Good morning.

Over the weekend, Holcim, a Fortune Global 500 company and one of the largest construction material companies in the world, announced plans to spin off its U.S. division.

Holcim USA has been the largest, fastest growing, and most profitable part of the Switzerland-based company. On its own, the U.S. division will be the “leading pure-play North American building solutions company,” its parent company claimed. So why would Holcim want to spin off its crown jewel? The answer is simple: It’s in the shareholders’ interest, Holcim said.

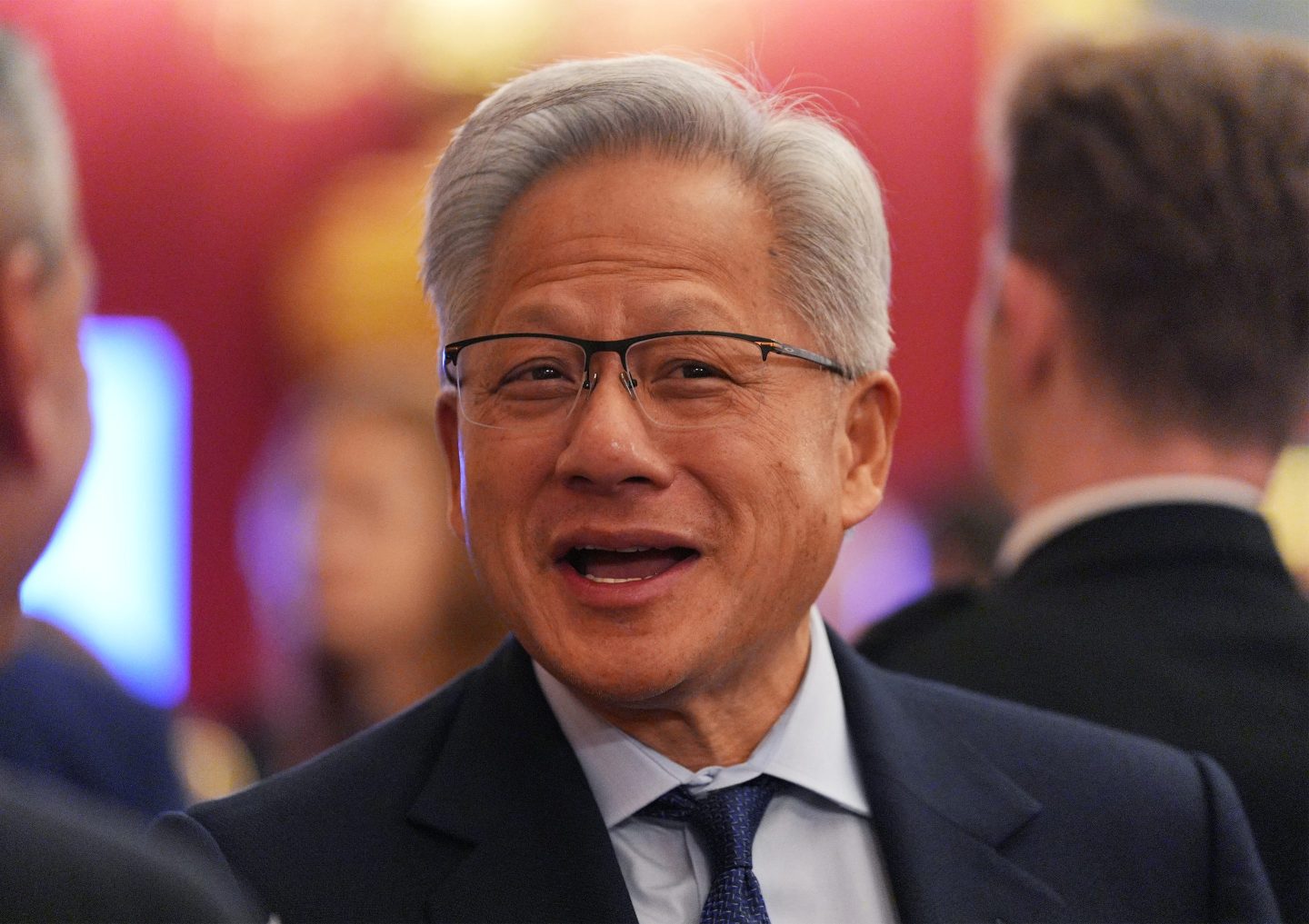

Here’s how it works: As of this writing, Holcim had a market capitalization of roughly CHF 39 billion ($45 billion). But according to Jan Jenisch, Holcim’s outgoing global CEO and incoming U.S. division CEO, “the North American business could be valued in the ‘ballpark’ of $30 billion despite just accounting for about 40% of sales last year,” the FT reported yesterday.

If that makes you blink in confusion, you’re not the only one. The era of globalization was meant to erase arbitrage and other hocus pocus between financial markets, limiting the variability in company valuations depending on where they’re listed.

But this part of globalization seems to have come to an end. Thanks to American growth and protectionism, it once again pays to be made and listed in the United States.

When I spoke to Jenisch this fall for a Fortune feature story on Holcim, he told me just how transformational the Biden administration’s green industrial policy has been. “The Build Back Better bill, and the famous IRA, it helps a lot, it sets the framework,” he told me. “They are supported by the government and tax credits. It sets the right incentives.”

These government incentives, combined with the ever-increasing growth rate gap between the U.S. and European economies, has convinced Jenisch that Holcim USA will “unlock value” for its shareholders almost immediately. The spun-off U.S. company is aiming to nearly double its sales by 2030, and, based on that glowing prospect, its share price may well soar from the get−go.

If Holcim becomes a textbook case of increasing shareholder value in the 21st century, though, the end of globalization may be nearer than we previously thought. And in the current macroeconomic environment, that would be bad news for every economy—except the exceptional American one.

