and has for years jumped through regulators’ hoops in a bid to introduce them to market. But regulators have repeatedly slammed the door in its face—preferring to deal with giant incumbents like Apple and Goldman Sachs. This is understandable given the events of the past year, but it’s unlikely to benefit consumers in the long term.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

The Securities and Exchange Commission sued Bittrex, claiming the exchange—once a big player in the U.S.—illegally operated as a broker-dealer, and that tokens it sold like DASH are securities. (CoinDesk)

Decentralized exchanges like Lido and Rocket Pool have experienced an unexpected level of inflows amid the ongoing Ethereum bull market. (Bloomberg)

The CEO of the Stellar Foundation—a veteran of Mozilla and Yahoo—says regulators should focus on stablecoin policy as they develop a framework for the industry. (Fortune)

Bitcoin’s recent rally has stalled near the $30,000 mark amid headwinds from the SEC and the macroeconomy. (Bloomberg)

Nike is doing its first NFT drop, selling virtual versions of iconic sneakers for $19.82. (Decrypt)

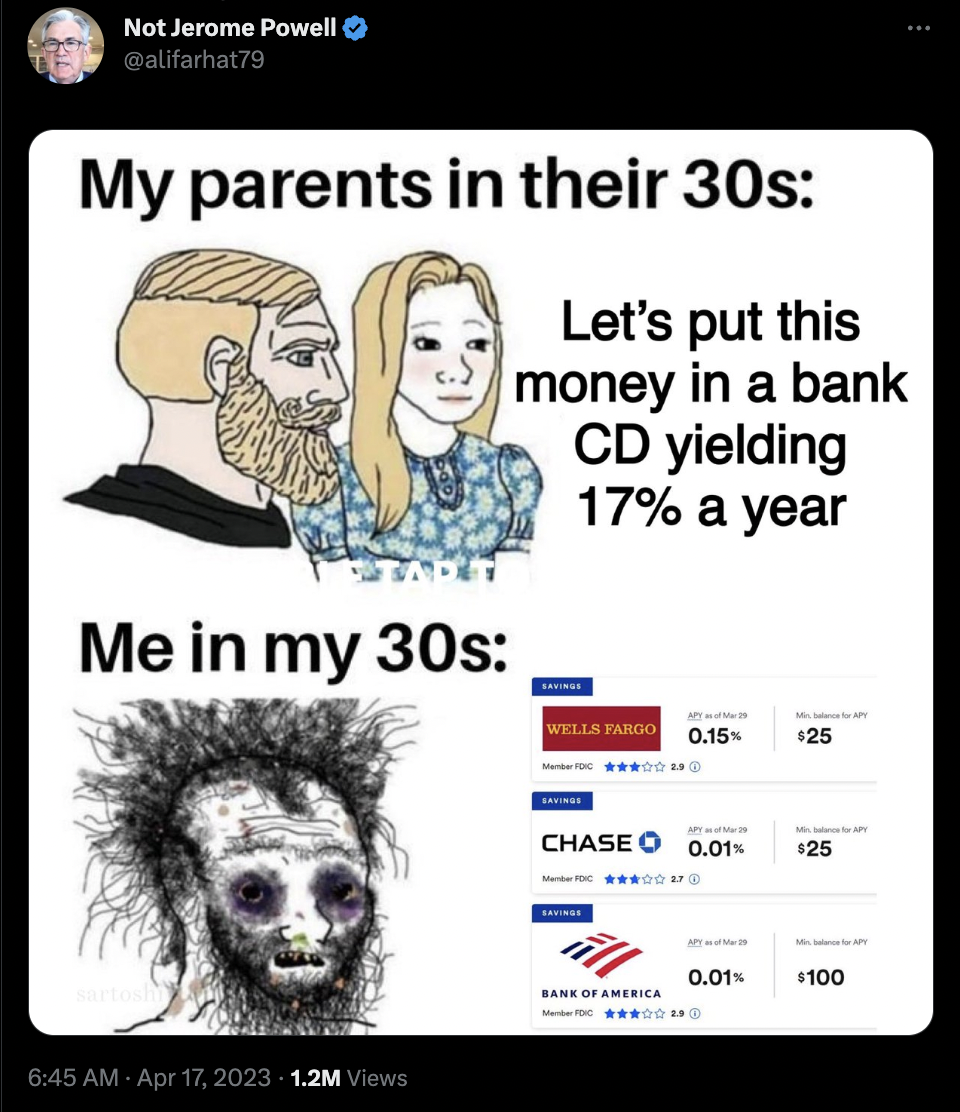

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.