- AI-leveraged drug development has become an $18 billion industry, but companies in the sector are experiencing some hardships. Beyond efforts to convenience investors their drugs are safe and effective, venture capital funding is drying up. Experts say this is due to macroeconomic and regulatory challenges and has less to do with failures from the technology itself.

Moonshot hopes of artificial intelligence being used to expedite the development of drugs are coming back down to earth.

More than $18 billion has flooded into more than 200 biotechnology companies touting AI to expedite development, with 75 drugs or vaccines entering clinical trials, according to Boston Consulting Group. Now, investor confidence—and funding—is starting to waver.

In 2021, venture capital investment in AI drug companies reached an apex with more than 40 deals being made worth about $1.8 billion. This year, there have been fewer than 20 deals worth about half of that peak sum, the Financial Times reported, citing data from Pitchbook.

Some existing companies have struggled in the face of challenges. In May, biotech company Recursion tabled three of its prospective drugs in a cost-cutting effort following a merger with Exscientia, a similar biotech firm, last year. Fortune previously reported that none of Recursion’s discovered AI-compounds have reached the market as approved drugs. After a major restructuring in December 2024, biotech company BenevolentAI delisted from the Euronext Amsterdam stock exchange in March before merging with Osaka Holdings.

A Recursion spokesperson told Fortune the decision to shelve the drugs was “data-driven” and a planned outcome of its merger with Exscientia.

“Our industry’s 90% failure rate is not acceptable when patients are waiting, and we believe approaches like ours that integrate cutting-edge tools and technologies will be best positioned for long-term success,” the spokesperson said in a statement.

BenevolentAI did not respond to a request for comment.

The struggles of the industry coincide with a broader conversation around the failure of generative AI to deliver more quickly on its lofty promises of productivity and efficiency. An MIT report last month found 95% of generative AI pilots at companies failed to accelerate revenue. A U.S. Census Bureau survey this month found AI adoption in large U.S. companies has declined from its 14% peak earlier this year to 12% as of August.

But the AI technology used to help develop drugs is far different than those from large language models used in most workplace initiatives and should therefore not be held to the same standards, according to Scott Schoenhaus, managing director and equity research analyst for KeyBanc Capital Markets Inc. Instead, the industry faces its own set of challenges.

“No matter how much data you have, human biology is still a mystery,” Schoenhaus told Fortune.

Macro and political factors drying up AI drug development funding

At the crux of the slowed funding and slower development results may not be the limitations of the technology itself, but rather a slew of broader factors, Schoenhaus said.

“Everyone acknowledges the funding environment has dried up,” he said. “The biotech market is heavily influenced by low interest rates. Lower interest rates equals more funding coming into biotechs, which is why we’re seeing funding for biotech at record lows over the last several years, because interest rates have remained elevated.”

