Good morning. M&A made a comeback this year, but growth is lagging in the middle market.

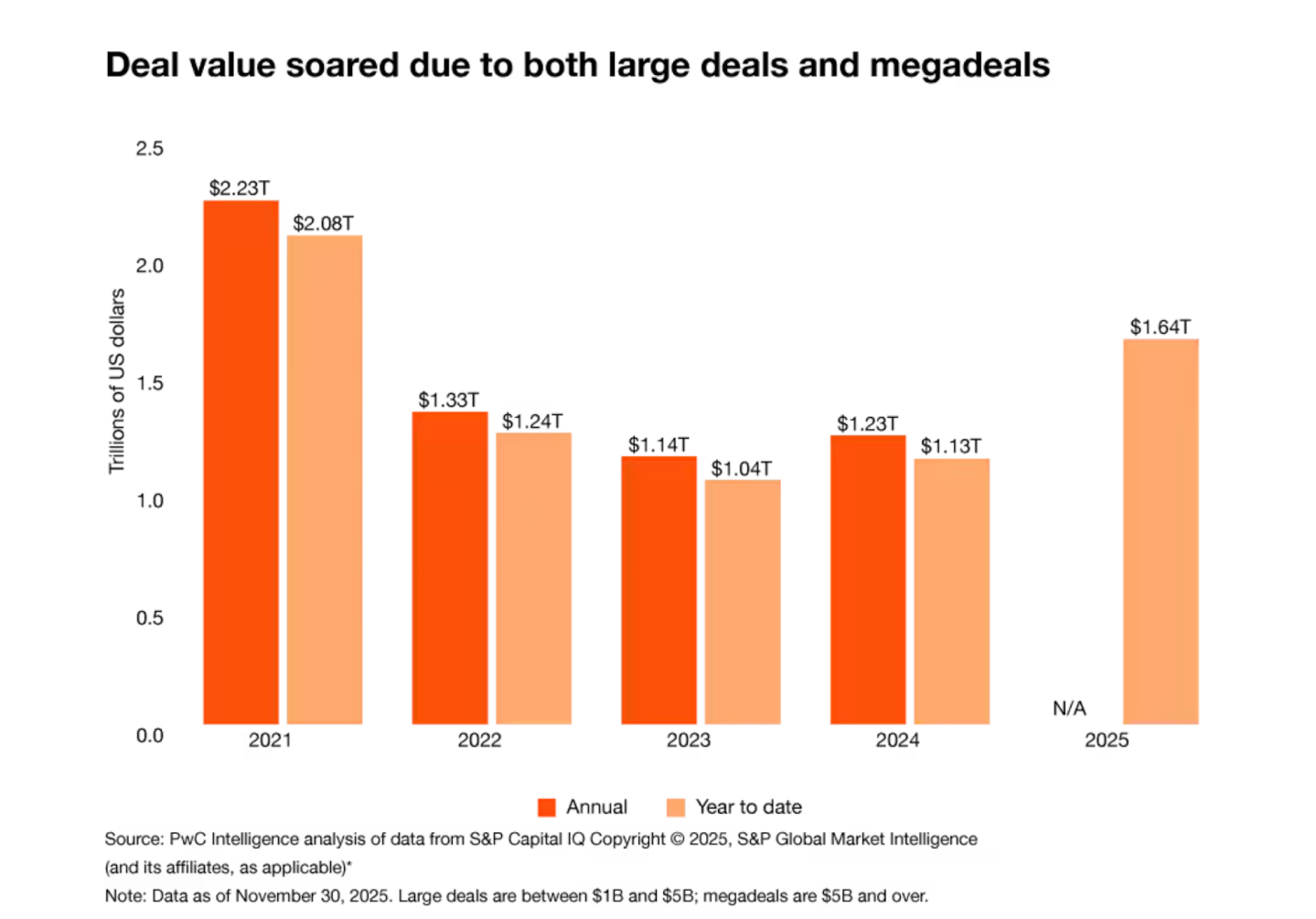

PwC’s U.S. Deals 2026 Outlook, released this morning, credits the AI boom and a revitalized private equity (PE) activity for the market achieving 10,333 deals worth $1.6 trillion through Nov. 30, 2025. Total deal value rose about 45% from last year and was the second-highest ever recorded, even amid major shifts in economic policy, such as tariffs.

Big bets on AI helped drive activity among tech companies—especially in megadeals. There were 74 megadeals (valued at $5 billion or more), the highest number since 2021, of which more than 20% were driven by AI.

