The dramatic rise in unemployment among Americans under 25—especially recent graduates—has become one of the most troubling economic headlines of 2025. Recent insights from economists, central bankers, and labor market analysts signal that this appears to be a uniquely American challenge, underpinned by a “no hire, no fire” economy rather than solely by the rapid ascent of artificial intelligence.

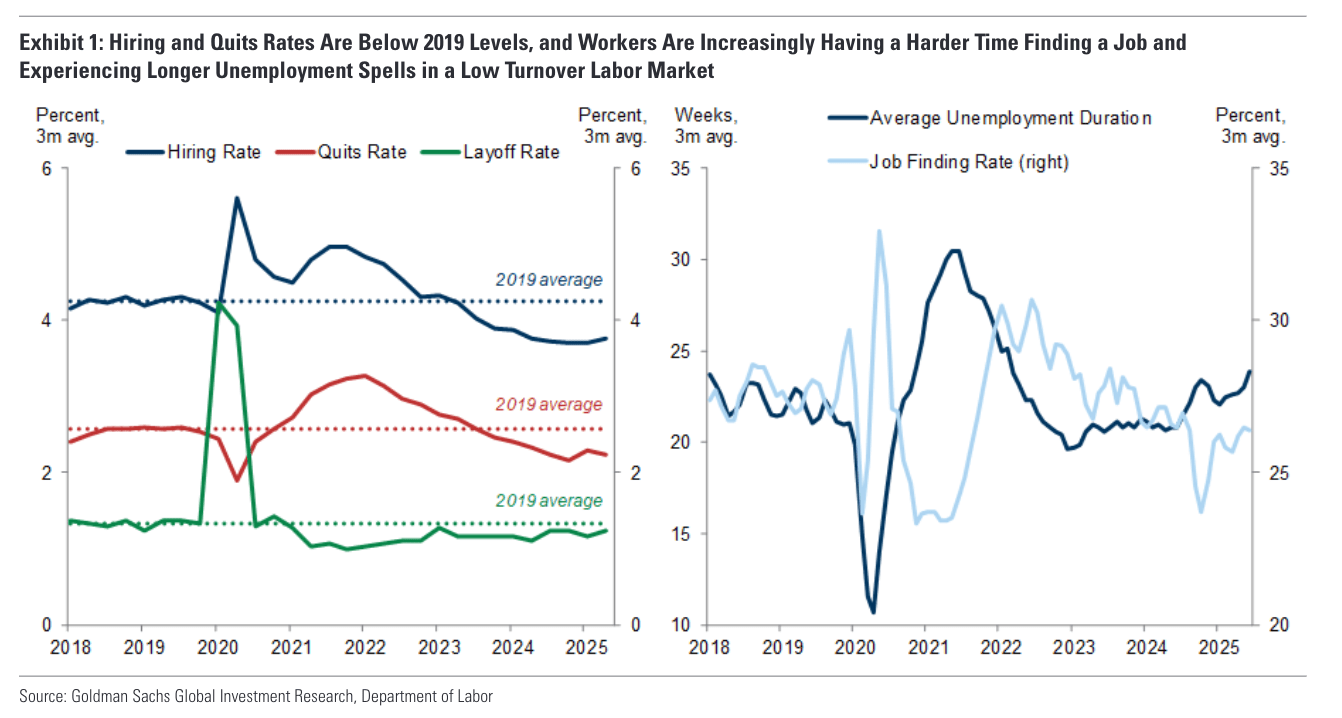

For many Gen Z workers, the struggle to land a job can feel isolating and fuel self-doubt. But that frustration recently got some high-level validation: Federal Reserve Chair Jerome Powell echoed economists’ concerns about the cooling labor market, telling reporters at his regular press conference following the Federal Open Market Committee that it’s an “interesting labor market” right now, adding that “kids coming out of college and younger people, minorities, are having a hard time finding jobs.” Noting a low job finding rate, along with a low redundancy rate, he said, “you’ve got a low firing, low hiring environment.” and noting that it’s harder than ever for young jobseekers to break in.

