All three major U.S. indexes fell Monday as Treasury yields hit their highest levels since the summer and oil prices continued to climb amid Middle East tensions.

Yields continued to surge as Friday’s blockbuster jobs report has many questioning how slow the Federal Reserve will go with further rate cuts this year—or if it may even pause.

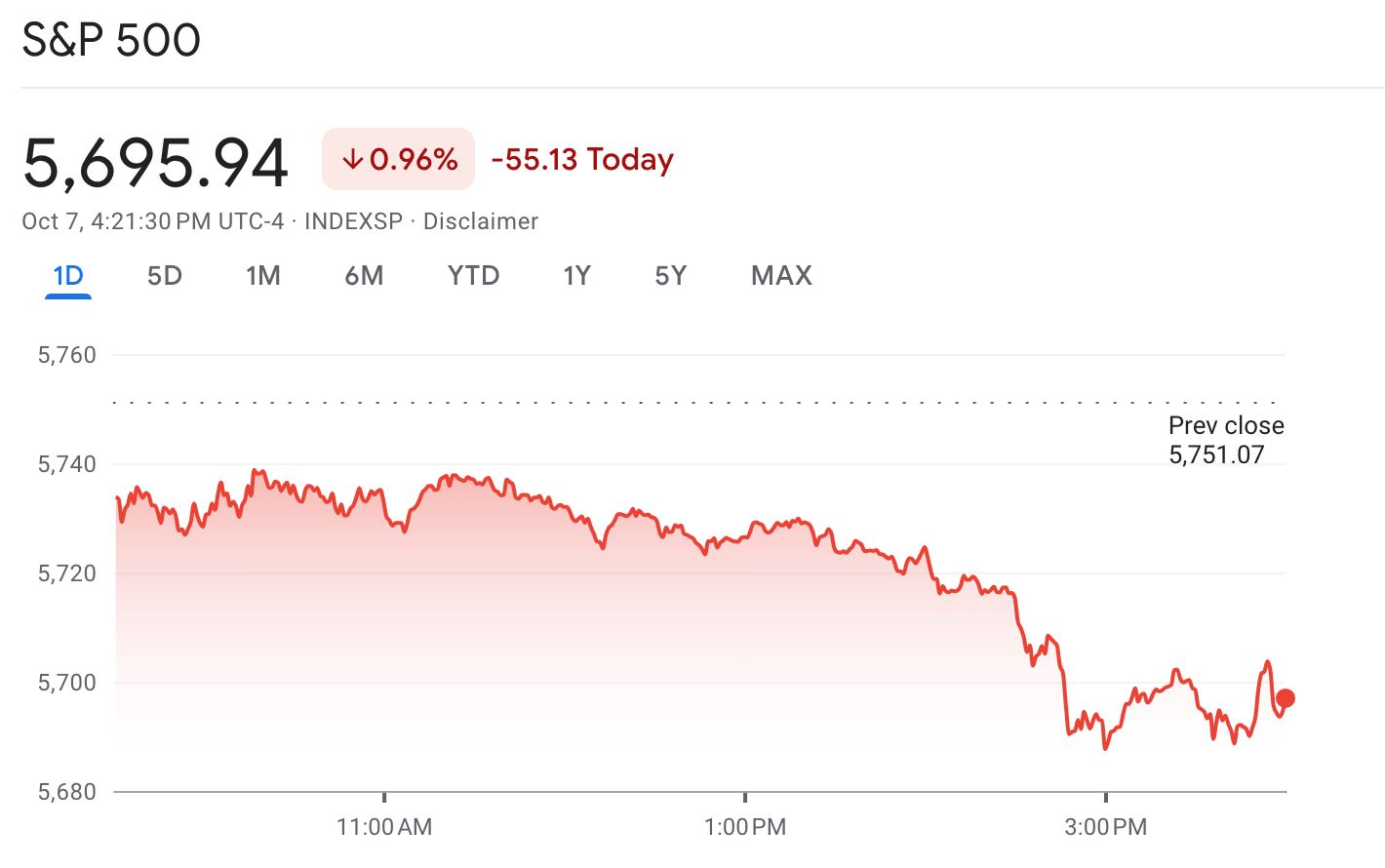

- S&P 500: 5,695.95 ⬇️ down 0.96%

- Nasdaq Composite: 17,923.90 ⬇️ down 1.18%

- Dow Jones Industrial Average: 41,954.24 ⬇️ down 0.94%

- STOXX Europe 600: 519.48 ⬆️ up 0.18%

- Hang Seng Index: 23,099.78 ⬆️ up 1.60%

- Nikkei 225: 39,332.74 ⬆️ up 1.80%

- Bitcoin: $63,126.50 ⬆️ up 0.48%

U.S. stocks slide as Treasury yields rise and oil prices climb

Brent crude jumped above $80 a barrel Monday and Treasuries dropped, sending the 10-year yield back above 4%. The S&P 500 dropped nearly 1%, while the Dow Jones Industrial Average was down 0.94% at closing. The tech-heavy Nasdaq composite also fell, tumbling 1.18% following a judge’s decision forcing Alphabet Inc. to open its app store to competition.

Europe reverses early losses on interest rate cuts

After sliding in early trading Monday, the Stoxx Europe 600 Index closed up, adding 0.18% as the European Central Bank signaled more interest rate cuts ahead. But Germany’s DAX Index fell on news that manufacturing and factory orders dropped dramatically in August.

Japan’s Nikkei rises on yen weakness and Nintendo surge

The Nikkei 225 index climbed 1.8% Monday as the yen fell to its lowest level against the dollar in two months. Nintendo shares jumped 4.4% following reports that Saudi Arabia’s sovereign wealth fund plans to increase its stake in the company.

China set to announce economic stimulus as markets reopen

Mainland Chinese markets will reopen on Tuesday after a weeklong holiday, with government officials expected to provide details on new economic stimulus measures. Markets in Shanghai and Shenzhen had surged before the holiday on hopes of policies aimed at boosting the real estate sector.