Morgan Stanley analysts have a few ideas for investors looking to pick winning stocks this earnings season. In a recent note, a team of analysts led by the investment bank’s executive director of equity research, Michelle Weaver, highlighted 10 stocks with near-term catalysts from potentially strong earnings, new product releases, or other events that could spark a bull run in their shares.

Although Wall Street’s consensus forecast for first-quarter S&P 500 earnings per share predicts average growth of just 2.7%, Weaver and her team expect a “sequential recovery” in earnings in the second quarter, followed by a second half “expansion.”

“We believe earnings growth is set for a healthier runway through 2024,” they wrote, adding that, although earnings estimates haven’t moved much over the past six months, “investor confidence in the achievability of those estimates has increased.”

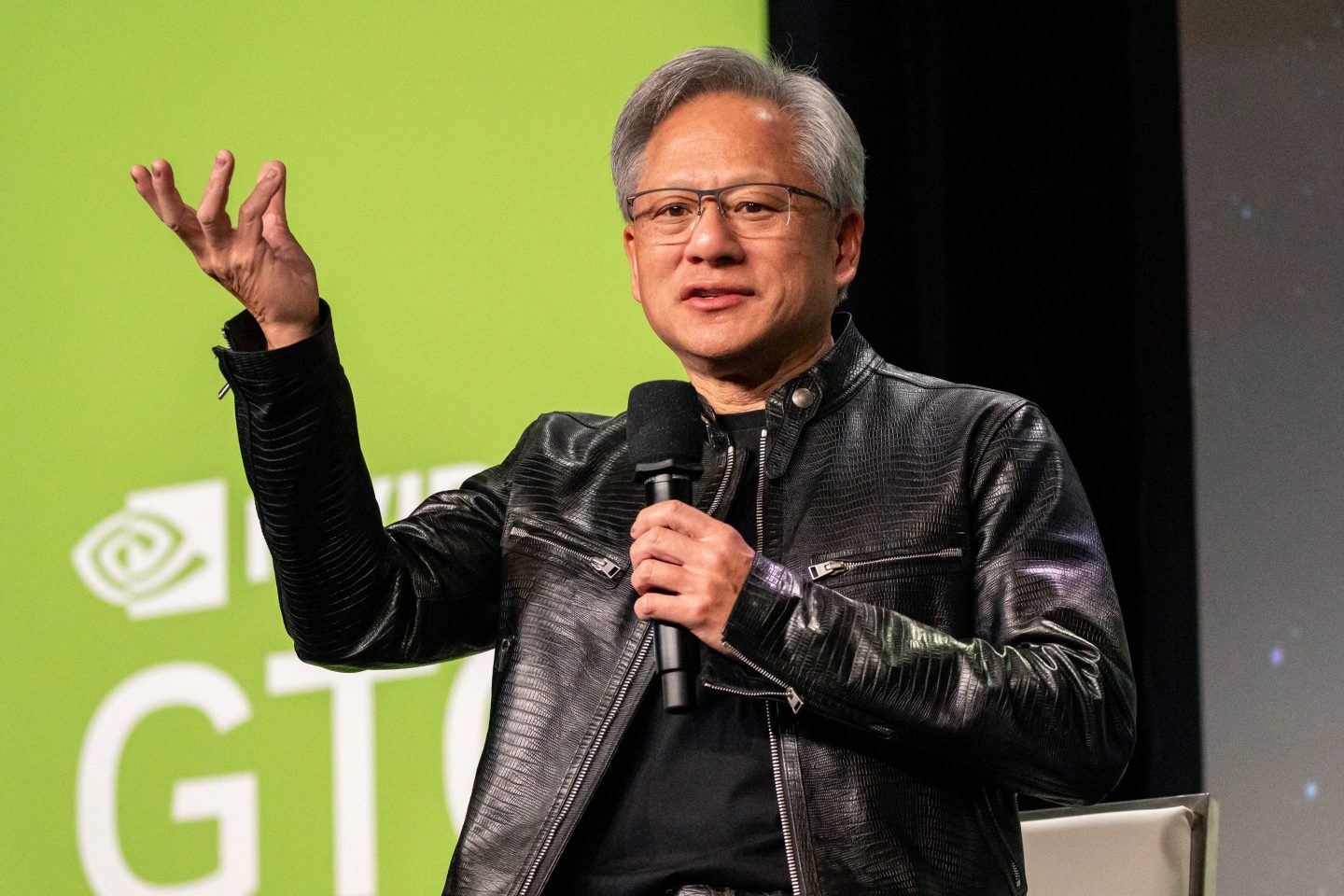

Even after surging more than 200% in the past 12 months alone, Nvidia emerges as a potential big winner this earnings season, according to Morgan Stanley’s Joseph Moore. Moore has a buy-equivalent “overweight” rating on shares of Nvidia, and expects the stock to spike 21% to $1,000 over the next 12 months as it dominates its AI competition. “NVDA continues to see strong spending trends in AI, with upward revisions in demand from some of the newer customers such as Tesla and various sovereigns,” he wrote.

Moore noted that there has been some “near-term anxiety” surrounding Nvidia’s transition from its older H100 generation chips to next-generation models. With a lot riding on sales of the new “Blackwell” AI chip, some investors feared that there could be a “pause” in Nvidia’s revenue growth, but Moore said that his “checks show no such pause, as underlying demand is strong.”

Despite rising competition from Intel, Huawei, Samsung, and others, Moore expects Nvidia to maintain its market share. “Blackwell generation pricing looks to make a strong competitive statement—reducing enthusiasm for competitive offerings,” he wrote.

That should allow the tech giant to beat consensus earnings estimates and report strong guidance for investors in May. “Investors ought to maintain outsized exposures to the generative AI theme, as compute demand remains strong and there are increasing signals pointing to a durable multiyear investment cycle,” Moore concluded.

