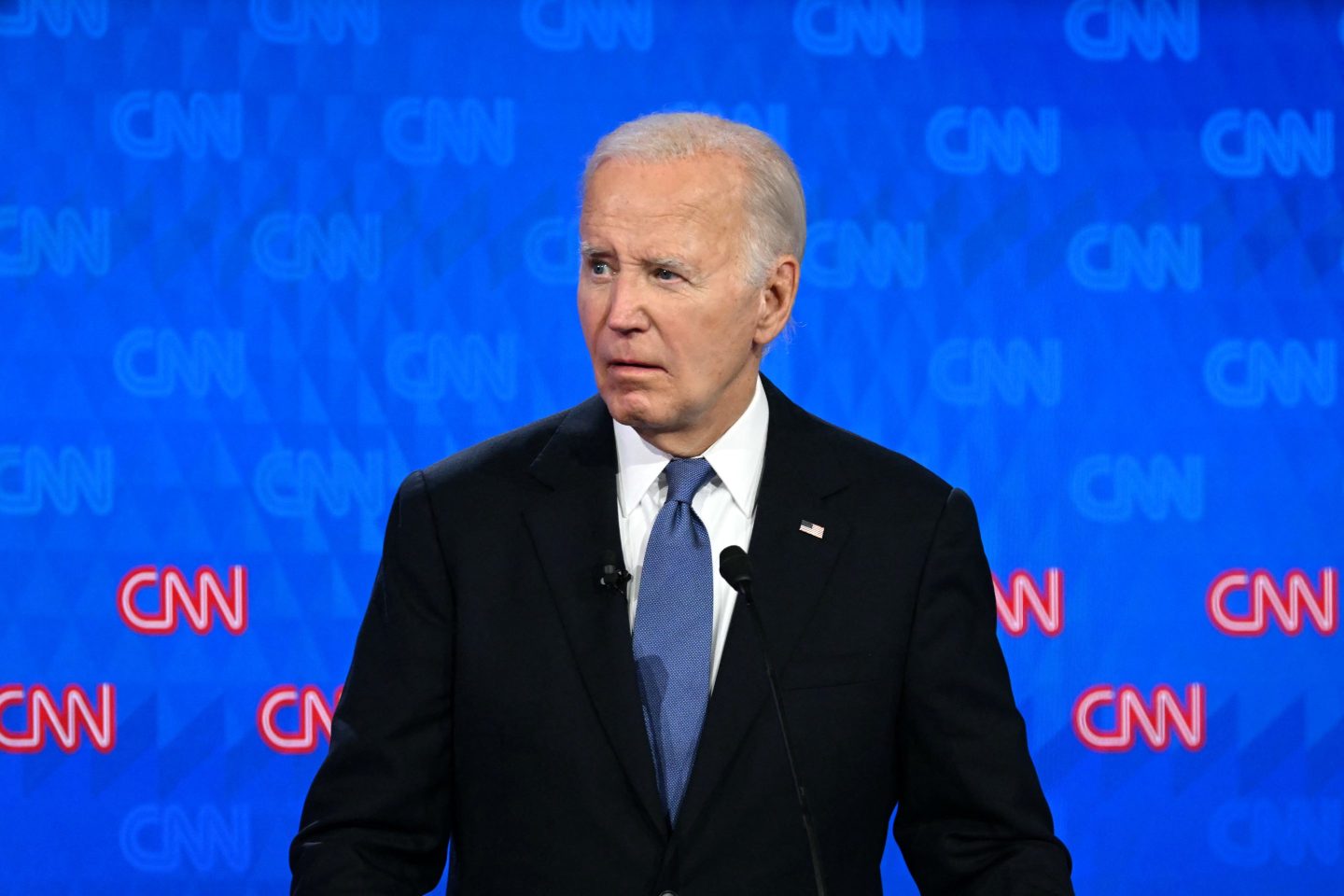

In a stunning turn of events, President Joe Biden officially bowed out of the race for the White House. For months, Biden’s age has been an election issue. But until debate night nearly four weeks ago, few pundits dared to suggest he would leave the race, with most viewing it as a near impossibility. However, the odds on well-known internet prediction markets such as Polymarket and Predict.It told a very different story.

A prediction market is an online platform where users wager money on future events—from who will be the next James Bond to when the Federal Reserve will cut interest rates to which country will win the most gold medals at the Paris Olympics.

The list goes on. Want to bet that Supreme Court Justice Clarence Thomas will be impeached this year or that the ICC will issue an arrest warrant for Israeli Prime Minister Benjamin Netanyahu? There’s a market for that.

