Markets in the U.S. kept sliding from their record highs, closing down Thursday on continued worries that escalating tensions in the Middle East could impact the global energy supply. Europe, too, was down for the same reasons, while Hong Kong stumbled from its three-week rise.

- S&P 500 Futures: 5,745.25 ⬇️ down 0.26%

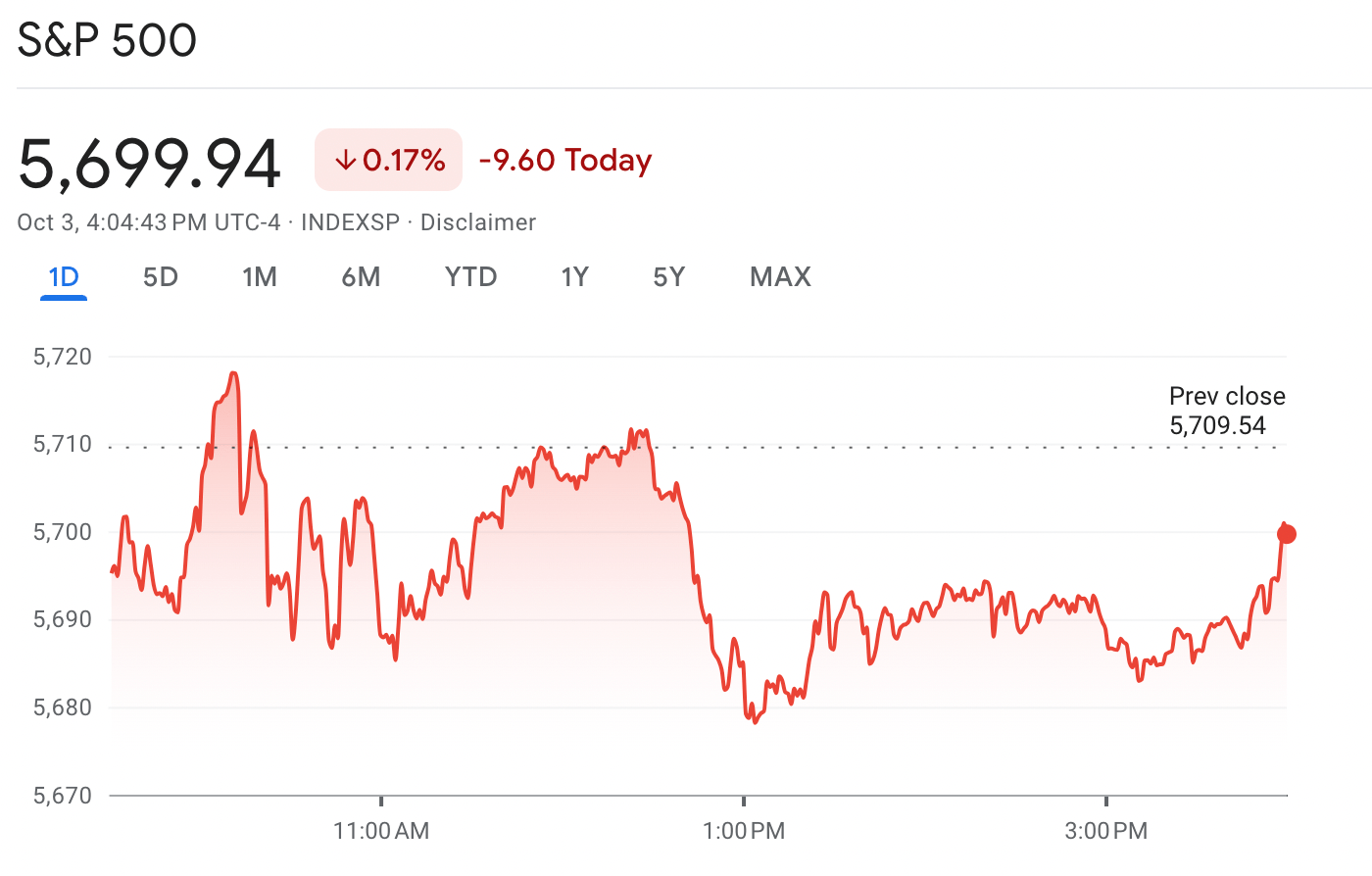

- S&P 500: 5,699.94 ⬇️ down 0.17%

- Nasdaq Composite: 17,918.48 ⬇️ down 0.037%

- Dow Jones Industrial Average: 42,011.59 ⬇️ down 0.44%

- STOXX Europe 600: 516.29 ⬇️ down 0.93%

- Hang Seng Index: 22,113.51 ⬇️ down 1.47%

- Nikkei 225: 38,552.06 ⬆️ up 1.97%

- Bitcoin: $60,985.30 ⬆️ up 0.58%

U.S.: Wall Street keeps sliding from records

Stocks dropped as oil prices surged, with Brent crude jumping 5%, reaching $77.62 per barrel, after starting the week under $72. This puts it on track for its largest weekly gain in almost two years. Investors’ eyes are on the Middle East crisis, where ongoing tensions between Israel and Iran threaten global supply chains, as the region accounts for a third of global oil output. Meanwhile, Nvidia shares bucked the trend, rising over 3% after CEO Jensen Huang highlighted strong demand for its next-gen Blackwell chips.

Europe: Stocks drop across the board on Middle East tensions

European stocks fell as escalating tensions in the Middle East weighed on markets. The Stoxx Europe 600 Index slid 0.9%, hitting its lowest in nearly two weeks, with automakers, construction, and mining sectors leading declines. Notable movers included Tesco Plc., which rose after boosting its profit outlook, and SAP SE, which dropped following an expanded U.S. investigation into price fixing.

China: Hong Kong stocks fade after three-week rise

Hong Kong shares retreated after a strong 6.2% surge the previous day, as traders locked in profits following a three-week rally of around 30%. Property stocks dropped, with the Hang Seng Mainland Properties Index falling nearly 6%, as enthusiasm around China’s stimulus efforts waned. Meanwhile, China’s markets stayed closed for the Golden Week holidays.

Japan: Interest rate meeting heartens exporters

The Nikkei 225 continued its volatile week, rising 1.97% after a 2.18% drop the previous day. Following a meeting with Bank of Japan Governor Kazuo Ueda, new Prime Minister Shigeru Ishiba dismissed the likelihood of immediate interest rate hikes, causing the yen to weaken—a positive development for Japan’s major exporters.