As much as you can try to prepare for sudden changes to income, nothing truly prepares you for being laid off. Take U.S. federal workers who have felt a shock to their job stability in recent days, as an example. A deadlock in Congress over a deal to keep the government funded has left many government employees furloughed or working without pay.

Members of President Trump’s administration have even threatened layoffs if Democrats don’t concede as the government works through its second day of a shutdown.

At the same time, there’s been an exodus of federal workers who left by choice. On Tuesday of this week, 100,000 federal workers formally quit their jobs as part of the Trump administration’s “fork in the road” Deferred Resignation Program (DRP)—marking the largest mass resignation in American history.

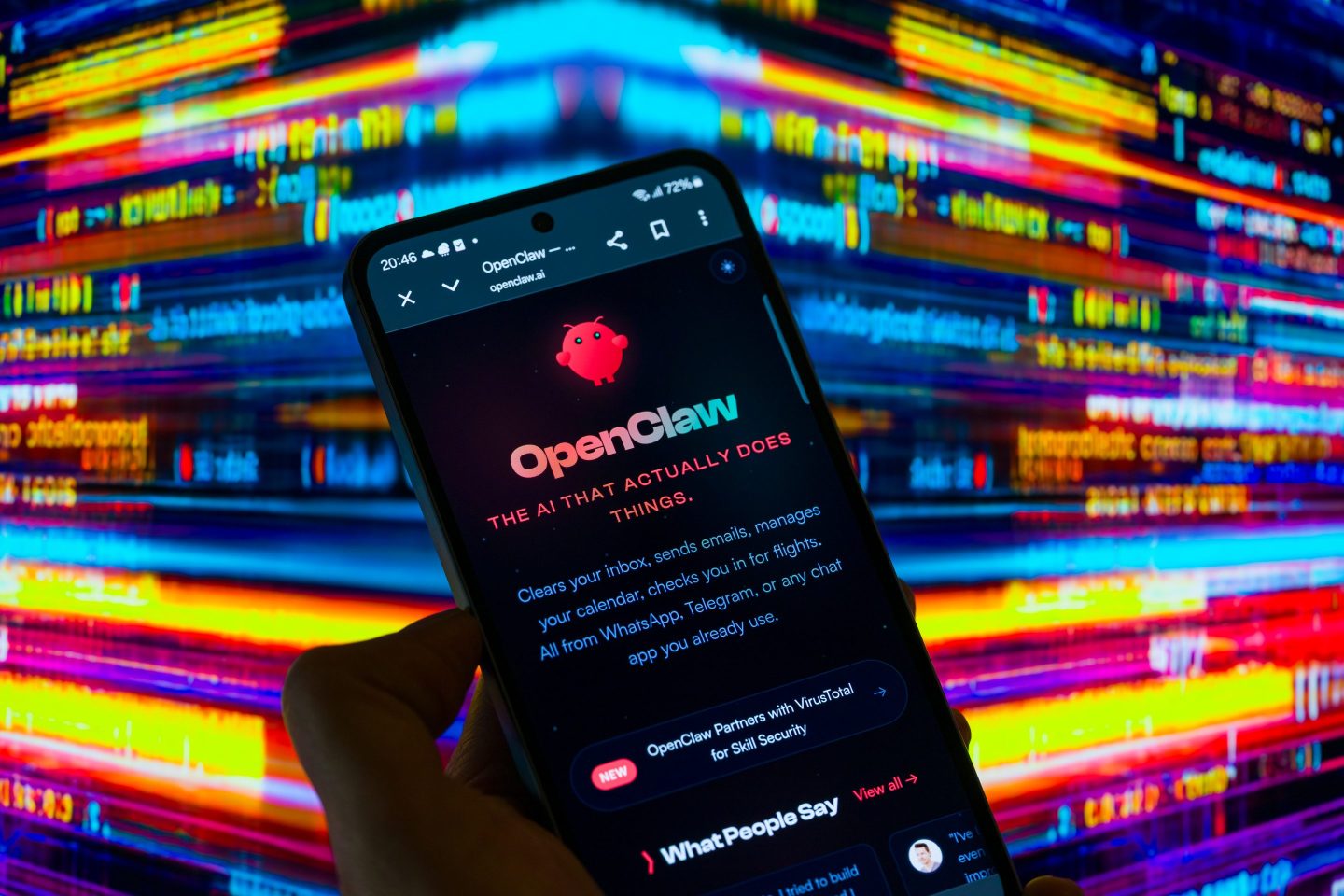

And then there’s AI-driven disruption, which is seeing people increasingly locked out of the workforce.

Whether you’re furloughed by politics, pushed out by automation, or walking away on your own terms, sudden income loss hits hard. But Michela Allocca, founder of Break Your Budget tells Fortune there are ways to prepare for substantial changes to your income.

1. If you are laid off, review your severance package now

Before anything else, Alloca recommends reviewing your payout from your place of work when experiencing a layoff.

“Oftentimes you are paid out in a lump sum, and it creates a false sense of security, because you’re being paid out like three or six months of paychecks all at one time,” she says.

“Make sure you enroll in unemployment and review your plan for your health care. Depending on if you get a severance package or what that looks like, you may not have to make any changes, or you may have to enroll in COBRA (Consolidated Omnibus Budget Reconciliation Act) right away. And if you don’t do that, then you can lose your coverage.”

2. Create a financial snapshot of your situation

For any significant financial event that impacts your income, whether it be a layoff or pay cut, Allocca says you should take a financial snapshot of your situation. Note down what’s in your savings accounts, (401K), checking accounts, credit card statements, and assess where your money is going.

It also helps to look at the timing of your next paycheck, whether it will be in the next couple weeks, or plugged into your severance package. This creates a clear idea of cash flow in the immediate term.