Fortune has reported on several megadeals this year, including Alphabet agreeing to acquire cloud security and AI company Wiz for about $32 billion; Meta buying a 49% stake in Scale AI for roughly $14 billion; and CoreWeave acquiring Core Scientific for about $9 billion.

Another finding of PwC’s report is that PE activity rose, with financial-buyer deal volume increasing by 4% to 1,484 transactions, while M&A value increased 54% to $536 billion. Meanwhile, IPO activity rebounded in the second half of 2025 as investors eagerly embraced new offerings. Pent-up demand, easing rates, and steadier trade policy should bode well for 2026 IPOs, according to PwC.

However, when it comes to the middle market, M&A slumped to a decade low, with just 496 projected deals, hindered by macroeconomic factors. Stabilization in trade policy and interest rates could improve conditions, according to PwC. PE firms are increasingly looking to the middle market for opportunities, although valuation gaps remain a challenge for exits.

Looking ahead to 2026, a finance chief at an industrial manufacturing company told PwC that “2026 brings a rare mix of pressure and momentum.” Although cost and supply-chain challenges persist, “interest rates, AI buildout, and energy infrastructure development are creating real opportunities,” the CFO said.

Finance chiefs typically approach M&A by evaluating both risks and strategic opportunities. I recently talked with Zane Rowe, CFO of Workday, about the company’s definitive agreement to acquire Swedish AI startup Sana for around $1.1 billion. The deal, expected to close in the fourth quarter of Workday’s fiscal 2026, follows two other strategic acquisitions, Paradox and Flowise. The acquisitions reflect the company’s disciplined approach to M&A, Rowe said. “We keep a very high hurdle on talent, team, technology, and cultural fit, and it’s really a paradigm that has to fit perfectly; and that’s how we think about our M&A strategy,” he noted.

PwC projects that despite several potential challenges, the current M&A uptick rests on solid ground. If trade policy stabilizes, interest rates drop, and AI enthusiasm continues, the firm expects the market to build on the significant gains it made in 2025, especially if macroeconomic drivers and renewed confidence help push both middle-market corporates and PE firms back into the M&A arena. You can read the complete report here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Christy Schwartz was promoted to CFO of Opendoor Technologies Inc. (Nasdaq: OPEN), a real estate technology company, effective Jan. 1, 2026. Schwartz, who has served as interim CFO, was selected after an extensive CFO search. On September 30, she became interim CFO, replacing Selim Freiha. Schwartz also previously served as Opendoor’s interim CFO from December 2022 to November 2024, and as chief accounting officer from March 2021 to May 2025. She also held the role of VP, corporate controller from August 2016 to March 2021.

Todd Saypoff was appointed CFO of Moore, a data-driven constituent experience management (CXM) company. Saypoff brings experience scaling financial operations across organizations ranging from startups to global enterprises. His background includes CFO roles at Lucid Holdings, Shazam, which was acquired by Apple, and NBCUniversal Owned Television Stations.

Big Deal

CFOs are the strategic partners to CEOs, and Teneo's annual "Vision CEO and Investor Survey" provides some insight into what chief executives are expecting in 2026.

Seventy-three percent of CEOs and 82% of investors expect the global economy to improve in 2026. The U.S. remains the most attractive market in the world for investment. Meanwhile, AI spending will continue to rise in 2026, with 68% of CEOs increasing investment.

More than half (53%) of investors expect ROI from AI in six months or less, while only 16% of large-cap CEOs believe they can deliver on that timeline. Another finding is that regulatory streamlining is expected to boost business. More than 80% of both CEOs and investors cite recent policy changes related to technological advancement and regulatory streamlining as being helpful to their business.

The findings are based on insights from over 750 global CEOs and institutional investors, representing nearly $19 trillion in company and portfolio value.

Going deeper

"Meet the 25 most powerful rising executives reshaping corporate America" is a new article by Fortune's Ruth Umoh that highlights the Fortune Next to Lead list, now in its second year. The list spotlights a group of 25 influential executives inside the Fortune 500.

Overheard

"History shows that breakthrough technologies don’t just slot into existing systems, they make us rethink those systems entirely."

—Charles Lamanna, Microsoft corporate president, writes in a Fortune opinion piece titled, "I lead Microsoft’s enterprise AI agent strategy. Here’s what every company should know about how agents will rewrite work."