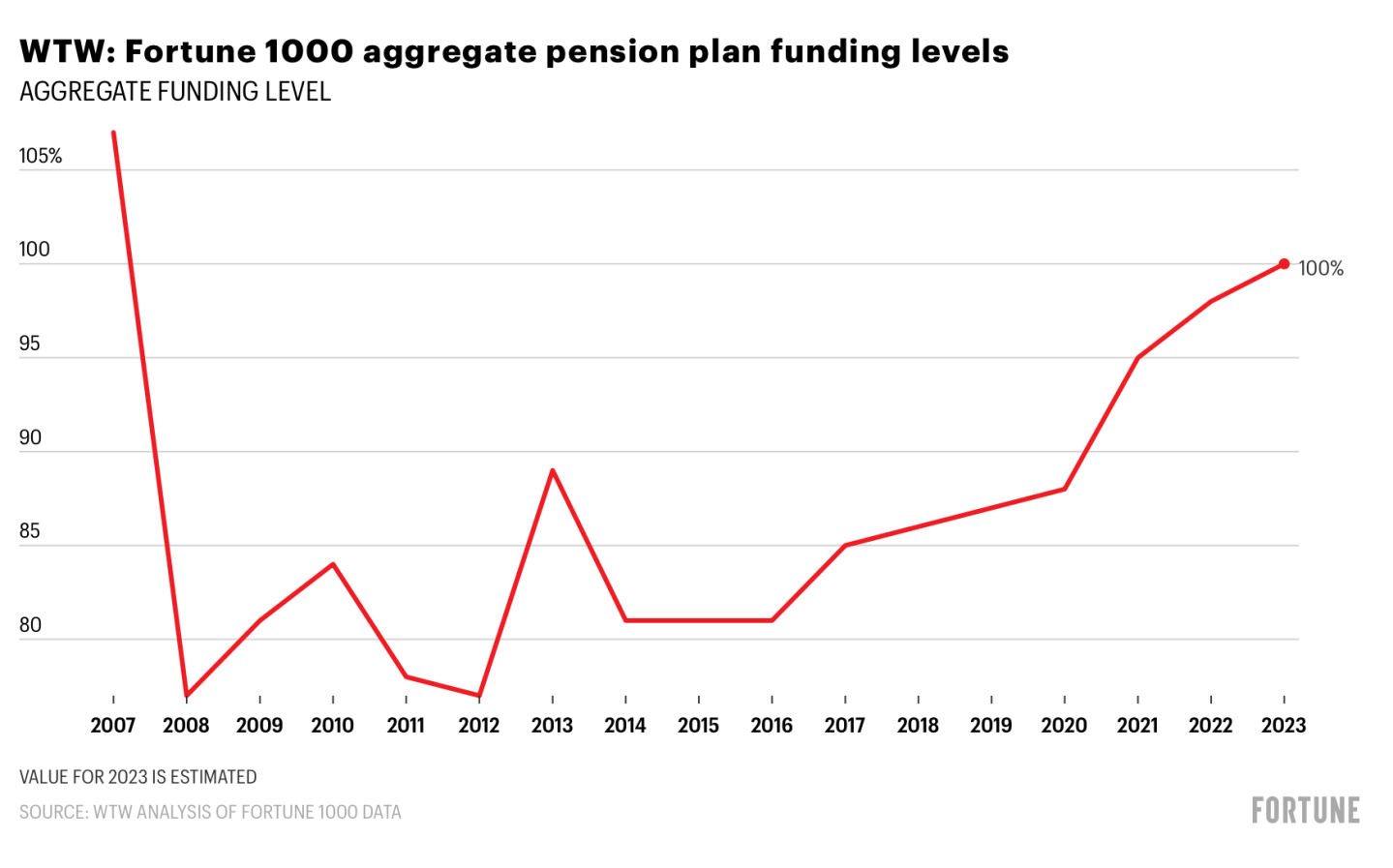

Good morning. For the first time since the 2008 financial crisis, the nation’s largest defined benefit (DB) pension plans appear to have completed a major turnaround by finishing a year with their liabilities fully funded, according to a new report.

