Super Micro has had a rocky few weeks due to a short-seller investigation and a reported DOJ investigation. Nonetheless, shares for the AI hardware manufacturer rose more than 20% over the past day after the company announced it would be shipping 100,000 GPUs per quarter. The stock price has since dipped but remains at nearly 10% above where it started the week.

As the hype around the AI sector drives demand for related stocks, from manufacturers to utilities, and attracts billions of dollars’ worth of venture funding in private companies, Super Micro’s recent success—which came after a dismal stretch—reflects investors’ continued appetite, regardless of risks.

A spotty past

Founded in 1993, Super Micro focuses on producing servers and storage systems for a variety of industries, from data centers to 5G. Its stock exploded after the launch of OpenAI's ChatGPT in November 2022, with Super Micro's share price rising from around $8 at the start of 2023 to a peak of $114 in March 2024.

Even before August's short-seller investigation released by the prominent firm Hindenburg Research, Super Micro faced a series of controversies, including a 2018 Bloomberg report claiming that Chinese officials had forced a backdoor into Super Micro's servers, as well as a 2020 settlement with the Securities and Exchange Commission over violations in accounting practices.

The allegations by Hindenburg, however, revived concerns about the company. In its report, the short-seller argued that Super Micro had "ridden the wave of AI enthusiasm" but was still guilty of "accounting manipulation," including pushing salespeople to ship defective products and rehiring executives involved in the previous scandal. The company's stock fell by as much as 26% on the day following the report.

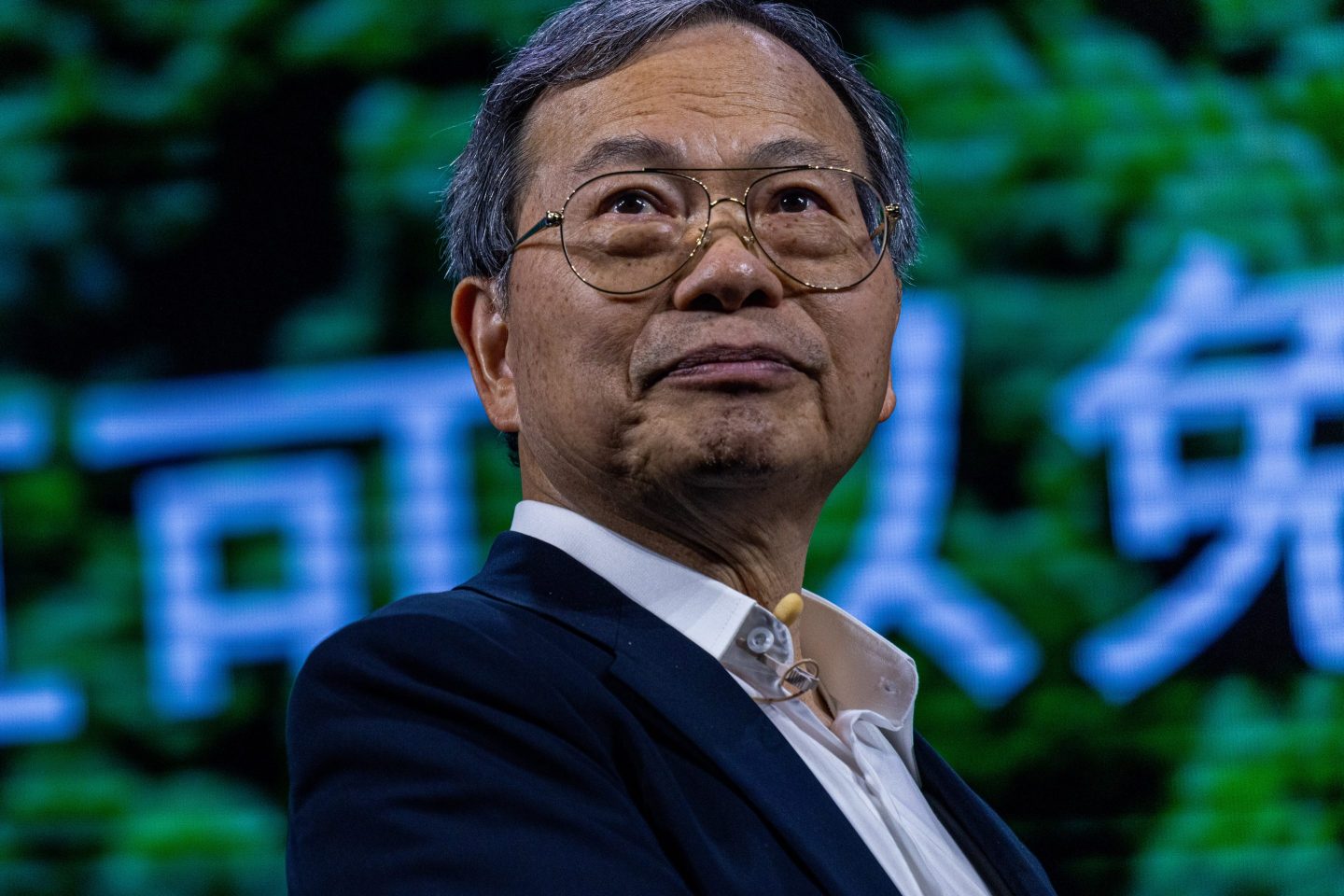

The day after the report, Super Micro announced that it would not file its annual financial forms on time because it needed to assess the "operating effectiveness of its internal controls." In early September, Super Micro CEO Charles Liang sent a letter to customers and partners saying that the report and delay would not affect the company's products.

Despite the assurances, Super Micro faced further scrutiny when the Wall Street Journal reported in late September that the Justice Department was investigating the company following Hindenburg's allegations, with a U.S. prosecutor in the DOJ's San Francisco office contacting people holding relevant information.

While Super Micro's stock continued to hover around $40 in early October, its announcement on Monday sent shares soaring. In a press release, the company touted its proprietary GPUs, a critical component used by data centers to train and deploy AI models.

Even with the recent rally, Super Micro is still delayed in filing its annual report and continues to face investor pushback, including two class-action lawsuits alleging that the company misrepresented or failed to disclose information to its backers.