Morgan Stanley’s team of analysts went on to highlight nine more stocks with buy-equivalent “overweight” ratings and near-term drivers that “should drive a meaningful move in each stock” in their note. Here are their earnings season movers.

9 more stocks with positive earnings catalysts

AbbVie

Pharmaceutical giant AbbVie has underperformed the S&P 500 over the past year owing to concerns over rising competition for Humira, a drug used to treat arthritis and other inflammatory conditions. But Morgan Stanley noted that Humira represents less than 10% of AbbVie’s revenue and cited a few upcoming catalysts that could boost the company’s stock price. Analyst Terence Flynn highlighted the potential for AbbVie to report rising earnings per share figures on April 26, and for a new schizophrenia drug to show promising results in an upcoming clinical trial in the second half of 2024. “We believe that growth from ABBV’s ex-Humira business (primarily Skyrizi, Rinvoq, and aesthetics) is underappreciated and will drive the stock’s multiple,” he wrote.

Price Target: $196

12-month Appreciation Potential: 15%

Amazon

Morgan Stanley tech analyst Brian Nowak expects Amazon to beat Wall Street’s earnings estimates by a “significant” margin in the first quarter. The company has been focused on efficiency and cost-cutting in its fulfillment and e-commerce businesses—using robotics, reducing shipping distances, and implementing a number of other strategies that are starting to pay benefits, according to Nowak. “We see room for continued cost improvements as AMZN has multiple operational levers to drive North America and [International] cost to serve per unit lower,” he wrote.

Price Target: $215

12-month Appreciation Potential: 20%

Corning

The materials science company Corning, which produces specialty glass and other materials for scientific applications, is another potential winner, according to Morgan Stanley analyst Meta Marshall. The company has suffered over the past few years given weak demand for many of its products, particularly display glass. But, according to Marshall, industrywide LCD-panel-maker utilization rates, which give a picture of industrywide LCD-panel production, have outperformed the “bearish assumptions” of many. That means Corning has more potential screens for its glass sales than analysts previously anticipated.

