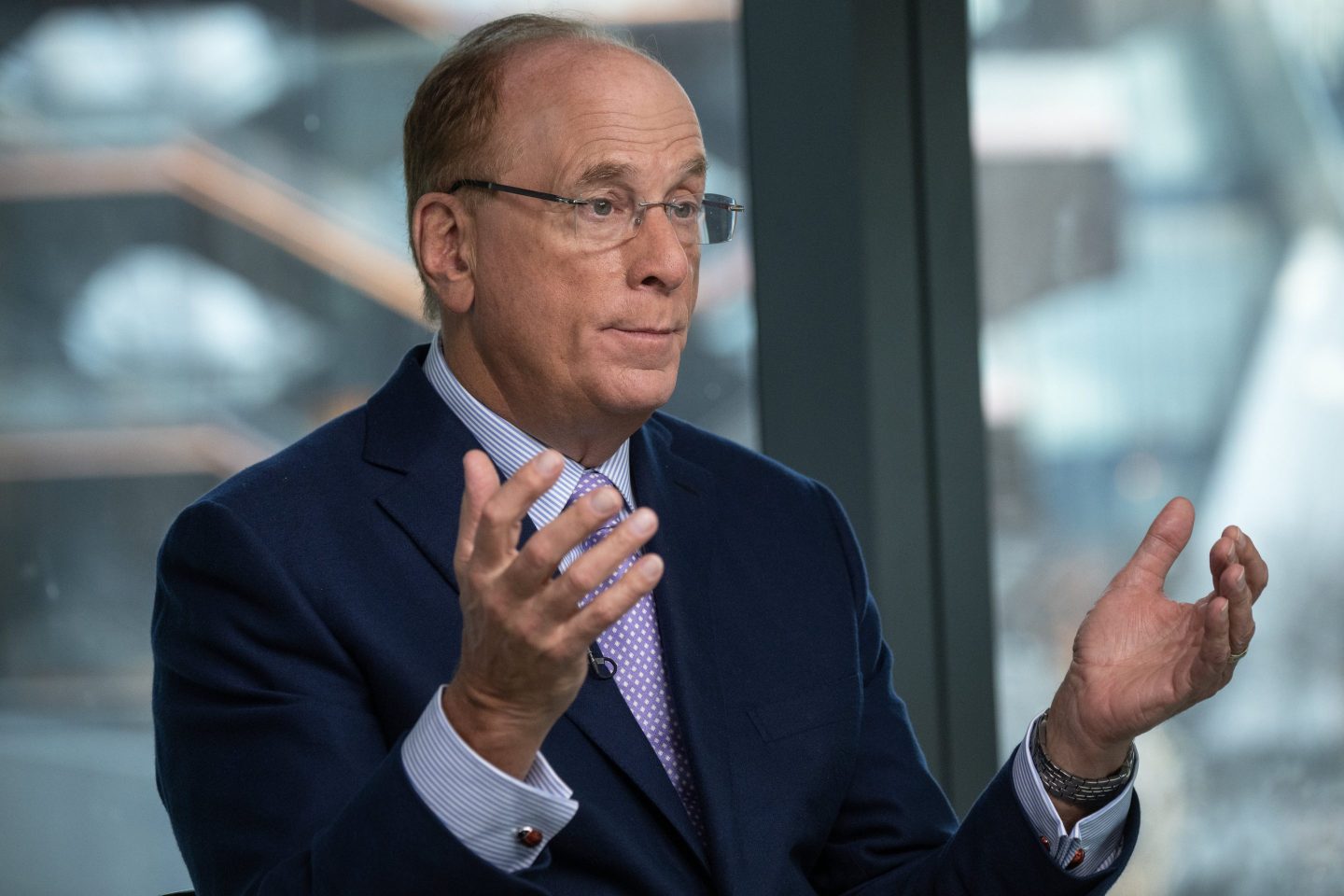

BlackRock Inc. Chief Executive Officer Larry Fink warned of a looming “retirement crisis” facing the US and called on baby boomers to help younger generations save enough for their own futures.

