- America’s long-standing economic exceptionalism—rooted in its size, stability, and global trust—has come under strain due to President Trump’s changeable trade policies, which have introduced volatility and legal challenges, prompting concern among analysts about the erosion of the U.S.’s structural advantages. While some still view the U.S. as the safest investment destination, others warn that the nation’s brand and ability to cheaply finance itself may be suffering long-term damage.

For many years, American economists have been able to shrug off the worst case scenario in periods of economic volatility thanks to their nation’s “exceptionalism.”

America’s “exceptional” status is the belief that the world’s largest economy is uniquely exemplary compared to others—and both data and history provides strong support to the idea.

But the bedrock of America’s exceptionalism has long been the United States’s size and stability, making it a safe harbor for assets in time of global turmoil.

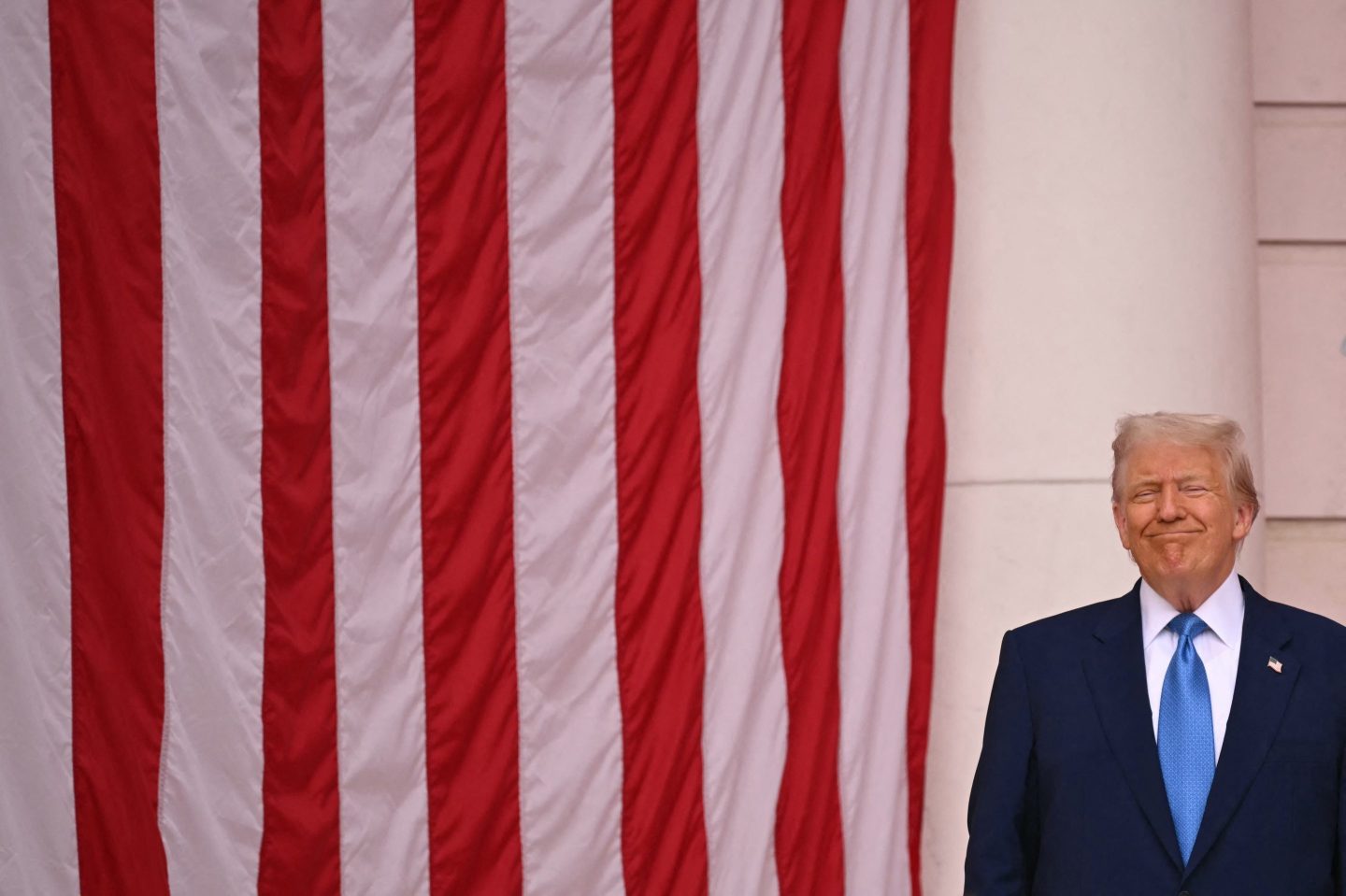

Since President Trump returned to the Oval Office, that stability doesn’t seem as guaranteed in the long term as it did before, with Deutsche Bank analysts writing that exceptionalism may be the collateral damage in Trump’s attempts to rebalance trade.

