As a tech reporter, you learn that startup founders can find inspiration from just about anywhere. But I’ll be the first to admit that horse trainers were never really on my short list of likely fodder for entrepreneurial aha moments.

Then I talked to Cole Riccardi, the CEO of Authentic Insurance.

Thoroughbred horses—the 1,000-pound athletes that compete in races like the Kentucky Derby—can seriously injure a human taking care of them when they become unruly, leading to a nightmare of a workers’ compensation claim for the horse trainer in charge of employing the caretakers. But an insurance program called a captive changed the rules of the game: This captive, called Big Stakes, incentivized New York-based trainers to maintain safety protocols by giving them a slice of the funds that aren’t spent paying off claims.

Riccardi’s family became involved in Big Stakes in 2019, and it was this insurance model that inspired Riccardi to create Authentic Insurance. Founded in 2022 but available to customers for only six months, Authentic applies the captive model to software companies. Riccardi’s startup handles the logistics of setting up this kind of insurance program, so software providers can offer the service and share in the profit, similar to what Big Stakes did for horse trainers.

Take for example Mindbody, the scheduling and business management platform used by more than 45,000 gyms and beauty studios across the U.S., including Orangetheory, Barre3, and Drybar. Each individual brick-and-mortar location needs insurance. Authentic partners with Mindbody to create an insurance program in which studios that use Mindbody software can also purchase insurance through the platform, rather than buying from a big-box carrier.

“Why should you need to purchase insurance through Liberty Mutual or State Farm?” Riccardi told Fortune. “We should have programs with other platforms that we know and trust.”

Authentic splits the upfront fees it generates 50/50 with software providers like Mindbody. And after it pays out all insurance claims, 80% of the leftover funds go back to the software companies, which can choose to keep the funds or return them to individual businesses. Riccardi’s company keeps the remaining 20%.

