“BRICS is dead,” Donald Trump declared at a February press conference. The U.S. president went on to threaten 100% tariffs against any country that wanted to “play games with the dollar” or threaten its status as the world’s reserve currency. For its part, the international grouping of countries known as BRICS says it wants to explore non-dollar-denominated trade, but is not interested in a full-fledged dollar alternative.

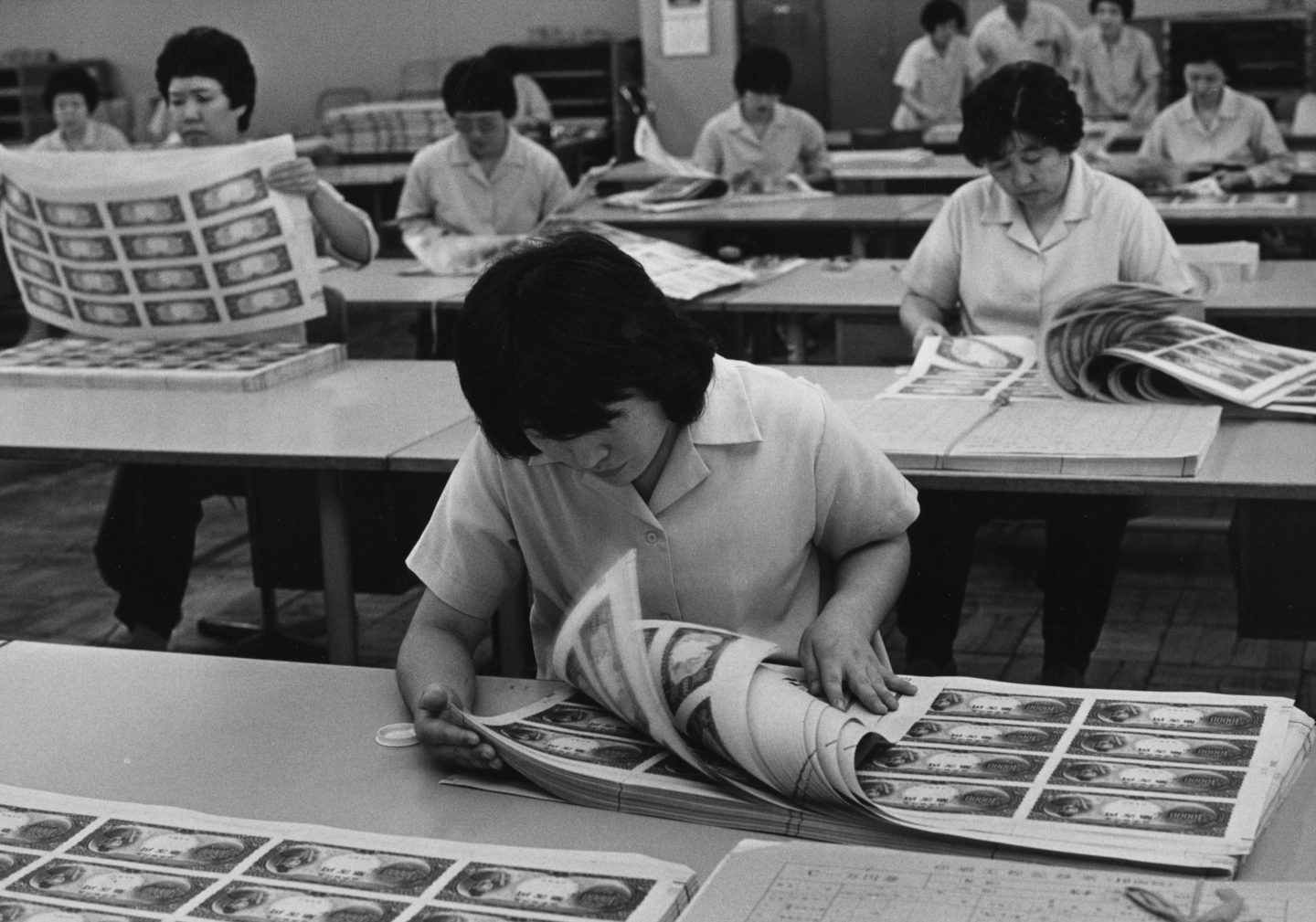

This isn’t the first time the dollar’s supremacy as the currency of choice for international trade has looked precarious. “Will the yen push aside the dollar?” Fortune asked in a 1988 article. “If money talks,” writer Carla Rapoport wrote, “then it might be time to learn Japanese.” Japan’s economy was surging, she explained: “One Japanese yen may be worth less than one U.S. cent, but that yen is becoming a super-currency of the late 1980s.”

Interestingly, the U.S. at the time often wanted Japan to internationalize the yen. Washington grumbled that Japan’s capital controls kept the yen’s rate low, making the country’s exports more competitive overseas. “Japanese officials saw a low-profile yen as a crucial element in their nation’s postwar economic miracle, and they were loath to mess with success,” writes journalist Paul Blustein in his just-published book King Dollar—an excerpt from which Fortune published on Friday.

Japanese officials dragged their feet. As Blustein writes in a colorful anecdote from his book:

U.S. impatience with Tokyo’s “step by step” approach was manifest at one session when Treasury Undersecretary Beryl Sprinkel, an ardent free marketeer with a stentorian voice, rejected the argument offered by the lead Japanese negotiator, Vice Minister Tomomitsu Oba. “I grew up in Missouri on a dirt farm,” boomed Sprinkel, who recalled that when piglets were born, “we had to cut their tails off. When we cut them off we didn’t cut them off one inch at a time! That would just hurt them more. We just hacked them off once up at the top and that was the end of it.” The translation, which took a few seconds to transmit, evoked shocked silence at first on the Japanese side of the table, until Oba laughed, which led to peals of laughter among his subordinates as well. The next day, Oba declared that he had understood Sprinkel’s story and henceforth Japan’s approach would change from “step by step” to “stride by stride.”

The collapse of Japan’s so-called “bubble” economy in 1992 ended chatter about the yen taking over the world. And today the yen remains weak against the U.S. dollar, even as Japan’s economy normalizes from years of deflation. Tokyo is less happy about the weak yen now, as both Japan’s consumers and companies rely more on imports, which are more expensive with a weaker currency.

Still, chatter about dollar dominance is growing again. Countries like India and China have tentatively explored bilateral trade in their own national currencies instead of the dollar. Will another challenger—the renminbi, the euro, or even crypto—topple the U.S. dollar?

Blustein is skeptical, noting that the dollar’s advantages, particularly the giant U.S. economy, make it “impregnable” to potential threats—“barring a catastrophic misstep by the U.S. government.”