Bloodthirsty activist investors are on track to topple more CEOs in 2025 than ever before, according to Barclays’ latest quarterly review of shareholder activism. In a sign of the heightened pressures that CEOs face, the record was only set last year, the bank notes. It adds to the emerging picture of what executive placement firm Challenger, Gray & Christmas, an authority on both layoffs and CEO hiring trends, called “the rise of the CEO gig economy” earlier this year.

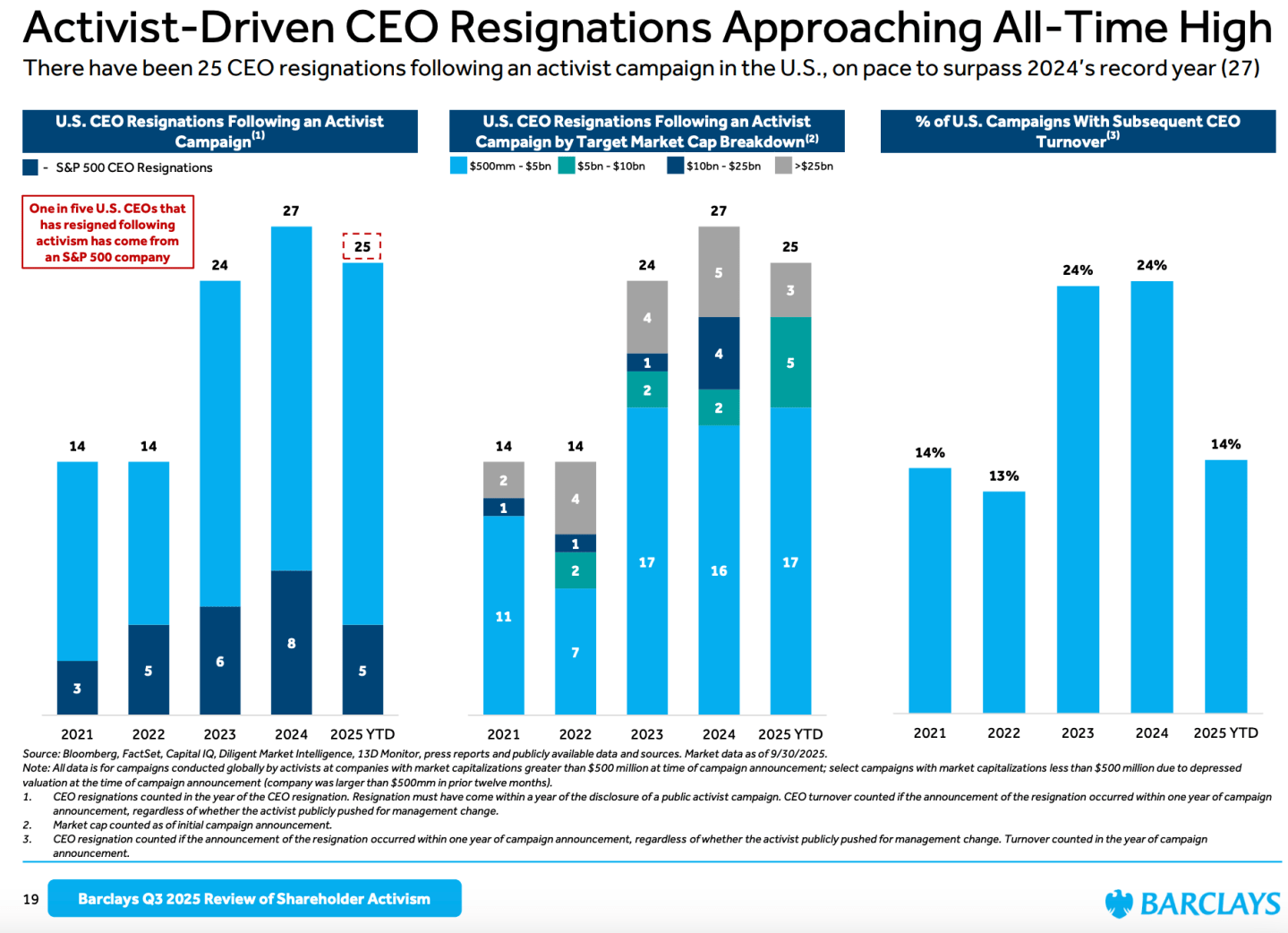

Barclays data show that in 2024, a record 27 CEOs of major global companies resigned or were forced out in the wake of activist campaigns—nearly tripling the numbers from just a few years ago. That figure, already the highest on record, is expected to be eclipsed in 2025 as the focus on CEO accountability intensifies, with 25 CEOs resigning year to date after coming under activist pressure, with 20% of the departures occurring at S&P 500 companies.

‘Almost a shareholder revolt’

Jim Rossman, global head of shareholder advisory at Barclays, told Reuters that it shows a remarkable shift. “There was almost a shareholder revolt last year,” he said, noting that investors aren’t as patient as in the past for performance to improve. He likened it to an attitude of “We want the companies where we are invested to change right now.” The 191 campaigns launched year to date in 2025 are the most ever, up 19% versus the long-term average.

Boards, wary of appearing complacent, have been shown to take action even before activist threats hit the headlines. In 2024, high-profile exits at firms like Lamb Weston and Kohl’s occurred amid mounting pressure, while at Boeing, Nike, Stellantis, and Hertz, CEOs departed before an active campaign ever materialized. This marks a cultural shift: Board representation by activists is often a prerequisite for CEO change, but even the mere presence or suggestion of activist activity may be enough to trigger a swift ouster.

The success of activist campaigns in securing CEO departures is tied to operational missteps and lagging shareholder returns. Activists typically strike after six quarters of trailing performance—a post-pandemic climate in which leaders can no longer blame COVID-era uncertainties for missed targets. Whether it’s overestimated growth in online retail or failed M&A plans, CEOs are finding themselves held directly accountable for execution—not just strategy.

What’s changed is both the frequency and the intensity of these campaigns. U.S. companies valued at over $500 million saw activist campaigns surge by 90% quarter over quarter in Barclays’ most recent report, a reversal of the typical slowdown in the summer season. Overall, U.S. campaign activity has been 23% higher than in 2024 year to date, supported by this “unusually busy” third quarter.

Boards no longer hesitate

Boards are now acting faster and more decisively. Where previous years saw them negotiate or install dissident directors, 2024 and 2025 have shown boards are quicker to act. This is reshaping the very nature of CEO tenure: The window to deliver results is shortening, and tolerance for underperformance is vanishing.

Activist board seats have also reached new highs: 98 year to date, a 17% increase. Major activists Elliott, JANA, and Starboard comprise nearly 38% of all these, with Elliott winning nine seats alone in the quarter. Increasing activist success is also correlated with what Barclays considers “improved quality of independent directors,” calculating that 39% of them have public company CEO or CFO experience, and 73% have public company director experience.

A new era of activism

The Barclays report signals that the wave of CEO departures is not a fleeting anomaly but the new normal, propelled by emboldened activists and increasingly impatient boards. With President Trump’s deregulatory administration in power and M&A scrutiny easing, the mix of liquidity and economic optimism is giving activists even more ammunition—ensuring that CEOs remain firmly in the crosshairs.

As 2025 unfolds, it’s clear: Activist investors aren’t letting go. For global companies, the leadership leapfrog is likely to accelerate, cementing shareholder activism as the decisive force in corporate governance—and the number of CEO heads rolling may soon set a new, even higher record.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.