The number of new companies that are started in China annually has collapsed as fundraising by Chinese venture capital firms has similarly imploded.

A recent Financial Times report described a dire Chinese startup landscape, with founders, investors, and VCs offering bleak comments on condition of anonymity.

“The whole industry has just died before our eyes,” a Beijing-based executive told the FT. “The entrepreneurial spirit is dead. It is very sad to see.”

According to data from IT Juzi cited in the report, the number of companies founded in China so far this year is just 260, on track to dip below 2023’s tally of 1,202 and a 99% decline from a peak of 51,302 in 2018.

In comments posted on X, IT Juzi’s CEO said the data don’t reflect all startups, adding that while China’s VCs and founders have faced challenges recently, the country still has “great creativity and entrepreneurial spirit.”

But VC fundraising has taken a similar dive. Yuan-denominated funds have raised the equivalent of $5.38 billion year to date, down from a peak of nearly $125 billion in 2017. Meanwhile, dollar-denominated funds have raised less than $1 billion, down from a high of $17.3 billion in 2022, according to Preqin.

The implosion of China’s startup creation comes as the economy has shown no signs of halting its slowdown, with fresh data on Saturday pointing to continued cooling across the board.

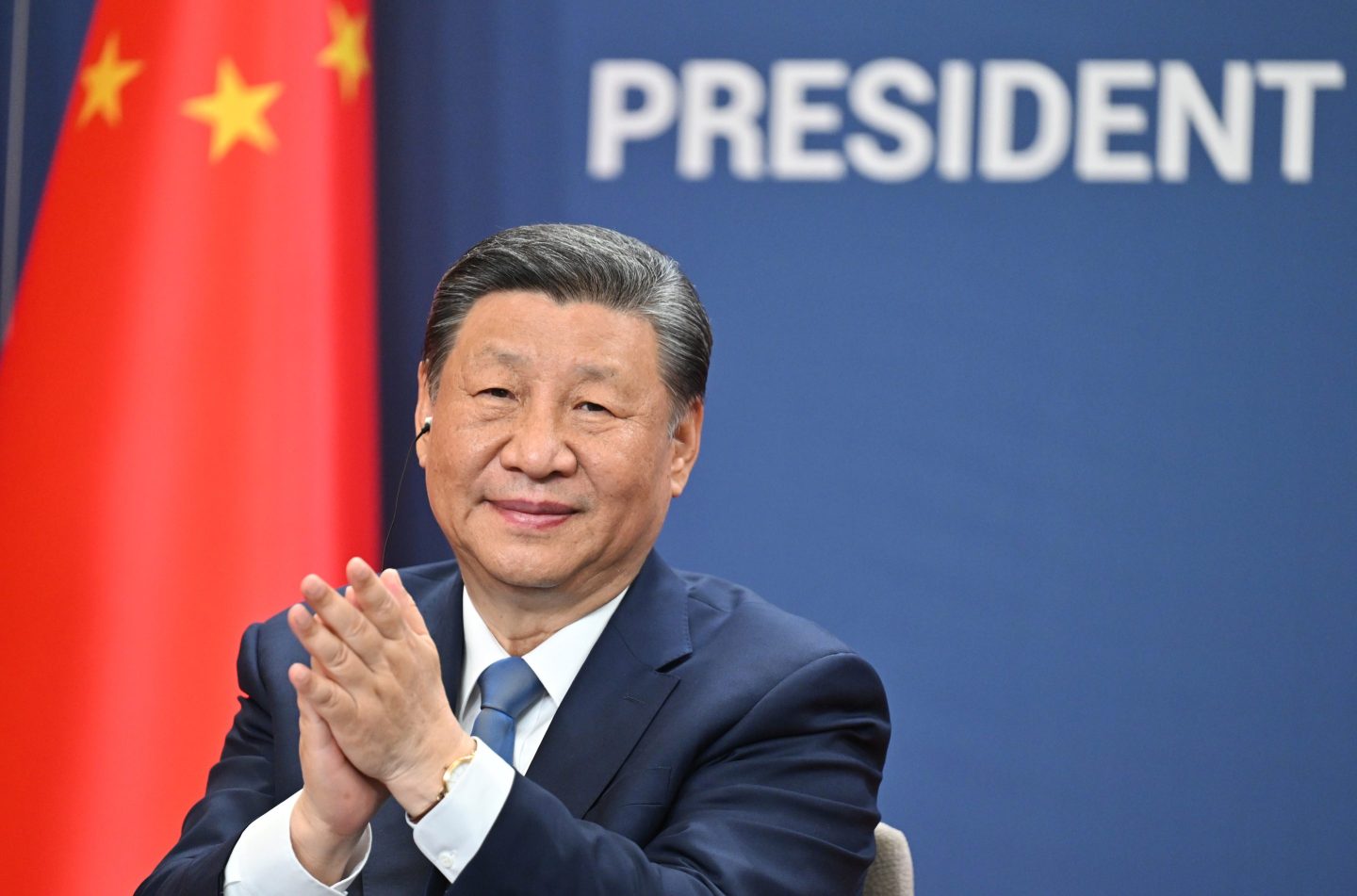

Meanwhile, Beijing’s industrial policies have exacerbated imbalances in the economy that are contributing to the slump. And President Xi Jinping’s crackdown on the private sector, anti-corruption campaign, and “common prosperity” drive have chilled entrepreneurial activity as well.

Sources also told the FT that state-run VCs have recently ramped up efforts to claw back their investments from startups that became insolvent or didn’t go public by a certain time. Stricter requirements that force founders to be personally on the hook for any loans have prevented VC deals too. As a result, foreign and domestic investors have slashed their exposure.

“In the past, US limited partners looking at Asia only wanted to meet China funds. Other markets like India struggled to get their attention,” one investor told the FT. “Today, we are like lepers. They don’t want to touch us with a 10-foot pole.”

As more investors bail, state-run funds have taken on a bigger role and now account for about 80% of the capital in the market, according to the report.

These funds are also requiring investment managers to guarantee returns, spurring them to seek low-risk opportunities or direct money to Beijing’s established priorities.

“It is contradictory to the VC spirit of engaging in high-risk and high-potential ventures,” a Chinese innovation expert told the FT. “In a portfolio of 10 companies, you would expect one or two to be a mega success and the rest to die. But now VC firms have to explain to the state why their companies failed and why they have lost the country’s money.”

Correction, Sept. 16, 2024: A previous version of this article misspelled Preqin.