Nvidia CEO Jensen Huang pledged to help Japan ramp up its AI capabilities by working with local businesses and research institutions to develop a network of advanced datacenters in the country.

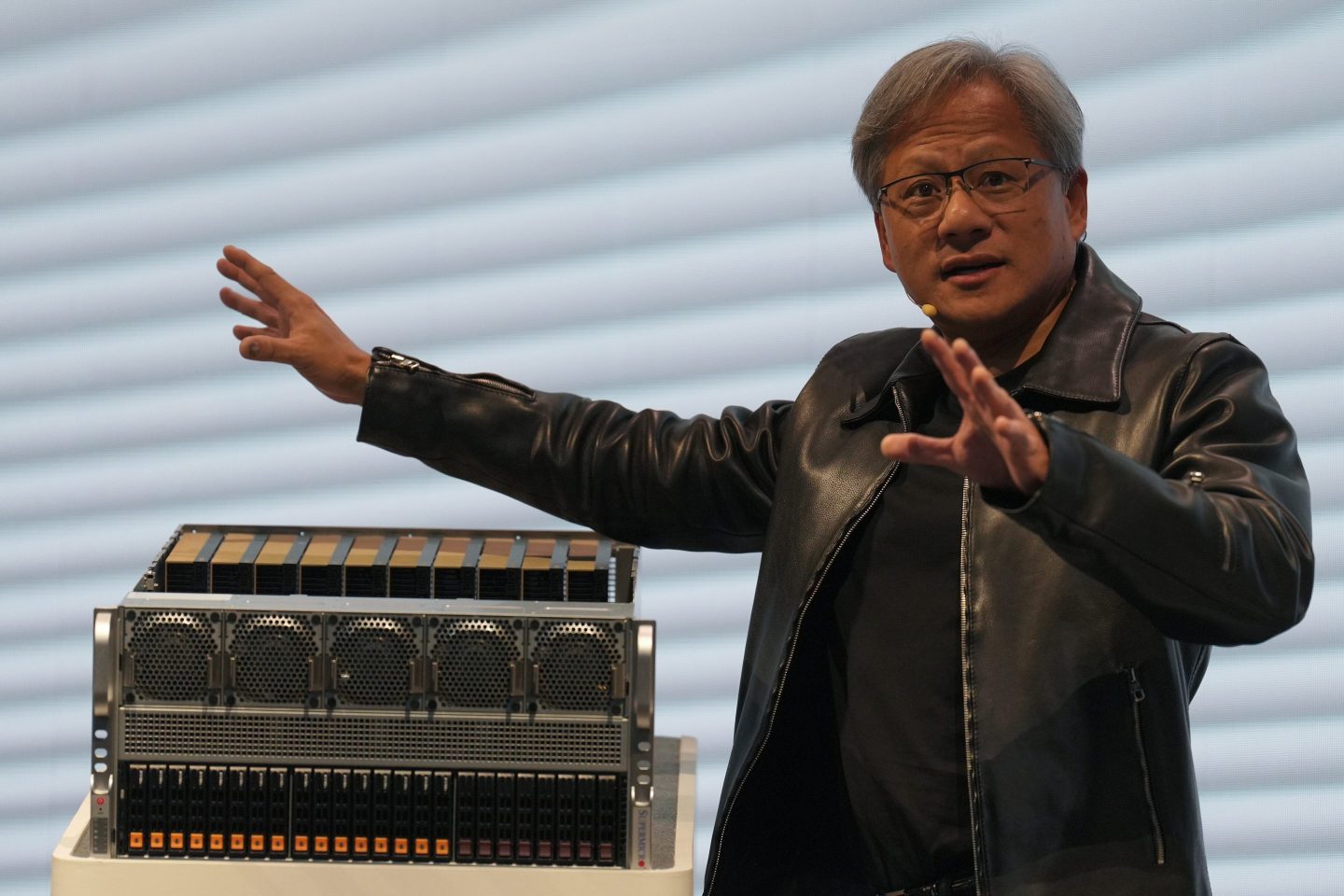

In a series of meetings with Japanese government officials this week, Huang announced plans to set up an AI research laboratory in the country, to invest in Japanese startups, and to help create “AI factories,” specialized datacenters designed to train and run artificial intelligence technology.

“Japan has all of the technical expertise, the industrial capacity to create your own artificial intelligence, right here in Japan,” Nvidia CEO Jensen Huang said in a meeting with Japan’s economy minister Yasutoshi Nishimura on Tuesday, according to Bloomberg.

Nvidia is at the center of the AI boom, as its processors are key to training the large language models that underpin the technology. The supercomputer used to train OpenAI’s ChatGPT, for example, used 10,000 of Nvidia’s A100 GPU chips. But the surge of interest in generative AI products is leading to a supply crunch for the processors used to power them.

In an earlier meeting, Huang promised Prime Minister Fumio Kishida that the chipmaker would do its best to supply critical AI processors to Japan. “Demand is very high, but I promised the prime minister we will do our very, very best to prioritise Japan’s requirements for GPUs,” Huang told a group of reporters outside the prime minister’s residence, according to Reuters.

Japan, once a powerhouse in the semiconductor industry, is trying to become a chipmaking leader again. Chip companies like Taiwan Semiconductor Manufacturing Company and Micron are pledging hundreds of millions of dollars to build new chipmaking factories throughout the country—with strong support from Tokyo.

But Japan’s most advanced chip factories are about a decade behind market leaders TSMC and Samsung, according to an August report from the Center for Strategic and International Studies. The Japanese producers that used to dominate dynamic random access memory (DRAM) in the 1980s have largely exited the business, but the country still remains competitive in some areas like NAND memory and image sensors. Tokyo understands that it may have only “one last chance” to stake out a strong position in the global chip industry, the report argues.

Japan announced a semiconductor strategy in June 2021, which includes a partnership with the U.S. and subsidies for domestic chip manufacturing. On Nov. 24, the Japanese government passed an additional $13.5 billion in funding to support its own chipmaking industry as part of an $88 billion extra budget to help households deal with inflation and encourage corporations to boost domestic investment.

“The semiconductor industry that Japan is now starting to grow and foster will be able to produce GPUs,” Huang said on Monday. “Countries like Japan are realizing that you need to own your own data, build your own AI factories, and produce your own AI intelligence.”

Tokyo Electron, Japan’s top chipmaker, has committed about $290 million toward a new development facility in the city of Koshi on the southwestern island of Kyushu. The island will also house a new TSMC foundry, worth roughly around $6.7 billion, set to open late next year. U.S. chipmaker Micron has also committed to invest about $3.4 billion in Japan over the next few years.

Nvidia’s data center revenue—which relates to customer interest in AI—hit $14.51 billion in its most recent quarter, a 279% increase from a year ago. Data center revenue now makes up around 80% of Nvidia’s quarterly revenue, a significant change from just two years ago, when the company’s gaming business drove the company’s sales.

Correction: An earlier version of this story cited a Bloomberg report that incorrectly stated that Nvidia planned to develop chip fabrication facilities in Japan. Nvidia’s comments about “AI factories” referred to datacenters, not chip manufacturing.