Goldman Sachs tackled the “most important question for the U.S. equity market outlook” on Monday: whether the market is “correctly valuing the benefits from AI.” The answer is a qualified yes, a denial that company valuations are at “bubble levels,” and a finding that the market is, shall we say, excessively optimistic.

The U.S. equity market may have already incorporated a significant amount of the potential long-term value generated by AI, according to a new analysis from the investment bank. Some “simple arithmetic,” analysts Dominic Wilson and Vickie Chang write, suggests market pricing for AI gains is running “well ahead of the macro impact,” with the valuation surge in AI-related companies approaching the upper limits of plausible economy-wide benefits.

While Goldman’s portfolio strategy team maintains that company valuations are high but not yet at “bubble levels,” a macro approach helps set constraints on “what is collectively possible.”

What’s a few trillion dollars, anyway?

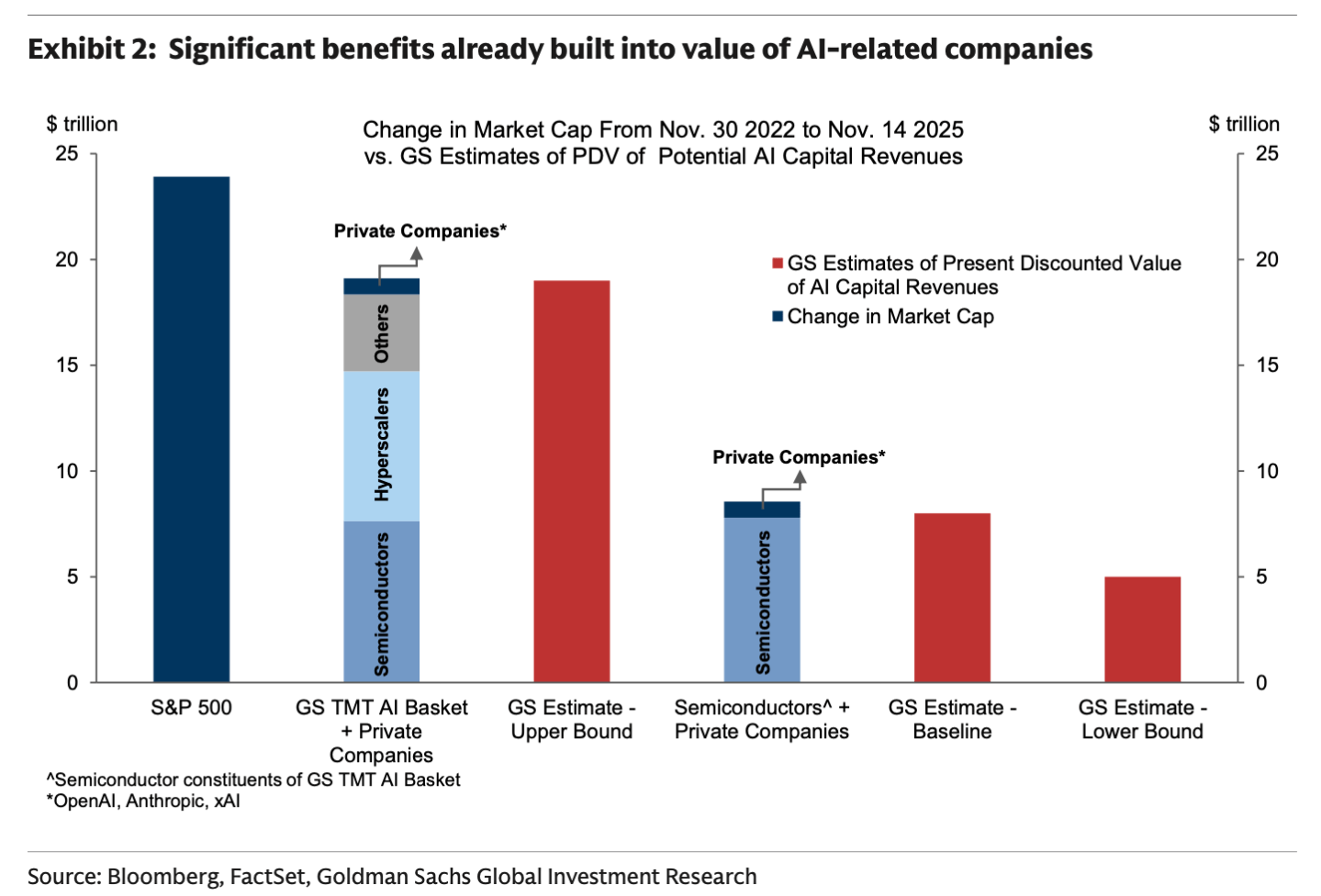

The report estimates that the Present Discounted Value (PDV) of the capital revenue resulting from generative AI for the U.S. economy has a baseline estimate of $8 trillion. Although this calculation is inherently uncertain, the plausible range for these future capital revenues sits between $5 trillion and $19 trillion. Significantly, these projected benefits are sufficient to justify current and anticipated levels of investment spending on AI-related capital expenditure (capex), a major concern in the financial media of late. On the other hand, the market’s enthusiasm appears to have sprinted far beyond the baseline macro calculations.

Since the introduction of ChatGPT in November 2022, Goldman calculates the value of companies directly involved in or adjacent to the AI boom has risen by over $19 trillion. This surge includes major gains in the semiconductor space and among “hyperscalers,” as well as almost $1 trillion for the latest valuations of the three largest private AI model providers.

This total valuation increase places the market gain at the “upper limit of the projected macro benefits” ($19 trillion) and far exceeds the $8 trillion baseline estimate. Specifically, the change in value for AI-related companies in the semiconductor space and the private AI model providers—which are more plausibly attributable solely to the AI boom—already exceed the $8 trillion baseline estimate of increased capital revenues.

Goldman Sachs notes forward-looking markets should price gains well ahead of time, characterizing this as “a feature, not a bug,” but the analysts identified two key risks that may reinforce the tendency to “overpay” for future profits, citing two ominous precedents: “Past innovation-driven booms—like the 1920s and in the 1990s—have led the market to overpay for future profits even though the underlying innovations were real.” (Goldman did not directly comment on the crashes of 1929 or 2000, which accompanied these famous booms from U.S. history.)

The two major risks highlighted are:

1. Fallacy of aggregation: Investors may imply excessive aggregate revenue and profit gains by extrapolating the stunning earnings growth achievable by individual companies across all potential winners. This risks the joint value ascribed to chip designers, model builders, and hyperscalers exceeding what they can ultimately capture together.

2. Fallacy of extrapolation: Competition often erodes initial profitability gains from innovation over time. Markets may overestimate the long-term earnings growth path if they treat transitory short-term profit boosts as persistent.

The underlying productivity promise of AI remains potent: Estimates suggest AI could boost U.S. productivity by around 1.5 percentage points for a 10-year period, eventually raising the level of U.S. GDP and earnings by roughly 15%. As long as both the broader economy and the AI investment boom remain “on track,” markets are likely to maintain an optimistic view. But outside hardware, current AI profits remain limited, which could present dangers if expectations do not materialize quickly.