While recent months have been dubbed by Deutsche Bank “the summer AI turned ugly,” and some major studies find AI adoption disrupting some entry-level roles, Powell was less sure. AI “may be part of the story,” but he insisted the main drivers are a broadly slowed economy and hiring restraint. Top economists at Goldman Sachs and UBS tackled the subject soon after and found Powell to be mostly on the money. This isn’t an AI story, at least not yet.

A deep freeze setting in

According to a Friday analysis by UBS chief economist Paul Donovan, titled “the kids are alright?” the spike in U.S. youth unemployment stands in stark contrast to global trends and cannot be blamed on artificial intelligence despite the current fascination with automation in public debate. “The U.S. labor market experience is peculiar,” he wrote. “Young Euro area workers have a record low unemployment rate. In the UK, the young persons’ unemployment rate has fallen steadily. Employment participation by young Japanese workers is near all-time highs. It seems highly implausible that AI uniquely hurts the employment prospects of younger US workers.”

Goldman Sachs economist Pierfrancesco Mei wrote on Thursday that “finding a job takes longer in a low-turnover labor market.” He argued that “job reallocation,” or the pace at which new jobs are created and existing ones destroyed, has been on the decline since the late 1990s, albeit more slowly as of late. Almost all job changes between existing jobs is taking place as “churn,” driving “almost all the variation in turnover since the Great Recession.” Goldman found that as of 2025, churn was well below its pre-pandemic levels, a “broad-based” pattern across industries and states, and this “mostly fall[s] on younger workers.” In 2019, it took a young unemployed worker about 10 weeks to find a new job in a low-churn state, now that’s 12 weeks on average.

UBS’ Donovan writes that “it might be tempting to blame technology” for the plight of the Gen Z would-be entry-level worker. “Machines, robots, or computers replacing humans is an ever-popular dystopian scenario.” Donovan concludes, similarly to Goldman that the U.S. pattern “more convincingly fits a broader hiring freeze narrative, affecting new entrants to the workforce.”

A blue-collar alternative?

According to Donovan, this also has the benefit of explaining the smaller impact on less educated workers, with high school dropouts able to find full-time employment at a younger age than recent grads, and so they likely found work before the 2025 deep freeze set in. With college enrollment also in a long-term secular decline, trade employment is becoming increasingly popular with blue-collar entrepreneurs, some of whom find themselves earning six figures and calling themselves boss while their peers become saddled with student-loan debt.

Over the long run, recent college graduates are empirically hit the hardest during “no fire, no hire” periods. During the Great Recession, when entire industries froze hiring, college graduates between 2007 and 2011 were uniquely hit by a lack of open positions. Those graduates earned less than their counterparts who graduated during non-recessionary periods — effects that persisted for 10-15 years, according to a Stanford briefing.

The implications for Gen Z and minority jobseekers are severe. Experts warn of “scarring effects”—long-lasting damage to earnings, homeownership prospects, and wealth accumulation. History shows that starting a career during a downturn can result in lower wages and a steeper climb up the economic ladder. On Wednesday, Powell spoke of other factors reducing the labor supply, such as harsher immigration measures; he also mentioned that minorities are having a harder time finding employment during the 2025 freeze.

“The overall job finding rate is very, very low,” Powell said. “If layoffs begin to rise, there won’t be a lot of hiring going on.” The AI question remains open, in the Fed chair’s words. Saying “there’s great uncertainty” around how big an impact AI is having, he offered a perspective, almost a guess, that “you are seeing some effects [from AI], but it’s not the main, not the main thing driving” the youth unemployment picture. Still, “there may be something there. It may be that companies or other institutions that have been hiring younger people right out of college are able to use AI that more than they had in the past. That may be part of the story … Hard to say how big it is.”