Last week, MIT published a report that should make every CEO sit up straight: 95% of generative AI pilots deliver zero return on investment. Let me put that in perspective, AI startups took in around $250 billion in venture dollars over the past 12 months, and only 5% of those projects created measurable value.

This is the definition of a gold rush. Investors are throwing shovels at anyone who promises they’ll strike digital gold. But most of these prospectors don’t know what they’re digging for, let alone how to build something that lasts.

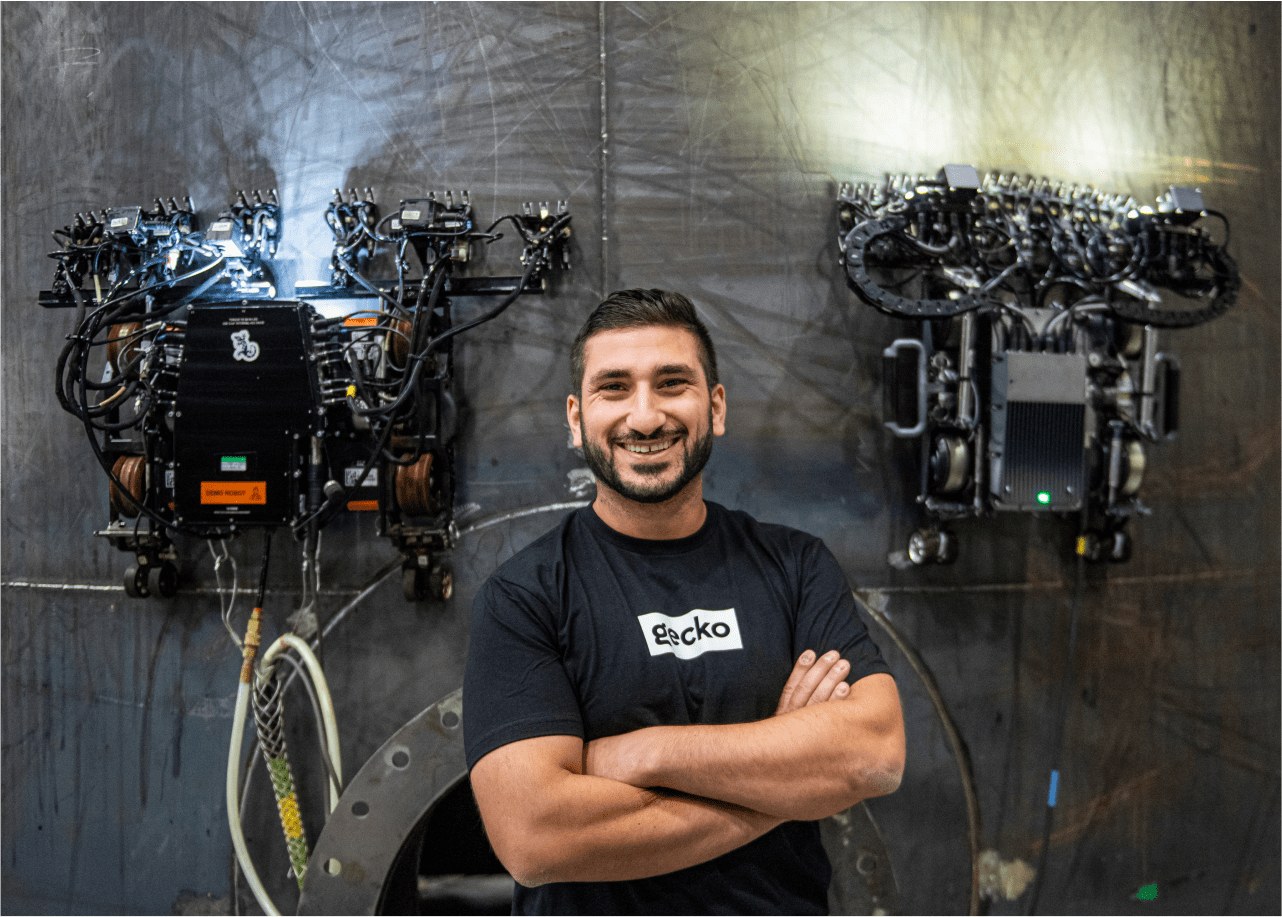

I run a robotics company that builds AI-powered software for some of the toughest industries on earth — energy, defense, manufacturing, mining. We were bootstrapped for years and we reached unicorn status just a few months ago, with a $1.25 billion valuation. Everywhere I’ve been going, whether it’s Davos, Washington DC, or the Middle East, the story is the same: executives have been sold a dream that isn’t rooted in reality. The hype is real. The fundamentals are wrong.

Why Most AI Pilots Fail

Here’s the hard truth: AI isn’t failing because of weak algorithms. It’s failing because of weak data.

Every Fortune 500 boardroom has seen the pitch. Sleek slide decks. Dazzling demos. Sweeping promises about transformation. But scratch the surface and you’ll find a fatal flaw, companies don’t have the data these algorithms need to work.

Poor data quality. Missing data. No ground truth. That’s the real problem, not the math. An algorithm is only as good as the fuel you put in. And right now, most companies are trying to drive Ferraris on empty tanks.

- How can an energy facility decrease BTUs and increase KWs if it doesn’t even know why its assets are failing or how to improve heat rates?

- How can a manufacturer increase production or efficiency if three-ring binders are the operating system?

Most people in tech don’t realize how analog the physical world is, and how complex the systems are. Edison once said, “Vision without execution is hallucination,” and that is what AI is doing in these pilots.

Atoms to bits: where the real ROI starts

But AI is only part of the story. Data collection is the story.

That’s why robots and AI need each other. Robots in the field can capture unlimited amounts of data points. Think ultrasonic, vibration, lidar, thermal, visual. Turning the physical world into high-fidelity digital models. Additionally, one enormous corpus of data that must be gathered, is the subject matter expertise that lives in the heads and hands of the people who maintain and operate the built world. The humans. These inputs are the raw material that AI can finally learn from.