That, he said, will prevent them from becoming disillusioned with capitalism and politics in coming years.

With people living longer lives but struggling to afford them and plan properly, Fink used his annual letter as chairman of the world’s largest asset manager to urge corporate leaders and politicians to pursue “an organized, high-level effort” to rethink the retirement system. More than half of BlackRock’s $10 trillion of client assets are managed for retirement.

“It’s no wonder younger generations, Millennials and Gen Z, are so economically anxious,” Fink wrote in the letter to BlackRock investors Tuesday. “They believe my generation – the baby boomers – have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.”

Young people “have lost trust in older generations,” Fink wrote. “The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.”

Fink said members of the boomer generation in positions of corporate leadership and politics have an obligation help fix the system, and he questioned whether age 65 should still be the conventional notion of when people retire. Individuals are eligible for Social Security benefits as early as age 62, and those born after 1960 are considered at full retirement age at 67. Medicare health insurance coverage starts at 65.

“No one should have to work longer than they want to,” Fink wrote. “But I do think it’s a bit crazy that our anchor idea for the right retirement age – 65 years old – originates from the time of the Ottoman Empire.”

By mid-century, a sixth of people globally will be over 65, up from 1-in-11 in 2019, Fink said, citing data from the United Nations. Almost half of Americans age 55 to 65 didn’t have money in personal retirement accounts, he said, referring to 2022 US Census data.

“The federal government has prioritized maintaining entitlement benefits for people my age (I’m 71) even though it might mean that Social Security will struggle to meet its full obligations when younger workers retire,” Fink wrote.

Fink said BlackRock will announce a series of partnerships and initiatives over the coming months to weigh major questions, including the average age of retirement and how to encourage older Americans to continue working if they want to do so. The decline of defined benefit pensions has also made it more challenging for people, including those who have saved conscientiously on their own, to understand how much they can spend in retirement, he added.

“The shift from defined benefit to defined contribution has been, for most people, a shift from financial certainty to financial uncertainty,” Fink said.

Increasing Criticism

In the more than a decade since Fink began writing high-profile annual letters to corporate executives and shareholders, BlackRock client assets have surged to more than $10 trillion, with significant stakes in companies, private assets and bond markets worldwide. The letters, typically published at the beginning of each year, have given Fink and the company a powerful say on social and political issues — and have drawn increasing criticism from all corners.

The focus on retirement this year emphasizes a core part of BlackRock’s investing business since its start in 1988 and follows several years in which Fink used his letters to press for greater action on global warming, only to then find himself — and the company — in a political maelstrom.

Climate change advocates say the firm isn’t taking strong enough action, while Republicans criticize Fink and BlackRock for allegedly hurting fossil-fuel producing states and promoting “woke” capitalism. Earlier this month, Texas officials said they would divest $8.5 billion in school-finance funds from BlackRock and criticized the firm for hurting energy interests in the state.

Fink said he has stopped using the term ESG and over the past year has emphasized the company’s work with energy firms. BlackRock has scaled back its participation in international climate investing alliances, and it has given clients more say over how their shares are voted at company meetings instead of relying on the money manager to vote.

In the letter, Fink said he is now focused on “energy pragmatism.” Decarbonization and the transition to clean technologies will take time, he said, and countries increasingly want to make sure they have reliable and safe access to energy sources, particularly after Russia’s invasion of Ukraine.

BlackRock has more than $300 billion invested in traditional energy firms and $138 billion in energy transition strategies, he said.

More comments from Fink’s letter:

- The US public debt situation “is more urgent than I can ever remember,” and the 3 percentage points in extra interest payments the US government now must pay on 10-year Treasuries compared with three years ago is “very dangerous”

- Private partnerships with governments are how large infrastructure projects will be built in the future, and BlackRock’s $12.5 billion acquisition of Global Infrastructure Partners positions the firm to grow in the industry

- BlackRock is “particularly excited” about the business opportunity for the firm’s bond managers given the surge in yields after 15 years of a low-rate environment and because clients are reconsidering their fixed-income allocations