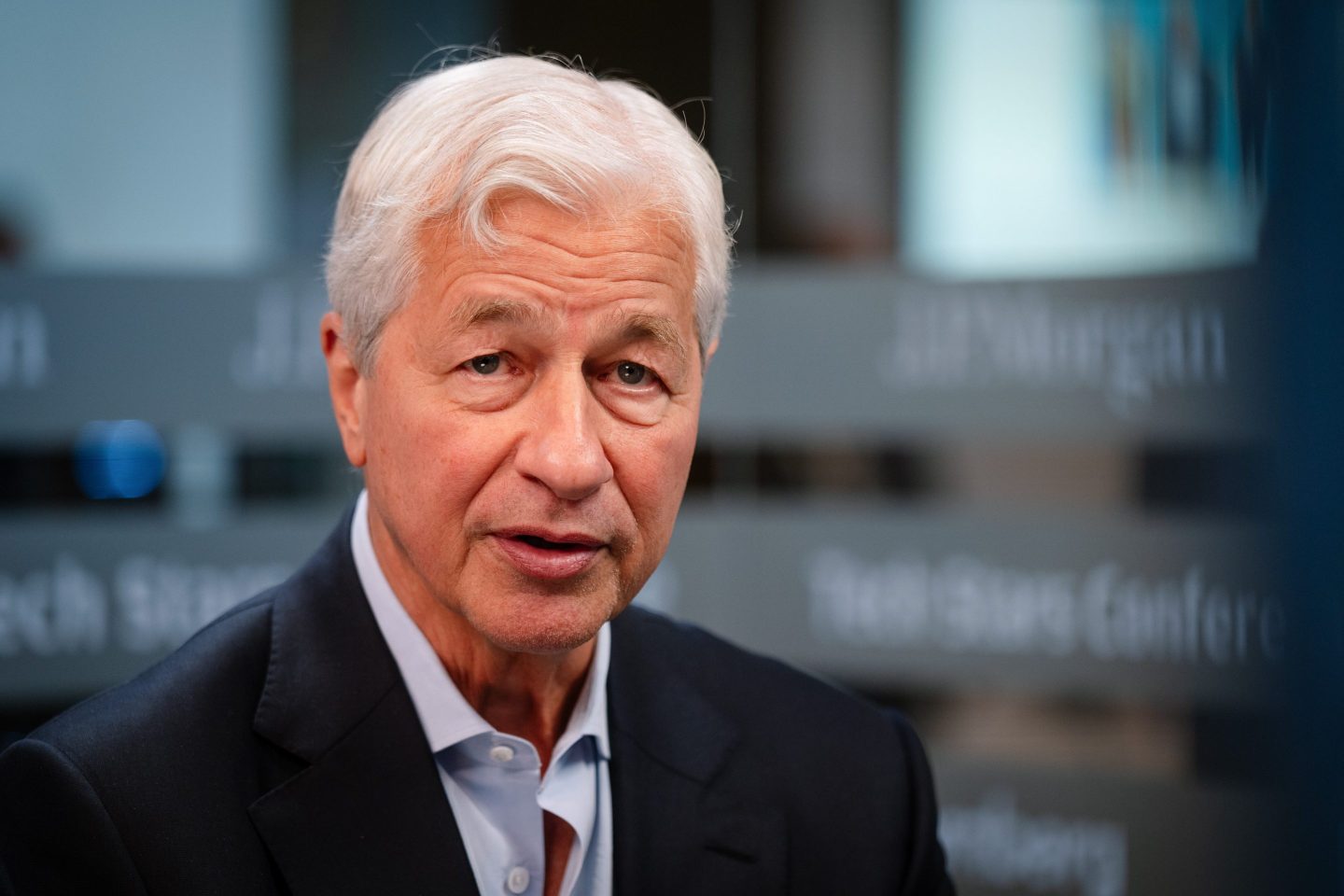

JPMorgan Chase CEO Jamie Dimon says corporate leaders can’t ignore the tidal wave of artificial intelligence reshaping their industries.

“I think people shouldn’t put their head in the sand,” he said Tuesday in a Bloomberg TV interview. “It is going to affect jobs.”

Dimon, who has long touted AI as one of the bank’s most powerful tools, said the technology is already reshaping nearly every corner of JPMorgan’s operations, from risk and fraud detection to marketing, customer service, and research.

“It affects everything,” he said. “It’s kind of the tip of the iceberg. We’re getting better and better at it.”

The bank now employs about 2,000 people working on AI systems it has been developing since 2012, Dimon said. JPMorgan has also built its own homegrown LLM model that is trained entirely on internal data.

“On my phone here, we have a suite, to do research and summarize reports and scan contracts,” he said, noting that roughly 150,000 employees use it daily.

The system is even beginning to develop “agentic capabilities” in coding. “It’s being used quite bluntly now,” he added.

JPMorgan’s AI spending has already paid for itself, Dimon said. JPMorgan spends about $2 billion a year on AI, and “for $2 billion of expense, we have about $2 billion of benefits.” Some of those savings are easily quantifiable—reduced headcount, fewer errors, and faster workflows—while other benefits, like improved service quality, are harder to measure exactly, he said.

When asked if the enormous corporate spending on AI infrastructure—from chips to cloud computing—resembles a bubble, Dimon said that while there was pain from frothy companies going under, “in total, it was productive.”

“It’s a lot,” he said. “I’m not sure it’s all ever going to be totally spent.” But, he added, history shows that massive technology shifts always come with both winners and losers.

“Take the internet bubble: When that blew up, I can name 100 companies that were worth $50 billion that disappeared,” Dimon said. “But out of it came Facebook, YouTube, Google. There will be big companies, real big success. It will work despite the fact that not everyone invested is going to have a great investment return.”

The technology’s disruptive potential will force uncomfortable choices for managers, he said. “There will be jobs that it eliminates,” he said. “You’re better off being way ahead of the curve and retrain people.”

The company is already redeploying staff as automation takes over the daily routine of work. “For JPMorgan, if we’re successful, we’ll have more jobs—but there’ll probably be less jobs in certain functions.”

His advice to peers: Embrace the technology, and start planning now. “Managers and leaders have to get their mind working on how they’re gonna use this thing,” Dimon said.