A Willis Towers Watson (WTW) analysis of the 358 companies in the Fortune 1000 that sponsor DB pension plans in the U.S. estimates aggregate funding status reached 100% at the end of 2023. That’s two percentage points higher than 98% at the end of 2022, and a big bump from 77% in 2008.

The companies have assets sufficient to meet future obligations that are listed on the balance sheet, Joanie Roberts, senior director of retirement at WTW, told me. “Even with interest rate volatility during 2023, pension plan funded status still held strong,” Roberts said. A lot of these companies have done well with their financial management strategies to basically hedge their assets with their liabilities, she said.

Strong market performance during 2023 is what’s causing the rosy funding news, Roberts said. She added that while the end of year results vary based on a given pension plan’s investment strategy, gains were driven by the equities market, particularly large-cap equities, while lower bond rates played a role as well. The equity gains helped to offset liability headwinds from falling interest rates, according to WTW.

Domestic large capitalization equities increased by 26%, while domestic small/mid-capitalization equities rose by 17%, the analysis found. Aggregate bonds had gains of 6%, while long corporate and long government bonds, typically used in liability-driven investing strategies, had gains of 11% and 3%, respectively, WTW found.

Pension plan assets declined 1% in 2023, finishing the year at $1.19 trillion. This is a result of another active year in pension risk transfers and cash contributions that were lower than in historical years, according to the analysis. However, declines in asset prices were offset by investment returns estimated to have averaged 10.4% last year.

But is funded status alone the only gauge for pension health? The increased funded status is welcome news to companies, Roberts told me. “But they’re also cognizant of their P&L costs that are going to the income statement as well as future contributions that they may need to put in,” she added.

Does Roberts have any tips for mitigating the risks associated with DB pension plans? In 2024, plan sponsors should be revisiting their pension strategy on what the future may look like having a pension surplus that can be used strategically, she said. Some companies may need to accelerate future cash contributions, while others may find that a well-funded plan provides them with more flexibility to reduce risk or even finance other retirement benefits for employees, according to Roberts.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Paul Todgham has resigned from his position as SVP of finance and CFO at Cognex Corporation (Nasdaq: CGNX), a provider of machine vision for factory automation, effective March 15. Todgham will remain available to the company on a consulting basis after that time. Cognex is conducting a search process to identify a new CFO.

Allan Reine, CFO at Foghorn Therapeutics Inc. (Nasdaq: FHTX), a clinical-stage biotechnology company, will be departing Foghorn to pursue another opportunity, effective Jan. 16. The company has begun a formal search for a successor.