More news below.

Peter Vanham

peter.vanham@fortune.com

@petervanham

TOP NEWS

Remote work is getting rarer

The number of fully remote jobs in the U.S. dropped by 9% between January 2022 and December 2023, reports a new study from LinkedIn. Competition is fierce: Fully remote jobs receive 46% of all applications, despite only making up 10% of open roles. LinkedIn senior economist Kory Kantenga suggests that economic headwinds are hitting sectors more friendly to remote work, like tech and finance. Fortune

The chip industry’s dirty secret

The semiconductor industry may be critical to the rise of consumer electronics and AI, but it’s also resource-hungry. Plants use 100 megawatt-hours of power each hour, more than oil refineries or car plants, and also guzzle 1 million gallons of water a day. While chip companies like Intel are pledging to become more sustainable, more advanced chip factories will have even larger energy demands. Fortune

Back to hybrids

GM dealers are pressuring the U.S. car company to offer more hybrid vehicles, worrying that a push to all-electric vehicles will leave some customers behind. Drivers are choosing hybrids over EVs due to concerns about cost and scant charging infrastructure. GM’s competitors are offering hybrids with good results: Toyota was the top seller of cars globally in 2023, thanks in part to strong hybrid sales. The Wall Street Journal

AROUND THE WATERCOOLER

Ironman taps Equinox president as new CEO in effort to woo more type-A executives by Phil Wahba

Where will growth come from in the next decade? A geographic deep dive into the Future 50 by Martin Reeves and Adam Job

Commentary: Boeing CEO Dave Calhoun is on the hot seat. Here are 3 concrete steps he must take to restore the company’s credibility by Jeffrey Sonnenfeld and Steven Tian

Accounting giant EY is tracking its return-to-work push with ‘turnstile access data’—and many workers aren’t even making it 2 days a week by Prarthana Prakash

Amazon walking away from its $1.7 billion iRobot deal leaves the Roomba maker without its founding CEO and staring down a 31% staff cut by Marco Quiroz-Gutierrez

This edition of CEO Daily was curated by Nicholas Gordon.

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.