“There’s a growing sense that we’re now on a turbulent but sustained path towards de-escalation,” wrote Deutsche Bank economist Jim Reid in a note this morning seen by Fortune. “Even if the U.S. administration remain hawkish on trade, we have already seen there are limits to that approach, particularly in the face of market turmoil and declining approval ratings for President Trump.

“So although we think there’s likely to be prolonged uncertainty and a notable slowdown in U.S. growth over H2, the de-escalation so far will support growth relative to earlier expectations.”

That being said, “a lot of collateral damage has already been done.”

The past few months have been bumpy for markets, to say the least, as they have responded to rapidly changing policy with some of America’s key trading and military partners.

To quickly recap the past few months, President Trump entered the Oval Office and threatened tariffs on Mexico, Canada, and China to push the nations to curb immigration and the cross-border flow of fentanyl. Tariffs on Canada and Mexico were briefly paused before coming into effect around a month later.

Trump also began announcing sector-specific tariffs on products like autos and steel, and touted widespread economic sanctions due to be announced on April 2 or, as he called it, Liberation Day.

In early April President Trump shocked markets by announcing tariffs at the more extreme end of the spectrum, with a 10% universal hike on imports as well as hefty increases on the likes of the EU and China—all in the name of rebalancing trade. China responded with its own measures, promoting a tit-for-tat price war which saw import tariffs on Chinese goods hit 145%.

Trump then delayed the majority of Liberation Day tariffs and axed all sanctions to 10% for 90 days, though he recently threatened and then re-paused import hikes on the EU of 50%.

While agreements with the likes of the U.K. have been agreed upon in principle, the Trump team faced another setback last week after a court ruled the Liberation Day tariffs were unlawful and told the White House to remove them, before that decision was swiftly paused in appeals court.

As such, Reid writes: “Our outlook argues that the structural foundations of U.S. exceptionalism—particularly the ability to finance itself cheaply via the dollar’s reserve status—have begun to erode. So we remain structurally bearish on the dollar and expect U.S. term premia to keep rising.”

While knocks to U.S. exceptionalism may impact confidence in longer-term views, Reid does point to a short-term boon for investors: risk. The very fact that America could potentially be seen as less of a safety net could offer greater returns to those willing to take chances.

Viktor Shvets, head of global desk strategy at Macquarie Capital, also believes American exceptionalism is eroding, but added: “We believe that it is a process not a collapse, creating environment of a gradual rise in U.S. risk premia and avoidance of disorderly asset re-pricing. Investors will continue narrowing spreads between U.S. and non-U.S. assets, supporting EMU and Japan.”

In the note shared with Fortune yesterday, Shvets adds that Macquarie is still cautious on China’s ability to grow, but added he expects to see the nation’s risk premia to decline.

Betting against the U.S.

Questions of American exceptionalism aside, you’d be hard-pressed to find an analyst who (even despite current foreign policy volatility) would outright bet against the success of the U.S.

As Jamie Dimon, JPMorgan Chase CEO, recently told Bloomberg, in his opinion “if you were to take all of your money and put it in one country, it would still be America. I mean, it’s still the most prosperous nation on the planet.”

He added: “The United States still is the most prosperous, innovative nation on the planet. That’s not going to change.”

That being said, it seems some of the most notable names on Wall Street are still concerned by the long-term damage to sentiment that the White House’s policy may have inflicted.

As Ken Griffin, the founder and CEO of Citadel, puts it: “The United States is more than just a nation—it’s a brand…we’re eroding that brand right now.”

Speaking during Semafor’s World Economy Summit earlier this year, he added: “On the financial markets, no brand can compare to the brand of the U.S. Treasuries…we put that brand at risk.”