“We remain [overweight] Corning as we view it as a name well-positioned to participate in many mega-trends over the coming years, and where recessionary demand conditions are already well built into the price,” she wrote.

Price Target: $35

12-month Appreciation Potential: 10%

Lazard

The financial-services giant Lazard should “deliver strong profitability” over the next few years, owing in large part to an M&A rebound, noted Morgan Stanley’s Ryan Kenny. Lazard made 59% of its revenues from advising on strategic M&A transactions between 2018 and 2022, according to Kenny. On top of that, the analyst said, there’s a key catalyst that could drive share prices higher in the near to medium term. “Lazard’s recent C-Corp conversion, completed in January 2024, should drive a multiple re-rating over time as newly eligible investors increase exposure to the stock,” he explained.

Price Target: $58

12-month Appreciation Potential: 46%

LifeStance Health Group

LifeStance Health Group, which offers online psychiatry and therapy services, beat all of Wall Street’s earnings estimates in the fourth quarter, but the stock has fallen 10% since. Morgan Stanley’s Craig Hettenbach believes that’s a mistake, and investors are “overlooking solid fundamentals and improving execution.” The analyst predicts another strong showing in LifeStance’s first-quarter earnings report in mid-May, which, he says, will serve as a catalyst for share prices, along with rising population-wide demand for mental health services.

Price Target: $10

12-month Appreciation Potential: 67%

Paccar

Paccar, which sells commercial trucks through well-known subsidiaries like Peterbilt and Kenworth, has soared more than 50% over the past 12 months amid stronger than forecast demand for commercial vehicles. Morgan Stanley’s Angel Castillo expects that run of performance to continue, even as truck sales decline slightly, owing to rising tractor orders. The analyst said he also believes the ongoing “commercial vehicle upcycle is only beginning.” He went on to highlight Paccar’s April 30 earnings, as well as the release of its preliminary truck order data on May 2, as potential positive catalysts for the stock.

Price Target: $147

12-month Appreciation Potential: 30%

S&P Global

The financial information, ratings, and analysis giant S&P Global will beat Wall Street’s estimates when it reports earnings on April 25, the result of “strong credit capital markets activity in the quarter and higher equity prices,” according to Morgan Stanley’s Toni Kaplan. The analyst pointed to the earnings report as a potential catalyst for further stock price appreciation, forecasting 55% year-over-year revenue growth in S&P Global’s transactional ratings business, compared with consensus estimates of just 34%.

“We view SPGI as a leading information services provider with a unique position among peers to expand in high-growth areas,” Kaplan wrote, highlighting the potential for “greater synergies” from its recent merger with fellow data provider IHS Markit.

Price Target: $500

12-month Appreciation Potential: 20%

SBA Communications

SBA Communications, a real estate investment trust (REIT) that owns and operates wireless communications infrastructure, is set to benefit from strong earnings on April 29 after providing “conservative” guidance to investors, according to Morgan Stanley’s Simon Flannery. The analysts said that SBA Communications is still benefiting from the 5G investment cycle, noting that only 50% of 5G tower sites have been upgraded with the more modern mid-band 5G tech.

Flannery highlighted the extension of SBA Communications’ buyback program, potential M&A activity, and interest rate cuts, as well as the defensive nature of communications infrastructure stocks, as positive catalysts for its stock moving forward. “Fundamentals for SBA remain strong, backed by secular tailwinds from growth in U.S. mobile data at ~18% annually over the next six years,” he added.

Price Target: $243

12-month Appreciation Potential: 22%

Seagate Technology

The data storage company Seagate Technology should beat Wall Street’s earnings forecasts when it reports earnings April 23, according to Morgan Stanley’s Erik Woodring. The analyst noted that intra-quarter “checks” on Seagate showed rising hard drive disk production. “After a nearly two-year downcycle, it’s become clearer that the [hard drive disk] market is entering a gradual cyclical recovery, and moving into a period of AI-driven storage demand growth,” he wrote.

Price Target: $115

12-month Appreciation Potential: 31%