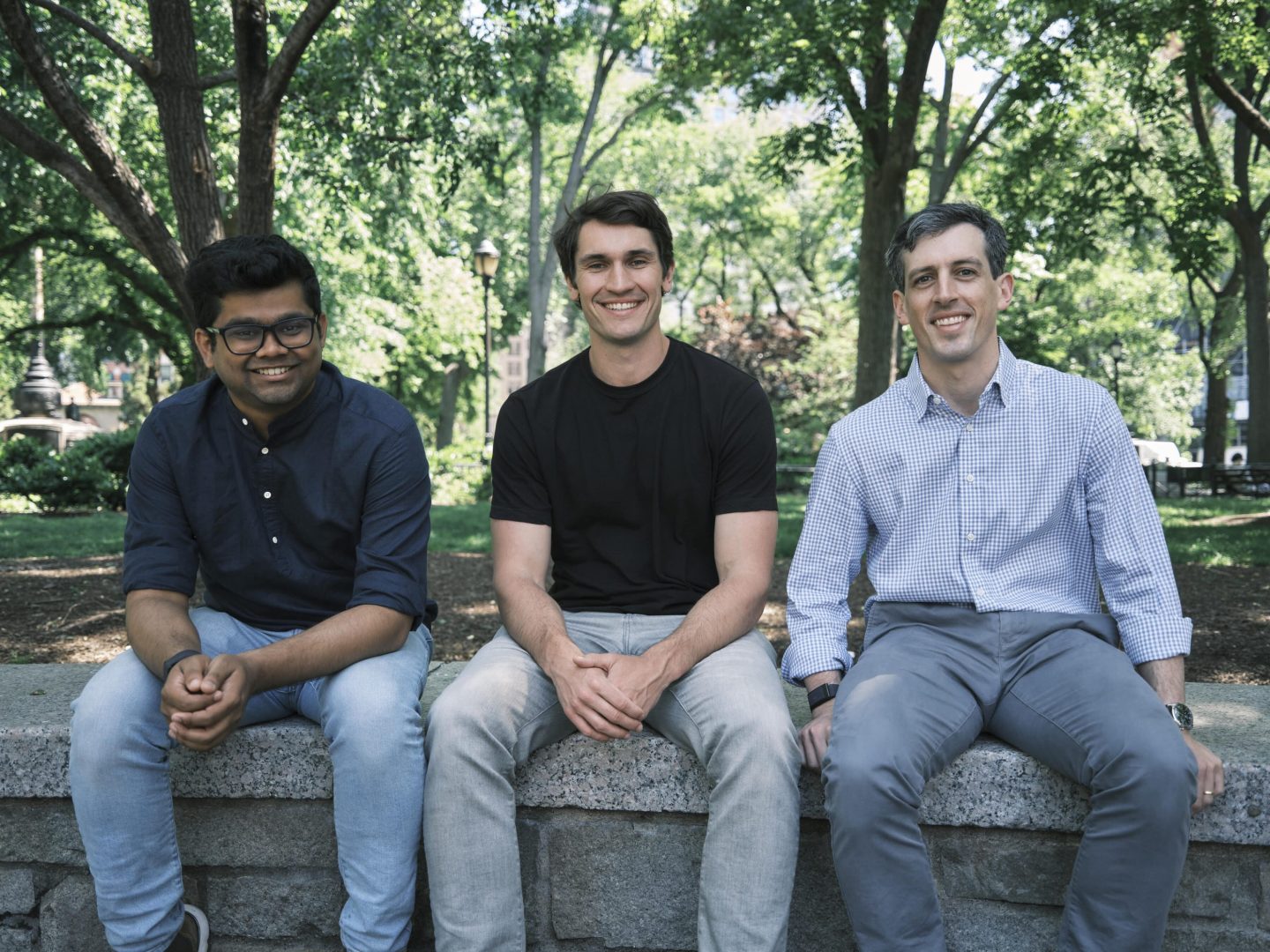

Following a $5.5 million seed round in 2022, Authentic has raised $11 million in Series A funding, Riccardi exclusively told Fortune. New York-based early stage venture capital firm FirstMark Capital led the round, with additional participation from Slow Ventures, Altai Ventures, MGV, Upper90, and Commerce Ventures.

“They can take advantage of that customer relationship to deliver the same kind of insurance coverage at significantly better economics,” FirstMark partner Adam Nelson told Fortune. “Cole [Riccardi] is such a unique blend of product visionary, deep industry expertise, and analytical capital markets know-how that let him get from zero to one here, which surprised everyone we talked to in the market.”

Riccardi, 30, is a New Jersey native who now lives in New York. He met his cofounder Kyle Babirad, who specializes in insurance pricing, while both worked in the insurance industry. Riccardi spent five years as an investor at Aquiline Capital Partners, and many of the insurance tech companies Riccardi had been looking to invest in had hired the consulting firm in which Babirad was president.

Authentic has doubled its headcount to 16 since January, and it plans to hire more engineers to build out products, Riccardi said. The funds will also go towards new product offerings, including workers’ compensation, health insurance products, and benefits.

In addition to partnering with Mindbody, Authentic works with restaurant management software Restaurant365, barber booking app theCut, and gym operating system PushPress. Riccardi’s company has sold more than 100 policies through its partners but expects to sell more than 1,000 by the end of the summer.

As for Riccardi’s connection to horse trainers, he credits Big Stakes for inspiring him but plans to stay in his lane by selling to software companies—not horse trainers. There can be more than one winner in this race.

Rachyl Jones

Twitter: @RachylJones

Email: rachyl.jones@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Transcend, a San Francisco-based data privacy platform, raised $40 million in Series B funding. StepStone Group led the round and was joined by HighlandX and existing investors Accel, Index Ventures, 01 Advisors, Script Capital, and South Park Commons.

- Gameto, a New York City-based women’s health company developing a program designed to make egg freezing and in vitro fertilization shorter, safer, and more accessible, raised $33 million in Series B funding. Two Sigma Ventures and RA Capital led the round and was joined by existing investors Insight Partners, Future Ventures, BOLD Capital Partners, and others.

- ExpressionEdits, a Cambridge, U.K.-based biotechnology company using AI and other technology to optimize protein expression, raised $13 million in seed funding. Octopus Ventures and redalpine led the round and were joined by BlueYard Ventures, Wilbe Capital, Acequia Capital, Amino Collective, and Hawktail.

- Vizcab, a Lyon, France-based platform designed to measure and reduce the carbon impact of construction projects, raised €9 million ($9.8 million) in a Series A extension. KOMPAS VC led the round and was joined by Global Brain and Brick and Mortar Ventures.