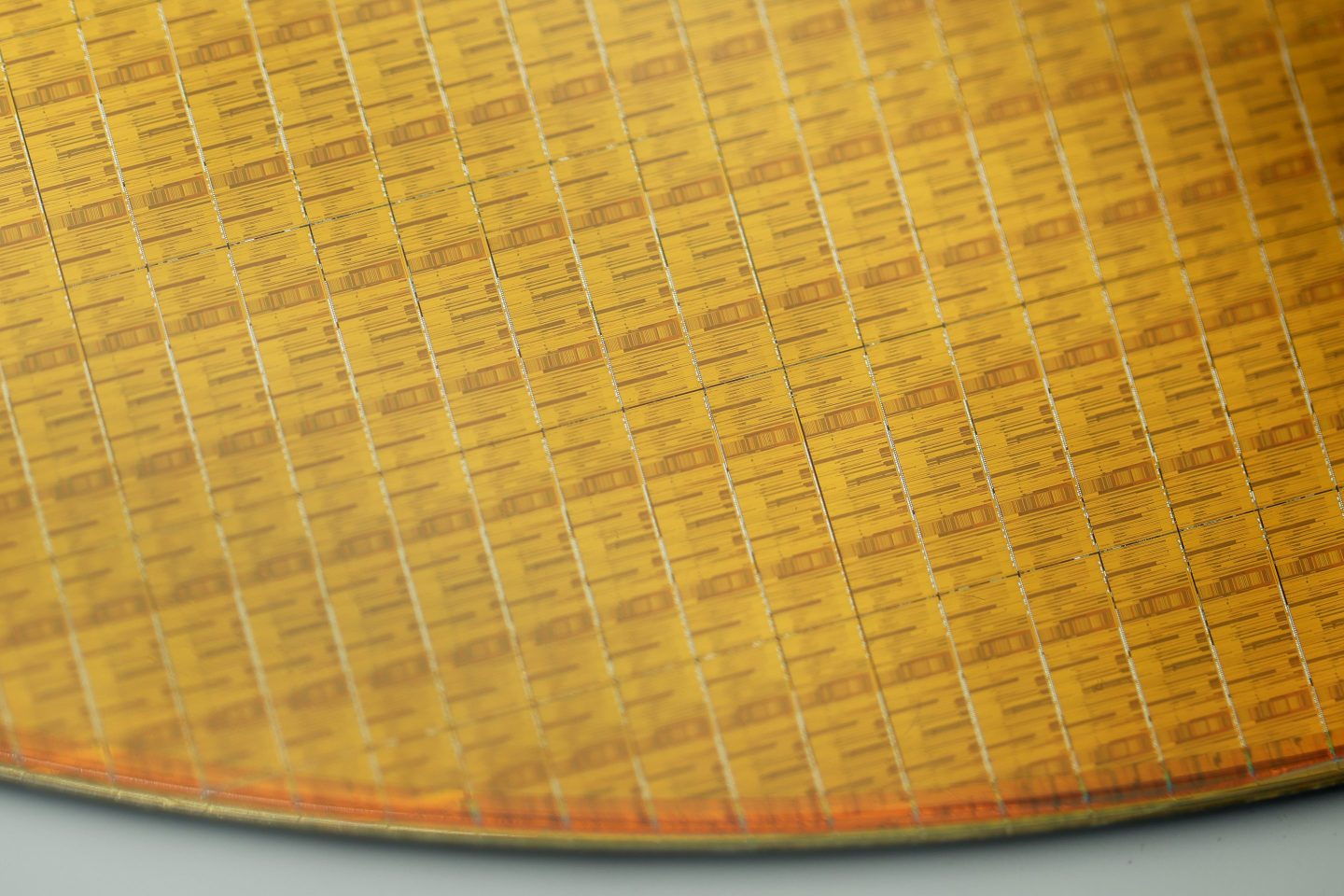

It wasn’t always this way. Leveraging AI in drug development is not only thanks to growing access to semiconductor chips, but also how technology has allowed for quick and now cheap ways of mapping the entire human genome. In 2001, it cost more than $100 million to map the human genome. Two decades later, that undertaking cost about $1,000.

Beyond having the pandemic to thank for next-to-nothing interest rates in 2021, COVID also expedited partnerships between AI drug development start ups and Big Pharma companies. In early 2022 biotechnology startup AbCellera and Eli Lilly got emergency FDA approval for an antibody used in the early COVID vaccines, a tangible example of how the tech could be used to aid in drug discoveries.

But since then, there have been other industry hurdles, Schoenhaus said, including Big Pharma cutting back on research and development costs amid slowing demand, as well as uncertainty surrounding whether President Donald Trump would impose a tariff on pharmaceuticals as the U.S. and European Union tussled over a trade deal. Trump signed a memo this week threatening to ban direct-to-consumer advertising for prescription medications, theoretically driving down pharma revenues.

Limitations of AI

That’s not to say there haven’t been technological hiccups in the industry.

“There is scrutiny around the technology themselves,” Schoenhaus said. “Everyone’s waiting for these readouts to prove that.”

The next 12 months of emerging data from AI drug development startups will be critical in determining how successful these companies stand to be, Schoenhaus said. Some of the results so far have been mixed. For example, Recursion released data from a mid-stage clinical trial of a drug to treat a neurovascular condition in September last year, finding the drug was safe but that there was little evidence of how effective it was. Company shares fell double digits following the announcement.

These companies are also limited by how they’re able to leverage AI. The drug development process is one that takes 10 years and is intentionally bottlenecked to ensure the safety and efficacy of the drugs in question, according to according to David Siderovski, chair of University of North Texas Health Science Center’s Department of Pharmacology & Neuroscience, who has previously worked with AI drug development companies in the private sector. Biotechnology companies using AI to make these processes more efficient are usually only tackling one small part of this bottleneck, such as being able to screen and identify a drug-like molecule faster than previously.

“There are so many stages that have to be jumped over before you can actually declare the [European Medicines Agency], or the FDA, or Health Canada, whoever it is, will designate this as a safe, approved drug to be marketed to patients out in the world,” Siderovski told Fortune. “That one early bottleneck of auditioning compounds is not the be-all and end-all of satisfying shareholders by announcing, ‘We have approval for this compound as a drug.’”

Smaller companies in the sector have also made a concerted effort to partner less with Big Pharma companies, preferring instead to build their own pipelines, even if it means no longer having access to the franchise resources of industry giants.

“They want to be able to pursue their technology and show the validation of their platform sooner than later,” Schoenhaus said. “They’re not going to wait around for large pharma to pursue a partnered molecule. They’d rather just do it themselves and say, ‘Hey, look, our technology platform works.’”

Schoenhaus sees this strategy as a way for companies looking to prove themselves by perfecting the use of AI to better understand the slippery, mysterious, and still greatly unknown frontier of human biology.

“It’s just a very much more complex application of AI,” he said, “hence why I think we are still seeing these companies focus on their own internal pipelines so that they can really, squarely focus their resources on trying to better their technology.”