Cheerios maker General Mills Inc. cut its guidance for fiscal 2025 sales in a sign of slowing consumer spending across the US.

Organic sales are expected to fall as much as 2% this year, the company said on Wednesday. General Mills, which is now in its fourth quarter, had previously projected a gain of as much as 1%. This guidance doesn’t include the impact of tariffs yet to be implemented.

The company’s shares dropped 3.3% at 10:01 a.m. in New York. The stock had declined about 5% this year through Tuesday, roughly the same drop as the S&P 500 Index. Shares of Nestle SA and Kraft Heinz Co. also fell.

With increasing economic uncertainty, consumers are pulling back, including on food spending. Packaged food makers have been cutting prices to spur purchases. General Mills said on Wednesday that it’s planning to reduce prices for items such as fruit snacks.

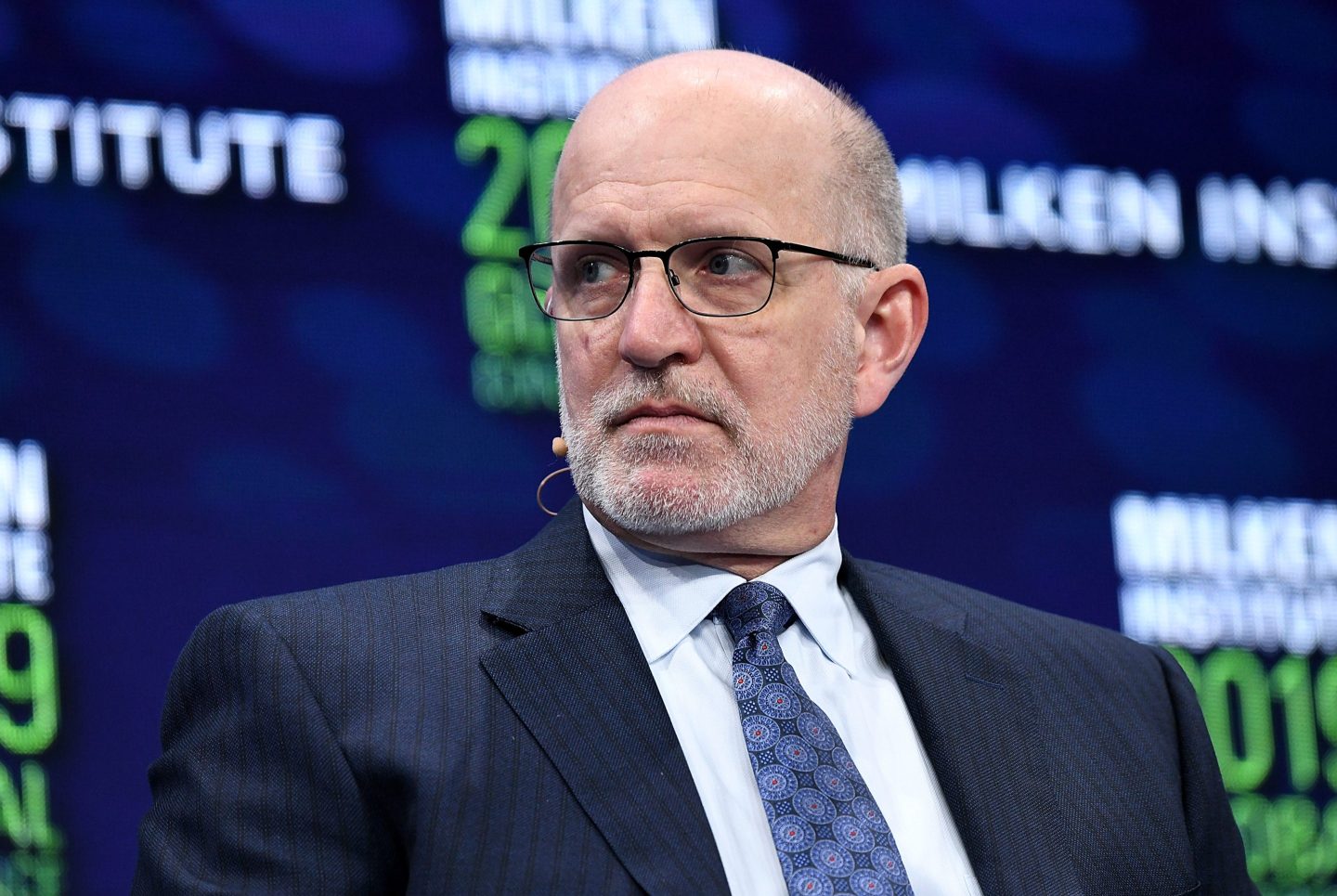

On the earnings call, General Mills Chief Executive Officer Jeffrey Harmening said that the company had originally expected the consumer environment would improve, but “that hasn’t really been the case.”

“Consumers are really looking for value,” Harmening said. “That’s very clear.”

Harmening attributed the slowdown in snacking to the broader economy, noting that consumers are already eating at home at higher levels than before the pandemic, and now are getting even choosier at the supermarket.

General Mills, whose biggest customers include Walmart Inc. and Kroger Co., said retail sales last quarter in North America fell 7%, wider than company’s overall revenue decline of 5%.

In response to weakening demand, the company will also increase spending on marketing, Harmening said.