This is where value is created: turning atoms into bits. It’s the difference between binders of inspection reports stuffed in filing cabinets and comprehensive digital maps of infrastructure that let AI do its job. With that foundation, AI isn’t just a flashy demo, it prevents failures, extends the life of assets, reduces emissions, saves billions, and creates trillions.

The geopolitics of AI

MIT’s study wasn’t just a corporate red flag, it was a national one. The race for AI supremacy is really a race for energy and industrial capacity.

AI models don’t run on hype, they run on power. Nations that secure energy resources and digitize their industrial base will win this century. That’s why I’ve shifted my focus toward the U.S. and Middle East, regions that understand that energy and data aren’t side issues, they’re the keys to global leverage.

An unreliable grid, crumbling infrastructure, and inefficient factories aren’t just economic problems. They’re vulnerabilities. If America doesn’t solve its physical-world data gap, we risk falling behind competitors who are willing to do the hard work of building first-principle systems.

The future belongs to data creators

Here’s the takeaway: the so-called AI bubble won’t pop because AI is useless. It will pop because too many companies tried to skip the hard work of data creation.

The winners will be the ones who understand that owning the data means owning the AI. Algorithms will come and go. Data endures.

When I talk to customers in energy, defense, and manufacturing, I don’t ask them to try my tool in an overcrowded toolbox. I invite them to become “AI Native”, which means, if you share your data with my platform, I will bring 10X more data with my robots, sensors, forward-deployment engineers to you to make you a uniquely advantaged AI company that happens to make steel, MWs, petroleum or military equipment.

So here’s the one question every CEO should ask the next time someone pitches them an AI solution: “What data will this AI actually use?”

If the answer is vague, walk away. Because no matter how polished the pitch, without the right data, the ROI will be zero. Every. Single. Time.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.