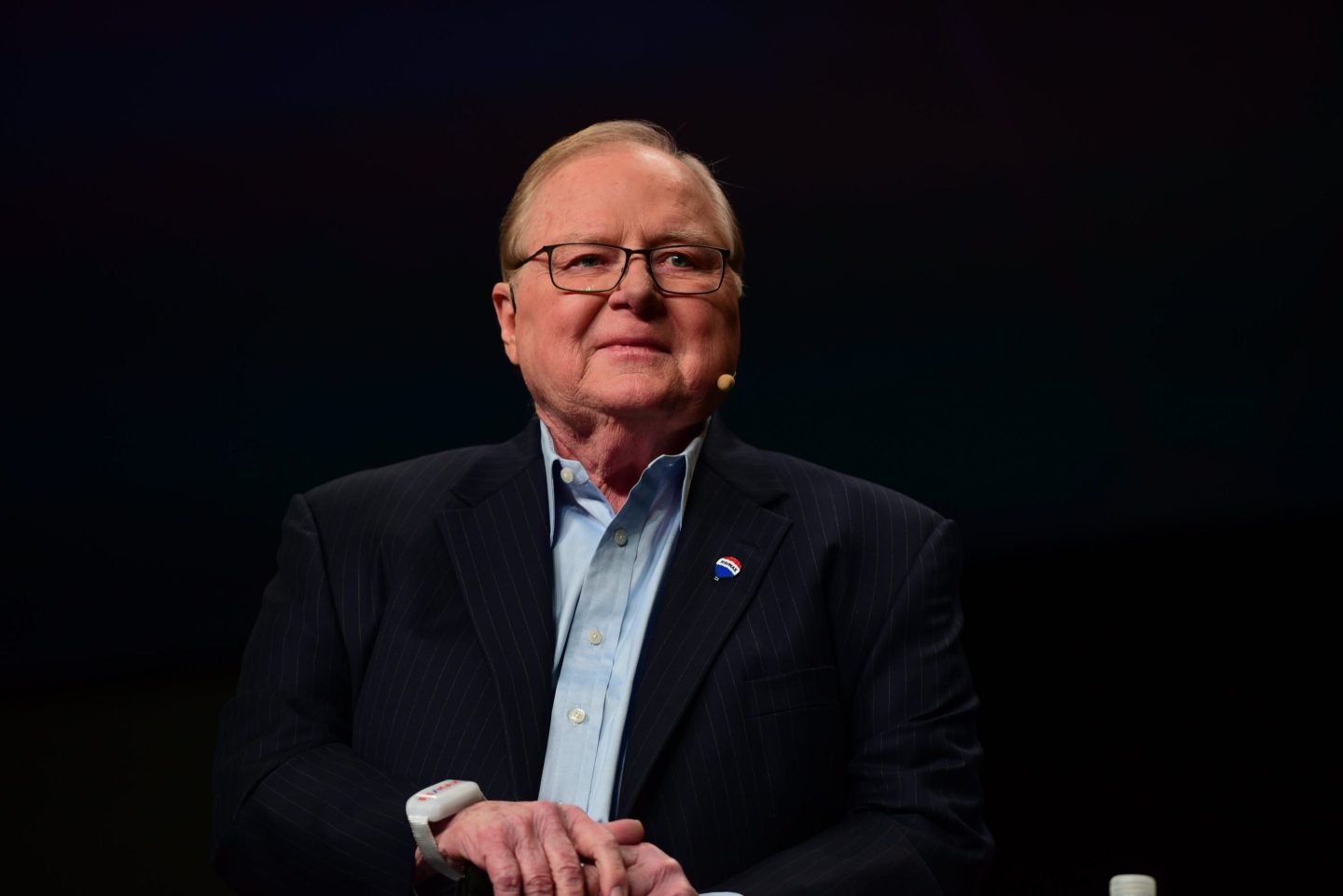

The National Association of Realtors’ $418 million settlement over an alleged conspiracy to inflate commissions received preliminary approval yesterday. It’s a new world order: Sellers won’t have to pay buyers’ agents anymore. There’s been talk of a metaphorical death of real estate agents, or a mass extinction; the jury is still out, but RE/MAX cofounder and chairman Dave Liniger doesn’t seem too concerned.

“It seems chaotic in this market,” Liniger told CNBC. “We’ve always been a cyclical business. And if you look at the oil embargoes, you look at 17% interest rates, you look at the 2007 financial crisis, realtors learn to adapt, change their sales, and continue to succeed.”

That isn’t to say things will be easy. “I think it’s going to be a lot of pressure on buyer agents,” he said after being asked if realtors will go away completely.

There’s been dual agency for decades, since people decided buyers should be represented too—and the National Association of Realtors (NAR) made it so sellers paid a commission on the sale of their home that was split between a seller’s agent and buyer’s agent, he explained. It was baked into listings. Of course, that was all before home sellers successfully sued NAR. “That’s changing now,” Liniger said. “They’ve decided that does not work, and so the buyer agent is going to have to justify themself.”

In an earlier interview with Fortune, before the NAR settlement, Liniger explained why his company, which he previously helmed as chief executive for almost 45 years, chose to settle for $55 million after being named in antitrust lawsuits. He said he would have rolled the dice and gone to trial if it was just him on the line—but he and his leadership team had to do what was best for everyone involved. It’s a good thing they did, because he settled in September last year, a month or so before a Missouri jury awarded $1.8 billion in damages to sellers and found NAR and its peers liable for inflating commissions.

Nevertheless, at the time, when asked if commissions would really change, Liniger said: “I wish I could tell you; I have no idea… I’ve never seen this before in my career. I’ve been here for 55 years… I think time will tell.”

Industry watchers seem split on whether the settlement, and corresponding changes, will affect the housing world, and if so, by how much. Ken Johnson, a former broker and current associate dean in Florida Atlantic University’s college of business, whose research focuses on real estate economics, previously told Fortune that not much will change—for realtors or anyone else. And Mark Karlan, a lecturer in finance, real estate, and law at UCLA, who has participated in billions of dollars’ worth of real estate transactions, recently told Fortune that there’ll be winners and losers. The winners in his eyes are sellers; the losers buyers, real estate agents, and brokers.

Redfin chief executive of almost 20 years Glenn Kelman told Fortune in an interview that a change in commissions would seem to benefit sellers; but even so, it’s not clear whether the housing market will be impacted.

Apart from a groundbreaking settlement, there’s more going on in the housing world. Affordability is shot after home prices skyrocketed during the pandemic-fueled housing boom and mortgage rates more than doubled not long after. Existing home sales fell to their lowest point in almost three decades last year. “The market is hurt because there’s more demand than there is supply,” Liniger said, referring to the lock-in effect, which has kept people with low mortgage rates or no mortgages at all from selling their homes.

That’ll change, though, he said. “Right now there’s about 4 million resales a year; it should be closer to 6 to 7 million. If interest rates start coming back down, people will start understanding a normal interest rate is 5.5% or 6%. And when that happens, I think you’ll see a lot of people sell,” Liniger explained. People got used to much lower mortgage rates, but there was a time when they were more than 18%.

It feels like it’s all bad, but he did offer a sliver of positivity. “The only good news is we’re getting closer and closer to the end of this cycle to where it’s going to turn around,” Linger said. Let’s hope so.