Elliott Investment Management has built a roughly $1 billion stake in Anglo American Plc, the UK-listed miner that’s received an unsolicited takeover approach from Australia’s BHP Group Ltd.

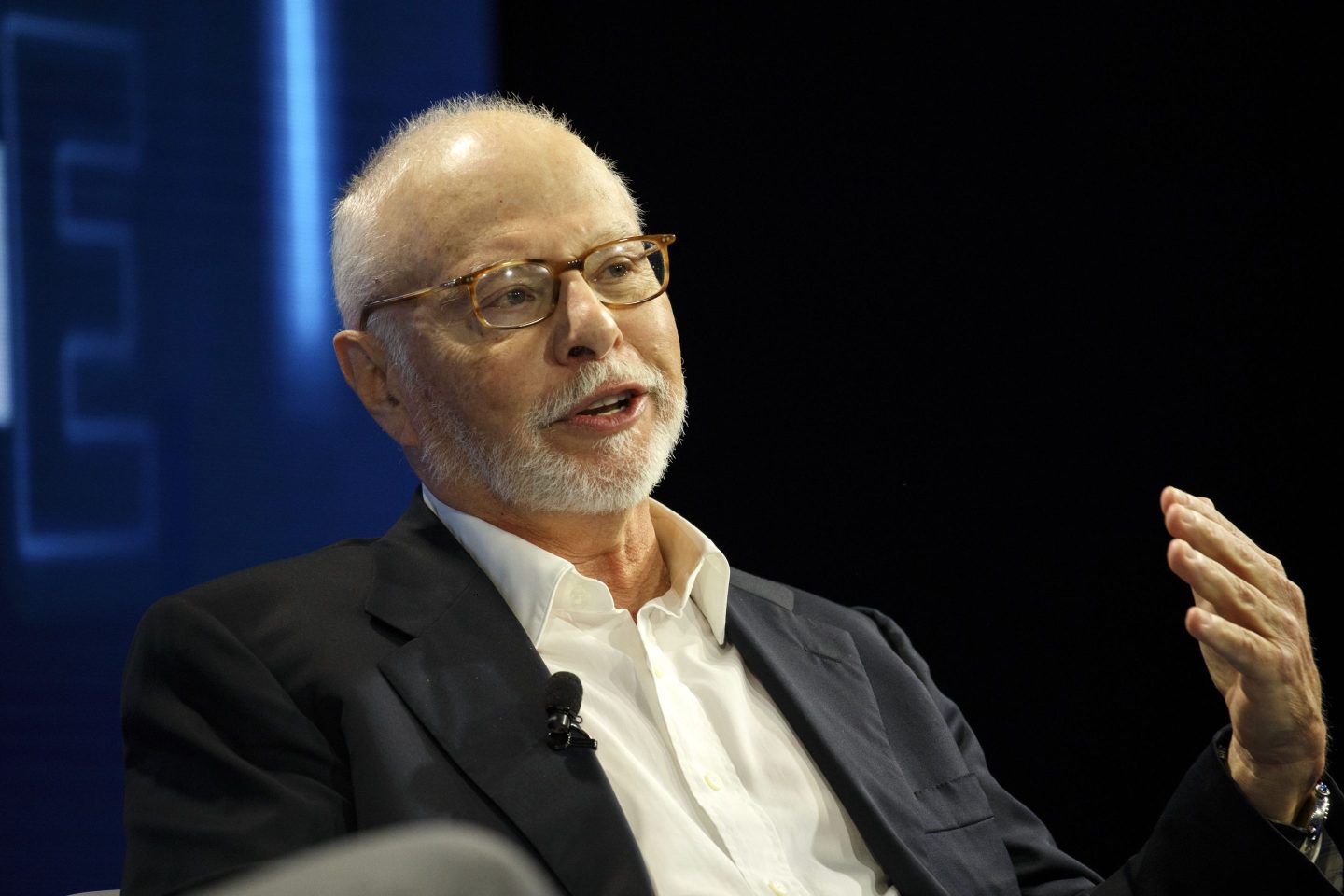

The activist hedge fund led by Paul Singer has exposure to almost 33.6 million Anglo American shares via derivatives, according to a UK regulatory filing Friday that confirmed a report by Bloomberg News. The firm amassed the 2.5% holding over recent months, according to people familiar with the matter, who asked not to be identified discussing confidential information.

The investment puts Elliott among Anglo American’s 10 biggest shareholders, data compiled by Bloomberg show. Anglo American shares jumped as much as 6.3% in London after Bloomberg News reported the stake.

Elliott also has a 0.07% short position in BHP, a separate filing shows. Representatives for Elliott and Anglo American declined to comment.

Elliott’s presence in Anglo American’s stock emerges with the mining company the subject of takeover interest from BHP. The Australian miner has proposed an acquisition that values its smaller rival at £31.1 billion ($38.9 billion) and would create the world’s top copper producer. Bloomberg News reported BHP’s approach on Wednesday. Anglo American said the proposal significantly undervalues the company.

Singer’s firm is known for stepping in to beaten-down stocks and then pushing companies to take measures ranging from share buybacks to outright sales of the business.

“We like to see value-driven investors in the register,” said Giuseppe Bivona, chief investment officer at another activist, Bluebell Capital Partners, which built a stake in Anglo American in February. The company “is surely worth much more than BHP is offering.”

Anglo American has long been viewed as a potential target among the largest miners, particularly because it owns attractive South American copper operations at a time when most of the industry is eager to add reserves and production.

But suitors have been put off by its complicated structure and mix of other commodities, as well as its deep exposure to South Africa. In February, Anglo American reported a steep drop in profit and lowered its dividend on the back of falling demand for diamonds and platinum group metals — commodities that are unique to its portfolio.

BHP has proposed an all-share deal in which Anglo would first spin off controlling stakes in South African platinum and iron ore companies to its shareholders.

Shares in Anglo American closed 3.2% higher in London on Friday at 2,643.00 pence, giving it a market value of about £32.4 billion. The stock surged 16% Thursday after BHP’s approach. Even after this week’s rally, the stock is still down more than a third from its peak two years ago.

Elliott took a sizable position in BHP in 2017 and pushed it to spin off certain oil assets. In 2021, the miner struck deals that extended its withdrawal from fossil fuels, including a sale of oil and gas operations to Woodside Petroleum Ltd.

Singer’s firm has been involved with other metals companies as well. In 2022 Elliott held talks with Kinross Gold Corp. that resulted in the miner announcing a $300 million share buyback. And it’s the majority shareholder in Triple Flag Precious Metals Corp., which provides financing for mining companies. It’s also setting up a new venture, Hyperion, to invest in mining assets.