S&P 500 futures were flat this morning after the index closed up 0.37% yesterday. The Asian markets were up across the board today, but Europe’s STOXX 600 marginally declined in early trading. The mixed picture mirrors an argument on Wall Street about whether the U.S. Federal Reserve will cut interest rates in December—delivering a new round of cheaper money that will likely be good for stocks—or keep rates on hold as it battles inflation.

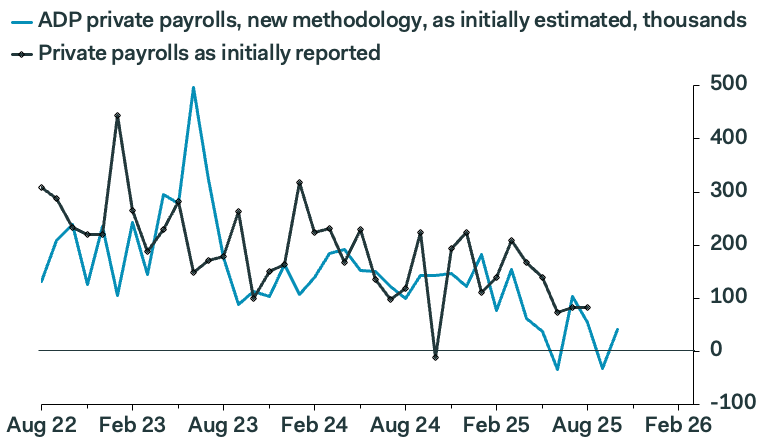

ADP’s private payrolls data came in yesterday with more job gains than expected, leading some to think that the job market remains relatively strong. That would reduce the likelihood that the Fed will cut. But others noted that the job growth was still slowing toward “stall speed,” the rate below which the economy creates fewer jobs than it loses.

The CME FedWatch index of bets on future interest rate levels showed 67.3% of speculators betting this morning that the Fed will take another 0.25% off the base rate, with the remainder betting the Fed will keep the rate on hold.

Deutsche Bank argued that a December cut was now less likely. “Private payrolls were up by +42k in October (vs. +30k expected), which was a clear rebound from the -29k contraction in September. That’s a release that’s taken on more significance than usual, given we’re missing the usual jobs report because of the shutdown,” Jim Reid and his team at Deutsche Bank told clients this morning. “The U.S. outlook was more resilient than feared.

“Those [numbers] meant investors dialed back their expectations for Fed rate cuts in the months ahead,” they said.

However, Samuel Tombs at Pantheon Macroeconomics argued via a chart that while the ADP private payroll number is growing, its growth rate is decreasing over time:

“That’s well below the break-even pace of payrolls … Labor market slack, therefore, likely continued to accumulate in October, suggesting the official data will make a strong case for the FOMC [Federal Open Market Committee] to ease again in December,” he said in a research note.

He was joined by Jamie Cox, a managing partner at Harris Financial Group in Richmond, Va., which has $1.3 billion in assets under management. “For Fed watchers, this ADP report should make it clear that a December rate cut is now in play. We are nearing stall speed in the labor market, and that will get the Fed’s attention,” he said in a note sent to Fortune.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures are flat this morning. The last session closed up 0.37%.

- The STOXX Europe 600 was down 0.08% in early trading.

- The U.K.’s FTSE 100 was down 0.3% in early trading.

- Japan’s Nikkei 225 was up 1.34%.

- China’s CSI 300 was up 1.43%.

- The South Korea KOSPI was up 0.55%.

- India’s NIFTY 50 is down 0.34%.

- Bitcoin was up at $103K.