There’s also a market for the 2024 presidential campaign—and its fundamentals shifted almost as soon as President Biden took to the stage in Atlanta on June 27. As the debate wore on and Biden visibly struggled, the odds that he would drop out surged across the prediction marketplace. By the end of the debate, the odds that Biden would abandon the campaign had spiked from 20% to 34%. Within a few days, they shot up to 70%—two weeks before it was revealed that prominent Democrats such as Nancy Pelosi were privately urging the president to step aside.

Did the market always know? And if so, what is it telling us about the future?

Of course, bettors expect Vice President Kamala Harris to become the nominee. Perhaps more surprising, she was ahead of Biden days before he resigned. What’s more, the market has her at 36% chance of becoming President, ahead of Biden’s 34% on the eve of the fateful debate.

Trump’s odds currently stand at 62%, according to Polymarket, though critics suggest the platform harbors a right-wing bias.

Remarkably, 72 hours before Biden dropped out, Polymarket had a way to bet on who Harris would choose as her VP nominee. At the time of writing, Arizona Senator Mark Kelly is in the lead.

Prediction markets, formerly a niche corner of the internet, have gone mainstream and are now being quoted and discussed in traditional media outlets. They’ve even lured geeky, data-obsessed thinker-celebrity Nate Silver, who became a Polymarket advisor last week.

But the bigger question is whether these markets are influencing the events they’re intended to predict. After a poor start, J.D. Vance’s odds of being replaced as Trump’s V.P. choice have shot up to 12%. I expect the former president is watching these numbers, not just the polls. Either way, this reflexivity loop between prediction markets and real-life events, if clearly established, could completely reshape how we look at elections in the future.

What’s a prediction market?

Online prediction markets are as old as the internet itself, with the first, Xanadu, launching back in 1990. Today, prominent Silicon Valley venture capitalists and technologists have big ambitions for these markets to solve major social and economic challenges.

Prediction markets excel at optimizing efficiencies—aggregating vast amounts of user data with real-life consequences and real money on the line. A farmer, for instance, could wager on a drought to insure against crop failure. During a pandemic, prediction markets can help epidemiologists track a fast-moving virus by looking at where and when bets are placed on its impact.

Betting on elections or sports is hardly new. We already accept that markets are efficient at pricing risk—just look at the stock market. So why not apply that to all fields of human endeavor?

While markets can be irrational and inaccurate day to day, in the long run, they are very good at determining value. Or as Benjamin Graham, the godfather of securities analysis, memorably quipped, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Prediction markets are real-world manifestations of “the wisdom of the crowd,” a scientific principle that large groups can often predict the outcome of future events with far greater accuracy than a single expert, especially when there’s money on the line. Graham’s mantra has become gospel in financial circles, where the wisdom of the crowds can impact capital market outcomes. Prediction markets suggest this thinking can easily extend beyond Wall Street.

Prediction markets are nothing new. Earlier attempts include Hollywood Stock Exchange, Intrade, and HedgeStreet. Some are still around but many have been shut down or failed to scale up over regulatory and legal concerns, with the potential of speculation on assassination contracts and terrorism futures.

In recent years, prediction markets have been given new life, and new capability, thanks to the emerging technologies of blockchain, smart contracts, digital money and digital wallets collectively known as Web3.

Unlike traditional betting platforms where centralized bookmakers or “bookies” require users to deposit money or give up personal information, on Web3-based prediction markets, money is wagered via smart contracts. These digital agreements between users provide the mechanism through which winners can be paid, instantly, when their bets are successful.

To be sure, traditional betting sites, such as Bet365, have posted odds around the election—who will be the nominee of each party and which candidate is now likely to win it all. But compared to online prediction markets, they offer a limited choice of eventualities to bet on and require users to deposit funds or hand over credit card and other personal information.

What is most remarkable about prediction markets is that they could allow for a more direct form of participation in elections, where you would be rewarded for being right. And with web3 tools, users remain in control of their funds and their fate every step of the way.

While some might spurn the financialization of our politics as a betrayal of our values, the close-knit relationship of money and politics is, unfortunately, as American as apple pie. Prediction markets at least put the power to profit from the outcomes in the hands of citizens.

This presidential election has shown that prediction markets can be a key part of mainstream political discourse. In fact, more than $600 million has been bet on various election odds on Polymarket alone, and we’re still months from November 5. In the future, prediction markets won’t just be part of the conversation. They will lead the conversation and perhaps even influence the direction of history itself. The reflexivity loop is coming – it may have even already arrived.

More must-read commentary published by Fortune:

- Women can’t fix the ‘broken rung’ unless they acknowledge the role they play in workplace bullying and discrimination

- Tech billionaires’ Trump-Vance dance is missing the point: You can’t always get what you want

- Gen Z’s enthusiasm for all things touchable is resurrecting the analog economy—and costing parents

- Nokia CEO: Europe shouldn’t be afraid to back its innovation champions

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.