Samsung Electronics Co.’s pivotal chip division reported a smaller-than-expected profit as the company fights to close the gap on archrival SK Hynix Inc. in the artificial intelligence arena.

Samsung is ratcheting up its research and operating costs, with executives saying the spending on memory would stay at a similarly elevated level as last year. Total capital expenditures came to 53.6 trillion won ($37 billion) in 2024.

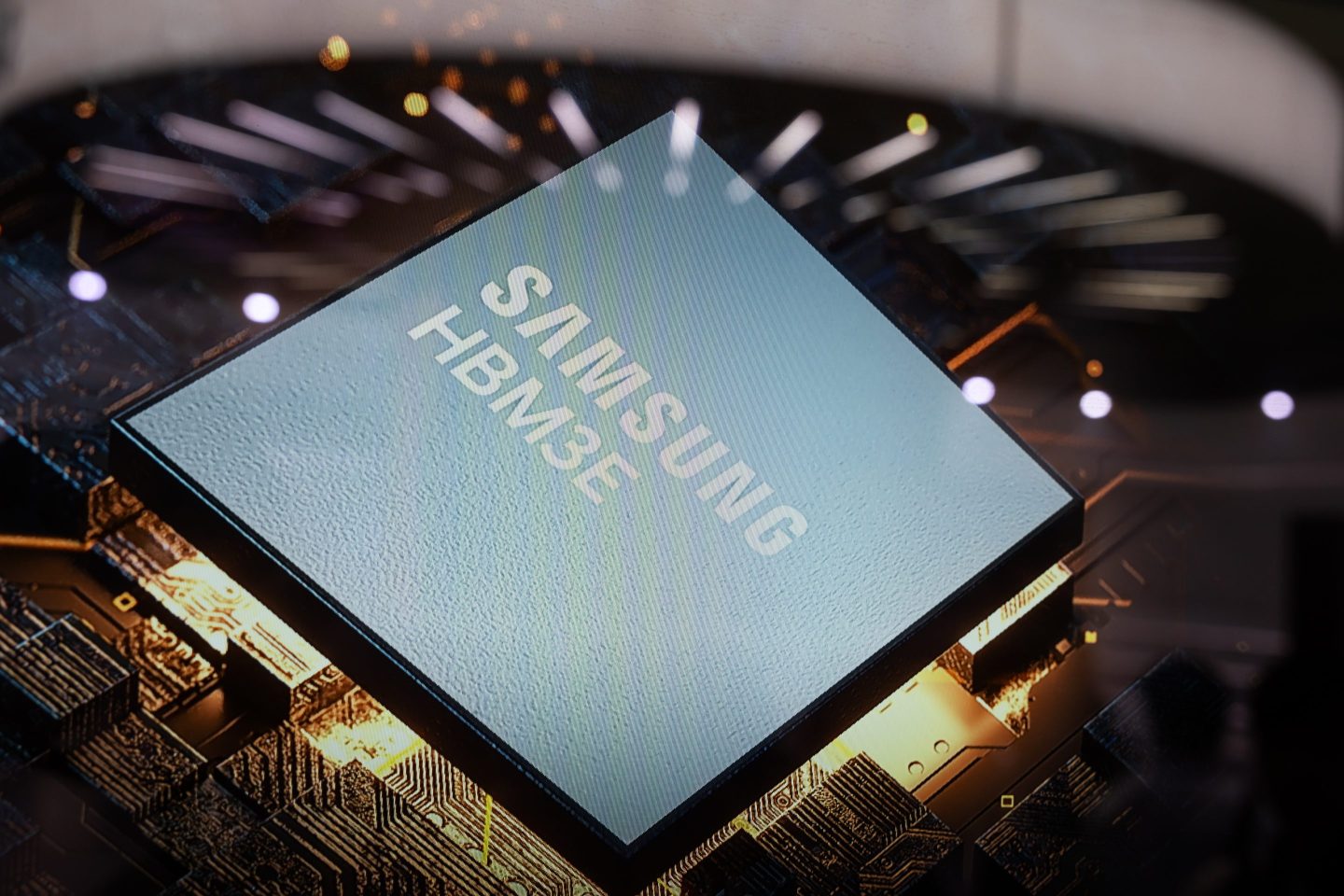

That push resulted in getting long-delayed approval for Samsung’s supply of 8-layer HBM3E — a less advanced variety of the high-bandwidth memory that SK Hynix supplies — from Nvidia Corp. for use with AI processors tailored for the Chinese market.

