- S&P 500 futures rallied 2.77% this morning after U.S. Treasury Secretary Scott Bessent announced a drastic reduction in trade tariffs on China. All the major indexes in Europe and Asia went up on the news. But China’s markets are rising higher than U.S. stock—an indicator that investors think the tariff war damaged American companies more than Asian ones.

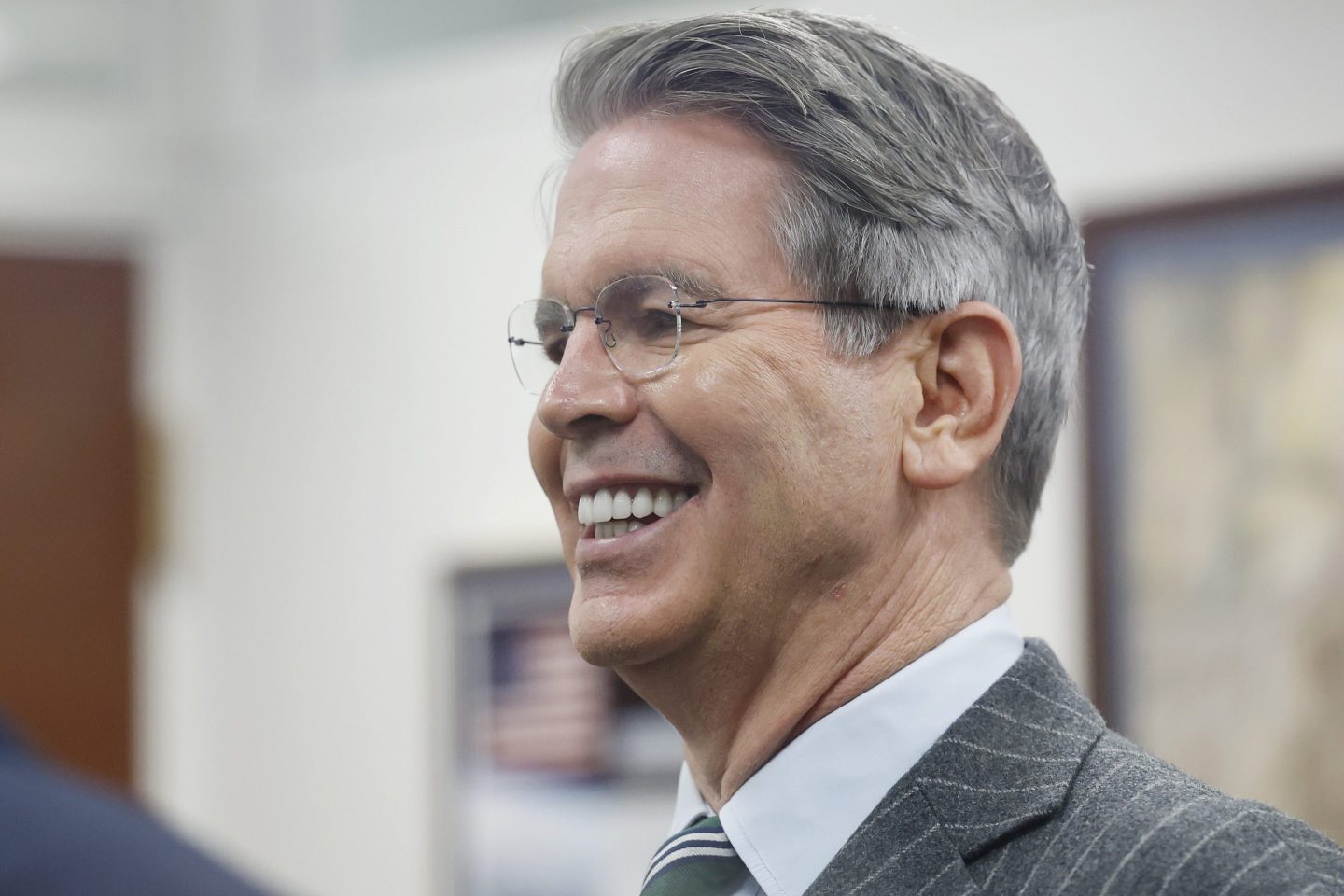

Speaking in Geneva where the U.S. and China had been negotiating all weekend, U.S. Treasury Secretary Scott Bessent said the U.S. will lower tariffs on China to 30% (down from 145%), and China will lower tariffs on the U.S. to 10% (down from 125%). The reductions will last for 90 days while further trade talks continue. A separate tariff of 20% on China, intended to deter the export of fentanyl, will remain.

Although tariff rates of 10-30% are still historically high, equity investors hailed the news as a step forward. Stocks rallied instantly, and all the main indexes in Asia and Europe were up this morning.

Notably, Hong Kong’s Hang Seng rose 3% and is now up 20% year to date. China’s mainland CSI 300 index rose 1.2% and is down only 1.7% year to date. By contrast, the U.S. S&P 500 is down 3.8% since the turn of the year—an indicator that investors think the tariff war damaged U.S. companies more than it damaged Asian companies.

Here’s a snapshot of the action prior to the opening bell in New York:

- In the U.S., S&P 500 futures are up over 2.7% this morning. The S&P closed down marginally at 5,659.91 on Friday, but that looks set to change at the opening bell in New York. The S&P is down 3.8% YTD.

- Hong Kong’s Hang Seng was up 3% today, and it’s up 20% YTD.

- China’s CSI 300 rose 1.2%.

- South Korea’s KOSPI was up 1.17%.

- The Stoxx Europe 600 was up 0.6%.

- The VIX fear index was down nearly 10% today.

Wedbush analyst Daniel Ives and his team welcomed the compromise between Washington and Beijing: “The U.S. and China today officially agreed to suspend most tariffs on each other’s goods in a ‘best case scenario’ … This is clearly just the start of a broader and more comprehensive negotiations, and we would expect both these tariff numbers to move down markedly over the coming months as deal talks progress. … in a dream scenario this morning Bessent/Chinese came out of these talks with massive cuts to reciprocal tariffs and is a huge win for the market and bulls.”

“We believe new highs for the market and tech stocks are now on the table in 2025,” he wrote in a note to clients.

The tariff reductions will halve the stagflation impact on the U.S., Bloomberg calculated. “We expect that could translate into a 1.5% hit to GDP and 0.9% boost to core PCE [inflation] over a period of two to three years,” the wire said.

Amid the exuberance, however, some sounded caution.

The China deal, like the U.K. deal, still leaves the U.S. with much higher barriers to trade than it had before—with implications for higher inflation, lower growth, and foreign countries benefiting from trade that was previously done with the U.S. The deal is “a worse endpoint than the markets expected in February,” Trevor Greetham, head of multi-asset at Royal London Asset Management, told the Financial Times.