- Switchboard, a Miami, Fla.-based decentralized oracle network, raised $7.5 million in Series A funding. Tribe Capital and RockawayX led the round and was joined by Solana Foundation, Aptos Labs, Mysten Labs, Subzero Ventures, Starkware, Arche Capital, Breed VC, and others.

- Kintsugi, a San Francisco-based sales tax automation platform for companies, raised $6 million in Series A funding. Link Ventures led the round and was joined by Venture Highway, KyberKnight, Plug and Play, DeVC, and angel investors.

- OpenSocial Protocol, a Hong Kong-based open-source social infrastructure later for web3 social experiences, raised $5 million in seed funding. Portal Ventures and SNZ led the round and were joined by Animoca Brands, Awesome People Ventures, Coin98, Decima Fund, and others.

- Anzen Finance, a Hong Kong-based decentralized platform creating USDz, a stablecoin backed by real world assets, raised $4 million in seed funding from Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, and others.

- Ducky, a Nashville, Tenn.-based AI automation tool for customer support teams, raised $2.7 million in pre-seed funding. Penny Jar Capital led the round and was joined by Bread & Butter Ventures, NOMO Ventures, Wilson Sonsini, and others.

- Zendata, a San Francisco-based provider of AI governance and data privacy solutions, raised $2 million in funding from PayPal Ventures, First-hand Alliance, Geek Ventures, and Altari Ventures.

PRIVATE EQUITY

- Cerberus Capital Management acquired a majority stake in M1 Support Services, a Denton, Texas-based provider of aircraft maintenance, repair, and other services to the U.S. government. Financial terms were not disclosed.

- Mubadala Capital agreed to acquire RelyOn Nutec, a Copenhagen, Denmark-based safety training and competence provider for the oil and gas, construction, and other industries, from Polaris. Financial terms were not disclosed.

- PrecisionX Group, a portfolio company of CORE Industrial Partners, acquired National Manufacturing, a Piscataway, N.J. provider of specialty deep and shallow drawn stamping. Financial terms were not disclosed.

- Sunrise Produce, backed by Investcorp, acquired Moceri Produce, a San Diego, Calif.-based distributor of specialty produce. Financial terms were not disclosed.

EXITS

- Energy Transfer (NTSE: ET) agreed to acquire West Texas Gas Midstream, a Midland, Texas-based owner and operator of a gas gathering and processing business, from Stonepeak for $3.3 billion.

- TransDigm (NYSE: TDG) agreed to acquire Raptor Scientific, a Berlin, Conn.-based provider of complex test and measurement solutions for advanced defense, space, and aerospace applications, from L Squared Capital for $655 million.

OTHER

- T-Mobile agreed to acquire the wireless operations and other assets from U.S. Cellular, a Chicago, Ill.-based mobile network operator, for $4.4 billion.

- Nordson Corporation (NASDAQ: NDSN) agreed to acquire Atrion Corporation (NASDAQ: ATRI), an Allen, Texas-based supplier of medical devices and components, for approximately $815 million.

IPOS

- Waystar Holding, a Lehi, Utah-based revenue management software provider for the healthcare industry, plans to raise up to $1.4 billion in an offering of 45 million shares priced between $20 and $23 on the Nasdaq. The company posted $747 million in revenue for the year ending June 30, 2023. EQT Partners, CPP Investment Board, Bain Investors, and Francisco Partners back the company.

- Novelis, an Atlanta, Ga.-based aluminum recycler and manufacturer of aluminum products, plans to raise up to $945 million in an offering of 45 million shares priced between $18 and $21 on the New York Stock Exchange. The company posted $16.2 billion in revenue for the year ending March 31, 2024. Hindalco backs the company.

FUNDS + FUNDS OF FUNDS

- Energy Capital Partners, a Summit, N.J.-based private equity firm, raised $4.4 billion for their fifth fund focused on companies in the power generation, renewable and storage assets, and critical sustainability and decarbonization infrastructure.

PEOPLE

- newark venture partners, a Newark, N.J.-based venture capital firm, hired Skylar Dorosin as principal. Formerly, she was with Accel.

- Secha Capital, a Johannesburg, South Africa-based impact investment firm, raised Nina Verder as principal and operator-investor. Formerly, she was with Verder Group.