But the effort, along with exposure to legacy DRAM, is weighing on South Korea’s largest company. Samsung’s semiconductor unit reported operating profit of 2.9 trillion won ($2 billion) for the December quarter, missing analysts’ average projections. It also forecast limited earnings growth in the current quarter. The company’s net income came to a bigger-than-expected 7.58 trillion won ($5.23 billion), thanks to a boost from its network business.

The stock price of Samsung fell 2.4% on Friday, the first trading day in Seoul after the Lunar New Year holiday. SK Hynix shares dropped 9.9%, reflecting in part concern that DeepSeek’s low-cost AI would upend the entire premise of big spending on data centers and powerful chips.

Samsung executives said on Friday the company expanded its HBM3E supply to multiple providers of graphic processing units and datacenter customers in the fourth quarter. Still, U.S. export restrictions on AI chips will likely weigh on its first-quarter earnings before overall memory chip demand starts recovering in the second quarter.

“We expect a temporary constraint on HBM sales in the first quarter,” partly due to U.S. curbs as well as efforts to launch an improved version of its HBM3E chips, Kim Jaejune, executive vice president of Samsung’s memory business, said during an earnings call. “There’s been a shift among major customers who are opting to wait for enhanced HBM3E products, which may potentially result in a temporary gap in HBM demand.”

At CES earlier this month, Nvidia Chief Executive officer Jensen Huang said Samsung will have to engineer a new design. “But they can do it. They are working very fast. They’re very committed to do it.”

“We firmly believe that the current challenges can be resolved swiftly,” Chief Financial Officer Park Sooncheol said. “And by overcoming these challenges Samsung can enter a new phase of growth.”

This year, Samsung will focus on cutting its exposure to conventional DRAM and NAND for PCs and mobile devices while chasing higher-margin arenas of server DRAM and HBM, where demand “remains strong,” executives said. It’s stepped up spending on research and development and front-end capacity expansion in its efforts to catch up with both SK Hynix and Micron Technology Inc. But the foundry business will remain weak, while mobile and PC demand will remain soft, they said.

Its smartphones, TVs and other appliances are facing growing competition, the company said, with executives citing ongoing uncertainties and delays in economic recovery.

Investors remain concerned about Samsung’s ability to claw its way back into the market for high-bandwidth memory chips, designed to work with Nvidia’s AI accelerators. The company has struggled to get its latest products certified by Nvidia — providing an unusually long window for SK Hynix and Micron to carve out commanding leads in the booming HBM market.

Samsung has reorganized its team of engineers, hoping to reverse its market position with the next generation of HBM chips, or HBM4. Both Samsung and SK Hynix aim to become Nvidia’s main vendor for HBM4 chips as they work to mass-produce them in the second half of this year.

“We still think that it is possible for Samsung to right the ship eventually in its HBM business and boost the country’s equity market, but a lot will hinge on its ability to achieve genuine commercial breakthroughs with the leading fabless AI names,” said Homin Lee, a Singapore-based senior macro strategist at Lombard Odier. “Time is running out as memory is becoming increasingly commoditized, with Chinese rivals catching up fast in the DDR5 segment despite export controls.”

SK Hynix posted record quarterly income earlier this month, eclipsing Samsung’s operating profit for the first time. Hynix said HBM made up 40% of its overall DRAM chip revenue in the quarter and it expects HBM sales to more than double this year.

In November, Samsung announced a plan to buy back about 10 trillion won of its own stock. Executives on the earnings call said the company is in the process of canceling some 3 trillion won of shares and it’s exploring the timing for the remaining 7 trillion won.