“For example, getting laid off on a Wednesday, but your rent is still due on Friday. That kind of thing. You’ve got to make sure you know what’s going on.”

3. Bare-bones your budget

Allocca says not to underestimate the importance of budgeting. Essentials like rent, insurance, transportation, and groceries can’t be skipped, but there will undoubtedly be other financial commitments that can be put on pause—even just for now.

“Instead of doing a monthly class pass or spending $250 for credits, maybe you scale those credits back or just join a traditional gym while you’re in this period of change. Other discretionary things: going out to restaurants, maybe bringing your social life home and cooking, or challenging yourself to a one-month no-spend,” she says.

“It doesn’t have to be stark, just small edits and changes so you’re keeping more money in your pocket.”

4. Strategize your savings

If you have a really strong emergency fund made up of at least three to six months of expenses in a high-yield savings account, then Allocca says, “you can continue making debt payments or contributions to an IRA.”

“But if you’re living paycheck to paycheck or only have about a month of savings, I would put all financial goals on pause and really focus on keeping as much cash in your pocket as you can.” Even then, she says to enroll in unemployment and collect as long as you can.

“I would compare unemployment to getting a part-time job, and if you can make more with a job, I would do that instead, so you actually have some money coming in and you’re not putting yourself in a precarious situation after a month or two.”

5. Ask for feedback and task track for the future

Unfortunately, sometimes changes to income, like getting laid off, is just bad luck. So Alloca says to always ask for feedback from an employer on why the lay off occurred and if there was anything to prevent it (budget cuts, performance, company changes).

“It’s not going to change the situation, but at least you’ll walk away with something.”

Even if you aren’t fearful of layoffs, she adds, it never hurts for people to start task tracking and logging projects that you are working on in tools like Google Sheets. That way if you do find yourself laid off, you can update your resume and get back in the market.

“I think really, just what I want to emphasize is like there’s so much of it that’s outside of your control. A lot of people internalize getting laid off as if they did something wrong,” Alloca adds. “And it’s like, sometimes it’s just the way the cookie crumbles.”