Big deal

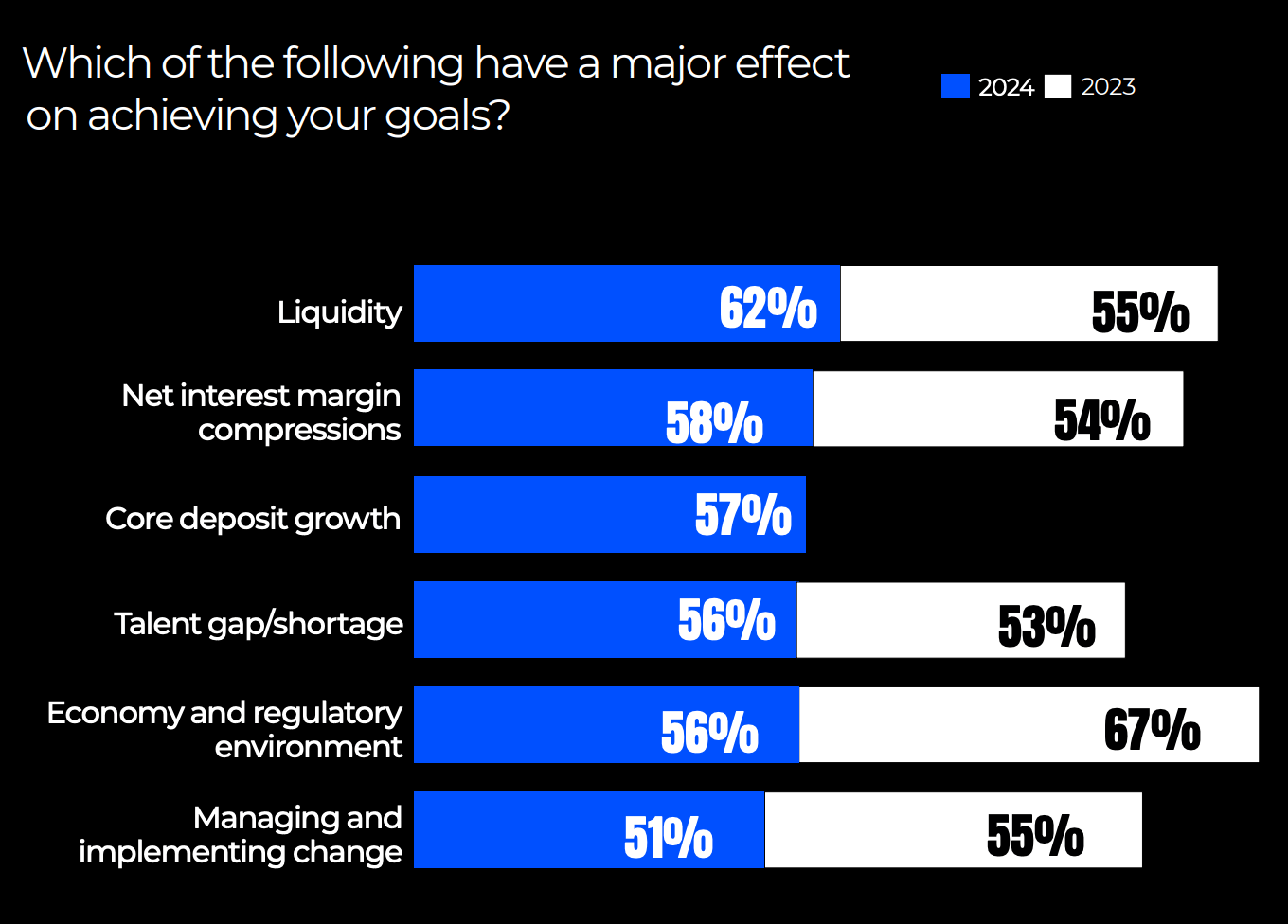

Wipfli, an accounting and consulting firm, has released its annual research report that looks in to the state of banking in 2024. Bank leaders are worried about cybersecurity, attracting and retaining talent, and meeting the changing customer needs, a national survey found.

Last year, the regulatory environment was listed as a top barrier to achieving goals, according to Wipfli. However, this year, it didn’t make the top three on the list. Banks reported liquidity, net interest margin compression, and core deposit growth as having a major effect on achieving goals. Wipfli expects to see more banks reevaluating how capital and deposit dynamics factor into risk modeling as they try to scale with stability.

The data is based on a survey of 398 financial institutions across the 28 states. Other key findings: 65% of banks report at least one identified instance of unauthorized access to data or networks; 51% say risk is a top barrier to using AI; and 56% of banks expect growth of only 1%-5%.

Going deeper

In "AI in 2024: What Can We Expect?" Wharton Business Daily’s Christian Terwiesch reflects on how far AI has come and what's in store this year. “It’s probably in our lifetime the biggest game-changer that we’ve seen,” Terwiesch says. “We need that technology. We need that productivity boost. And we shouldn’t feel scared of it by putting it into this kind of ‘it’s going to steal our jobs’ category."

Overheard

“Ageism is a problem, and I’d be lying to you if I said, don’t worry about it...Vitality is what fools an employer. If you walk in there vital, full of life and enthusiasm, they’re going to forget that you’re 53 and think you’re acting younger and be more attracted to you.”

—Barbara Corcoran, 74, founder of real estate giant the Corcoran Group and an onscreen investor on ABC’s Shark Tank, said during a broadcast shared exclusively for Corcoran’s Patreon subscribers, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.