Gold has been on a tear lately, notching several record highs, most recently nearing the $4,000 mark, as investors and central banks seek a safe haven amid a business climate full of uncertainty.

As Fortune has reported, Goldman Sachs is still bullish, calling for gold to hit $4,300 an ounce by late 2026, while Mark Haefele of UBS agrees that gold will remain an essential hedge. Deutsche Bank thinks that the gold rally shows that, deep down, investors are scared.

Bank of America Research isn’t so sanguine, with technical strategist Paul Ciana writing on Monday that investors should beware. “Risk of correction elevated,” he wrote in a market analysis seeking to answer the big question amid yet another government shutdown: “Can anything shut down the gold rally?” The answer is yes, of course. A “variety of multiple time frame technical signals and conditions warn of uptrend exhaustion,” Ciana noted.

Ciana acknowledged that while macroeconomic stresses and geopolitical tensions have funneled “safe haven” flows into gold, the trajectory has become precarious as speculative positions swell. The recent surge increasingly reflects momentum-driven buying rather than underlying fundamentals, Ciana stressed, elevating risks of a sharp reversal should sentiment shift or monetary policy surprise the market. He cited stretched charts, “overbought” signals, and waning positive divergence, warning that markets could see a correction if any supportive factors weaken or reverse.

The long history of gold rallies

Gold has hit several of Ciana’s upside targets, most recently $3,880. A “relevant peak may be close” since gold was trading about 20% above its 200-day simple moving average as of Monday, with major peaks in August 2020, August 2011, March 2008, and May 2006 occurring when prices were roughly 25% above that average.

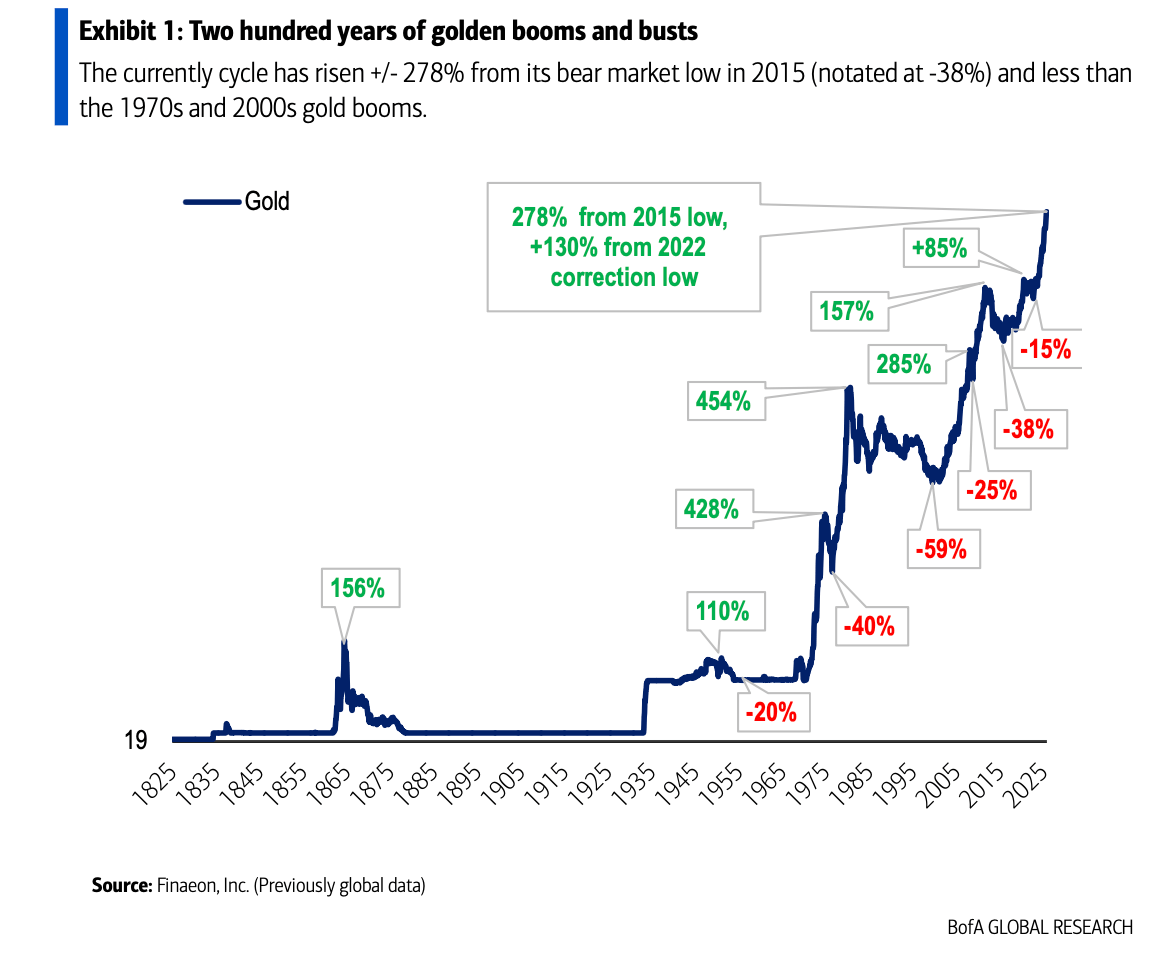

Since hitting lows in 2015, he noted, gold rallied about 85% into 2020, corrected roughly 15% into 2022 and then rallied another 130%. While caveating that further upside over the next two years is definitely possible and this boom is smaller than the booms of the 1970s and 2000s, Ciana sees a “rhyme” with several “midway corrections” in 2020–22, 2007–08, and 1975–76.

Zooming further out to the 19th century, Ciana notes that the gold boom of 1862–64 gained 156%, but then gave up that advance in the ensuing bust. The booms since the 1930s have not entirely shrunk back, he added, looking back into his history book.

Or is there much more room to run?

It’s a very different perspective from even within BofA, with a different team at the bank crunching numbers several weeks ago to say that gold may not be anywhere near reaching its limits. The global commodity research team led by Michael Widmer argued that gold’s ascent toward $4,000 was no surprise. With inflation above 2% and the Fed easing monetary policy, gold has “never declined” in such a scenario since 2001, Widmer’s team argued on Sept. 15.

Widmer noted that the global gold sector’s total market capitalization had ballooned by that point last month to more than $550 billion, nearly twice the peaks seen in 2011 and 2020, more than eight times the 2016 cycle low, and more than three times the recent cycle low in 2022. Still, looked at from a different perspective, as a share of the total global equity market, the metal is “far below” its previous highs, Widmer wrote. The sector stood at 0.39% of world market capitalization, still far below 2011’s high of 0.71%.

Where Widmer and Ciana seem to agree, though, would be just how quickly gold has been moving. Widmer’s price target of $4,000 was for 2026, after all, and gold finished Monday at $3,984.40.