In the months since the crypto market first collapsed last April, there have been several mini-rallies that suggested the worst was over—before the bottom fell out even further. Now, as January draws to an end, a new surge in prices has crypto believers daring to hope all over again. Are they fools to do so?

Perhaps not. There are three reasons to think the recent uptick, which has seen Bitcoin soar nearly 40% since Christmas, is not just a brief reprieve until crypto gets crushed all over again. The first is that the poison injected by the likes of Sam Bankman-Fried and Three Arrows Capital is starting to wash out of the system. All of the worst-case scenarios—including the bankruptcy of FTX and the domino-style fall of centralized lenders—have already transpired, meaning the market has likely absorbed the worst of the fallout and investors are gaining confidence again.

Second, as Bankless notes, structural indicators offer hope. These include a huge decline in the volume of leveraged trading positions—meaning there are fewer accounts at risk of liquidation, which in turn means there are fewer tokens susceptible to being dumped in forced selloffs. Meanwhile, stablecoin data shows a spike in the amount of “dry powder”—money waiting to be invested—held by big players sitting on the sidelines. If the current rally lasts, it will tempt many of the players to start making bets again. The same is true of crypto VC firms, which have raised gobs of money and will soon deploy it instead of sitting on their hands.

The final, and biggest, reason the current rally could have staying power is good news related to the macro economy, including signs that inflation is abating. Even though many view crypto as a haven apart from governments and the real economy, the truth is that the industry is highly susceptible to outside economic shocks like the pandemic and sudden Fed hikes. Now that things are looking up for the economy, it makes sense they are for crypto as well.

Lest this all sound rosy, there is a lurking force that could put crypto prices back in the toilet. That force is regulators in the U.S. and beyond who are flexing their might like never before in the wake of the FTX scandal. They are far from done meting out punishments on crypto companies and, at times, appear determined to sink the industry altogether. Harsh new laws or regulatory demands would snuff the current rally faster than you can say Shiba Inu Coin.

But for now, the current crypto appears sturdy, allowing optimists to think it is more likely that Bitcoin will continue to climb back toward $30,000 rather than return to the $16,000 lows of December.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

So-called Sam coins like Serum and Solana, named for their association with FTX’s disgraced founder, are enjoying a surprising bounce back. (Bloomberg)

Niche banks like Signature that cater to crypto companies are starting to retreat from the sector amid losses and regulatory pressure. (Fortune)

The Winklevii-owned Gemini, which had 1,000 employees as of November, slashed 10% of its workforce. (CNBC)

The FBI affirmed a long-suspected theory that it was North Korean military hackers who robbed $100M from a Harmony blockchain bridge last June. (Bloomberg)

Ethereum founder Vitalik Buterin proposes to increase privacy with a new system of “stealth addresses”—one-off public addresses accessible with a “spending key.” (The Block)

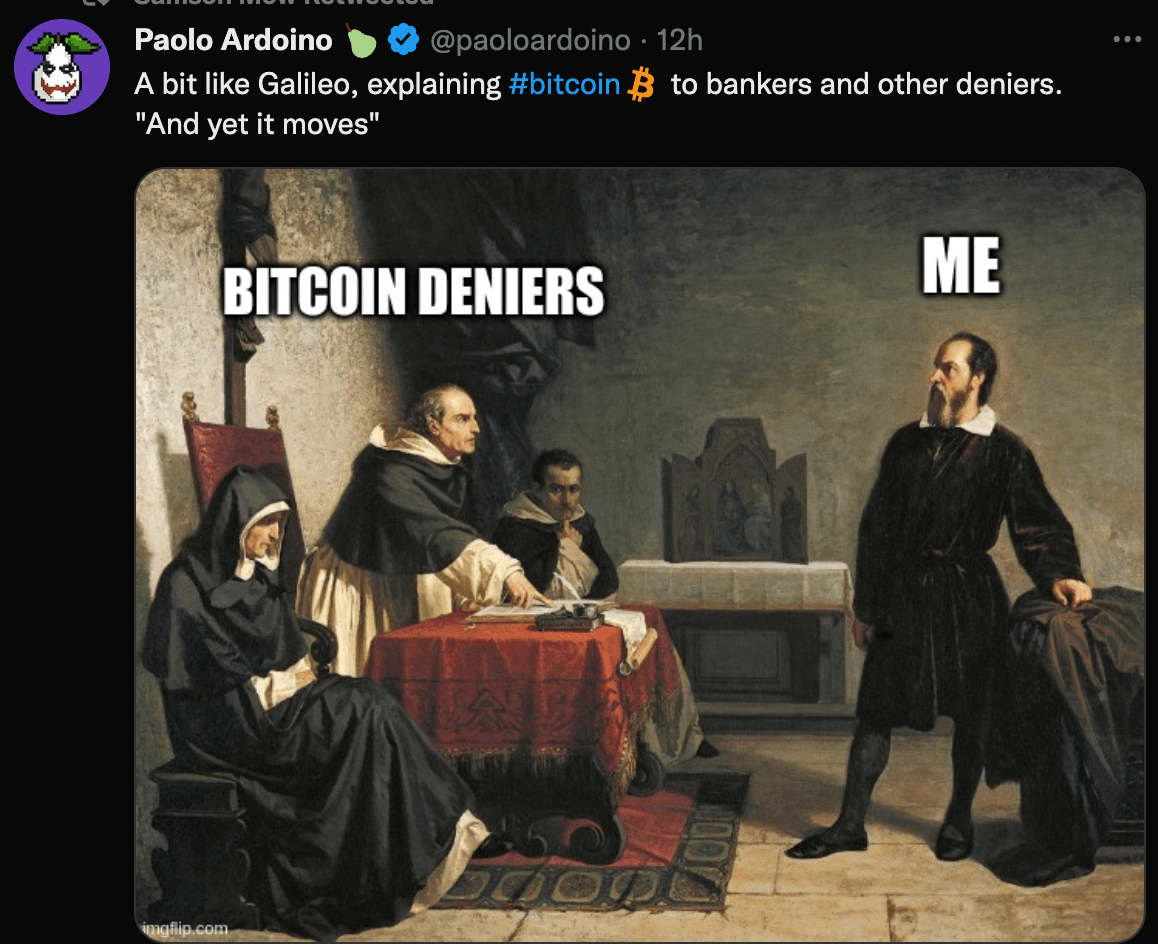

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.